Florida Ends Commercial Rent Tax After 55 Years

2% rent savings hits Florida tenants Oct. 1, but will landlords let it stick?

Good morning. Florida just erased its 55-year-old commercial rent tax, delivering a 2% rent break for tenants and a competitive boost for the state’s CRE market. The big question now: will the savings stay in tenants’ pockets or flow back to landlords?

Today’s issue is brought to you by AirGarage—unlock higher parking revenue with dynamic pricing

We’re tracking whether CRE investors are leaning in or pulling back—across multifamily, industrial, retail, and office. Take the Q3 Fear & Greed Survey.

Market Snapshot

|

|

||||

|

|

*Data as of 08/13/2025 market close.

TAX BREAK

Florida Ends Commercial Rent Tax After 55 Years

Starting October 1, Florida will officially scrap its unique tax on commercial lease rents, cutting costs for tenants and giving the state a new edge in the competition for businesses.

What’s changing: Florida’s commercial rent tax—once over 6% and at 2% in 2024—will vanish entirely. A tenant paying $100K/mo will save about $24K/yr. Tenants should see immediate benefits, though landlords in strong markets may reclaim some through higher rents, while softer markets may hold rates to attract or retain tenants.

The broader impact: The repeal is part of a $2.2B tax relief package aimed at boosting Florida’s business appeal, especially against high-tax states. Nearly $19B in securitized retail, office, and industrial loans in the state will be affected, with the Miami metro alone representing $10.3B—over half in retail.

Market fundamentals: Retail and industrial vacancies remain tight (under 5%), while office vacancies top 8% but beat the 15.08% national CMBS average. Asking rents are down about 3% since 2022 for retail and industrial, while office rents sit near peaks. In some markets, effective rents exceed asking, hinting at softening tactics like lower listed rates or aggressive escalations on existing leases.

Debt yield trends: Industrial loans in 2025 average an 8.98% debt yield, down from 14.58% in 2023, signaling looser lending standards. Office and retail yields remain higher at 12.80% and 11.80%, reflecting tighter underwriting. For near-term maturities, improved tenant affordability from the repeal could help close refinancing gaps.

Cap rate movements: Office cap rates have climbed to 8.33% in 2025, retail has eased to 6.42% after a 2023 spike, and industrial has stayed relatively stable but volatile. The repeal could slightly compress cap rates in tenant cost-sensitive sectors, but it won’t erase structural concerns in office.

➥ THE TAKEAWAY

Big picture: Florida’s rent tax repeal won’t boost in-place NOI overnight, but it strengthens leasing economics, especially for retail and industrial. In tight submarkets, it may give landlords pricing power; in softer ones, it could spur leasing. Overall, the shift tilts Florida’s CRE toward stronger tenant retention and long-term competitiveness.

TOGETHER WITH AIRGARAGE

Unlock Higher Parking Revenue with Dynamic Pricing

If your parking asset isn’t using dynamic pricing, you're leaving money on the table. AirGarage's AI-powered pricing engine adjusts rates in real time based on demand, seasonality, and local events—so your lot earns more during peak hours without lifting a finger.

Legacy parking operators rely on static pricing and manual rate changes that miss out on revenue spikes. AirGarage’s all-in-one parking management solution brings modern pricing optimization, streamlined operations, and lower overhead.

Property owners that switch see an average 23% NOI lift in year one.

Talk to AirGarage today for a free custom proposal—and see how much more your lot could be earning.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Contact us: C-PACE is non-recourse, long-term, fixed-rate financing that can fill gaps in the capital stack in any market. Whether for new construction, redevelopment, or recapitalizations, C-PACE offers a creative solution. (sponsored)

