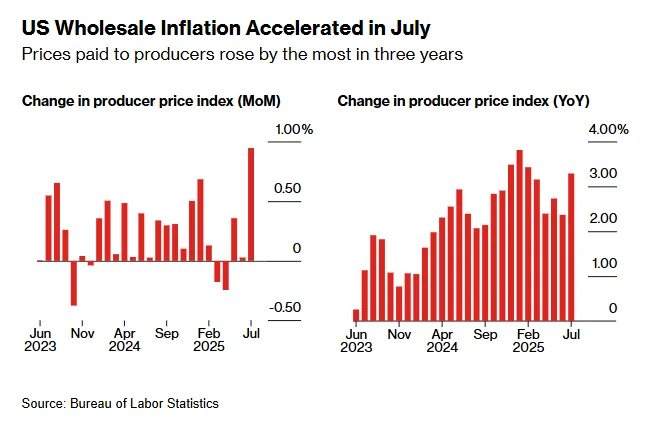

- Producer prices rose 0.9% in July, the biggest monthly gain since 2022, driven by higher services costs.

- Tariff-related pressures are mounting, with businesses starting to pass costs on to consumers.

- Fed rate cut expectations face uncertainty, as strong wholesale inflation complicates the policy outlook.

Inflation Heats Up Again

U.S. producer prices rose sharply in July, with the Producer Price Index (PPI) climbing 0.9% from the previous month—the most significant increase in three years. Year-over-year, wholesale inflation registered a 3.3% gain, according to Bloomberg.

The spike was primarily fueled by a 1.1% jump in services prices, especially in wholesale and retail margins, which rose 2%. Goods prices also increased, with food contributing 40% of the total gain, mainly due to rising vegetable costs. Core PPI (excluding food, energy, and trade services) also posted its strongest monthly gain since 2022.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Tariffs Starting to Bite

Economists say the rising PPI figures reflect growing cost pressures from U.S. tariffs on imported goods. Businesses had largely absorbed these costs earlier in the year, but margins are now tightening.

“We expect a stronger pass-through of levies into consumer prices in coming months,” said Ben Ayers, senior economist at Nationwide.

Processed goods prices for intermediate demand—reflecting earlier production stages—also jumped 0.8%, led by diesel fuel increases.

Fed’s Balancing Act

The report complicates the Federal Reserve’s outlook. Although consumer inflation data earlier this week showed only modest increases, the sharp rise in wholesale prices may raise concerns among policymakers.

“This report is a strong validation of the Fed’s wait-and-see stance,” noted Carl Weinberg, chief economist at High Frequency Economics.

While a rate cut is still widely expected at the Fed’s September meeting due to softening labor conditions, July’s PPI data may give officials cause to reconsider the timing or magnitude of future policy moves.

Why It Matters

The PPI is a closely watched indicator, feeding into the Fed’s preferred inflation gauge—the Personal Consumption Expenditures (PCE) index. July’s sharp rise in wholesale prices could foreshadow renewed inflation pressures ahead, especially if companies continue passing costs along to consumers.

With global trade dynamics and domestic demand both in flux, inflation—and the Fed’s response—remain the key variables to watch heading into the fall.