-

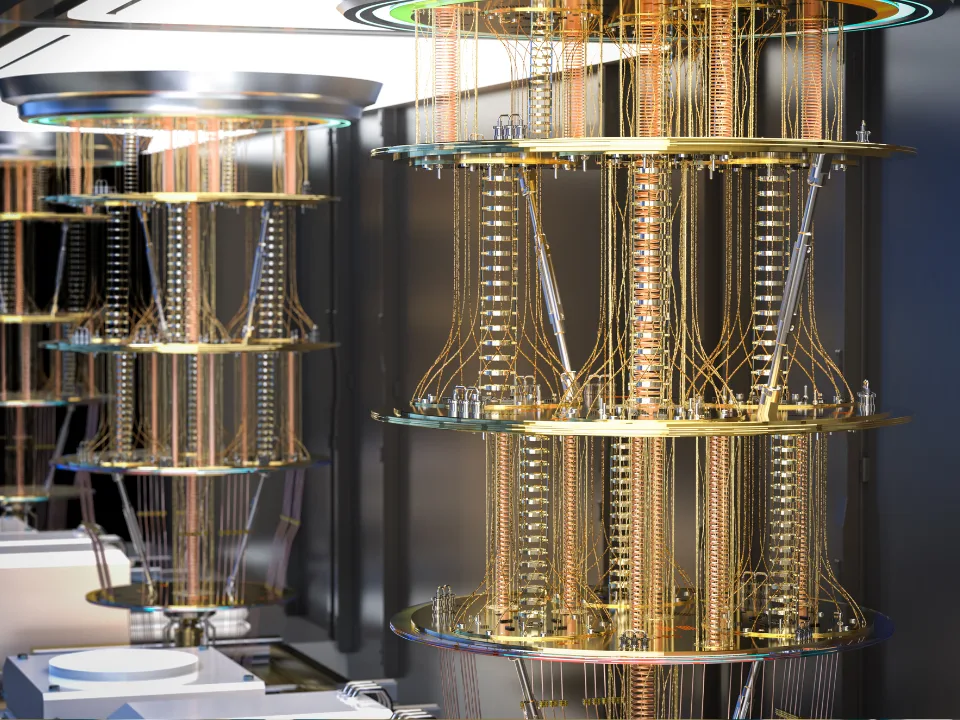

Space race: Quantum computing’s rapid push toward commercialization is creating a new demand for highly specialized real estate.

-

Rate relief: Rising odds of a September Fed rate cut offer hope for multifamily housing, easing borrowing strain despite lingering labor and inflation risks.

-

Origination wave: CRE lending roared back in early 2025, with origination volumes up 49% YoY, led by office, senior housing, and hotels.

-

Star power: Shohei Ohtani and his agent are being sued for allegedly using their star power to push out original partners from a $240M luxury Hawaii real estate project.

-

Opportunity knocks: Cooling prices and stabilizing fundamentals are creating a rare buying opportunity in California CRE, despite high rates and regulatory hurdles.

-

Refi rush: Weekly mortgage refinancing surged 23% as lower rates and rising demand for adjustable-rate loans boosted overall mortgage activity.

🏘️ MULTIFAMILY

-

Subsidy puzzle: Affordable housing projects cost far more than market-rate units due to complex financing, high soft costs, and regulatory burdens.

-

Golden renters: More Americans 55+ are choosing to rent over own, trading home maintenance for flexibility as rising costs and lifestyle shifts reshape retirement living.

-

Payout pivot: SL Green, Caesars, and Roc Nation scrapped a $22.5M payout to Times Square tenants, redirecting the funds to a broader West Side nonprofit to calm backlash over their flashy casino bid.

-

Disney development: Disney’s Cotino project in Rancho Mirage secured $187M in financing to advance its luxury master-planned community.

-

Record demand: Fifteen of the nation’s largest apartment markets hit all-time absorption highs in Q2.

🏭 Industrial

-

Warehouse winners: 3PLs dominated industrial leasing in H1 2025 as tenants scaled back space needs and e-commerce demand declined.

-

Prologis win: Prologis landed a full-building lease with DesignWorx in the Inland Empire, a welcome sign for a market grappling with rising vacancies.

-

Refi expansion: TPG secured a $408M CMBS loan to refinance a 38-property portfolio and acquire 13 more industrial assets, even as market momentum slows.

-

Redemption halt: Strategic Storage Trust VI will suspend most share redemptions starting Sept. 6, to preserve operating flexibility, following $3.3M in fulfilled redemption requests.

-

Production push: GE Appliances will invest $3B to modernize US plants and add 1,000 jobs across five states.

🏬 RETAIL

-

Fifth facelift: Fifth Avenue's redesign aims to accelerate its post-pandemic retail revival, drawing inspiration from global shopping districts.

-

Park over profit: The city of Glendale outbid private buyers to acquire a former Joann store for $24M, converting the retail site into a public park.

-

Sporting strategy: Macerich is reviving mall traffic with 3M SF of new leases, led by Dick’s House of Sport filling former Sears spaces.

🏢 OFFICE

-

Office milestone: NY office foot traffic topped pre-pandemic levels in July for the first time, fueled by stricter in-office mandates and leading a nationwide uptick in RTO trends.

-

Brooklyn buy: Cross Ocean and Lincoln acquired a fully leased 650K SF Brooklyn office building, banking on stable cash flow and NYC office market momentum.

-

No deal: Chicago’s Merchandise Mart isn’t likely to sell soon due to its size, stable income, and a lack of suitable buyers in a cautious market.

🏨 HOSPITALITY

-

Brickell buyout: Swire bought full control of Miami’s Mandarin Oriental for $37M and plans a new luxury hotel-condo project.

-

Spa strategy: Hotel spas, especially in luxury and resort properties, are becoming key revenue drivers, generating up to 4.2% of total hotel revenue.

📈 CHART OF THE DAY

Renter households are surging while homeowner growth has stalled.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |