- CPI rose 0.2% month-over-month and 2.7% year-over-year in July. Core CPI increased 0.3% and 3.1%, the sharpest six-month gain.

- Despite higher core prices, markets raised the odds of a September rate cut to over 94% due to weaker labor data.

- Lower rates could help rental housing by easing borrowing costs, but labor market weakness and rising input prices remain risks.

Inflation Recap

Chandan Economics found that consumer prices rose modestly in July, up 0.2% from June and 2.7% from a year earlier. This was the third straight month of annual acceleration. Core CPI, which excludes food and energy, climbed 0.3% month-over-month and 3.1% year-over-year—its largest gain in six months.

Used cars, new vehicles, and transportation services saw notable price increases. Gasoline, fuel oil, and shelter costs fell. Food prices were largely flat. Economists link the renewed price pressures to recent tariffs and trade policies.

Impact on Interest Rates

Normally, higher inflation would reduce the chances of a Fed rate cut. This time, the opposite happened. Inflation came in below elevated expectations, and labor market data weakened sharply. The US added just 73,000 jobs in July, with prior months revised lower by a combined 258,000.

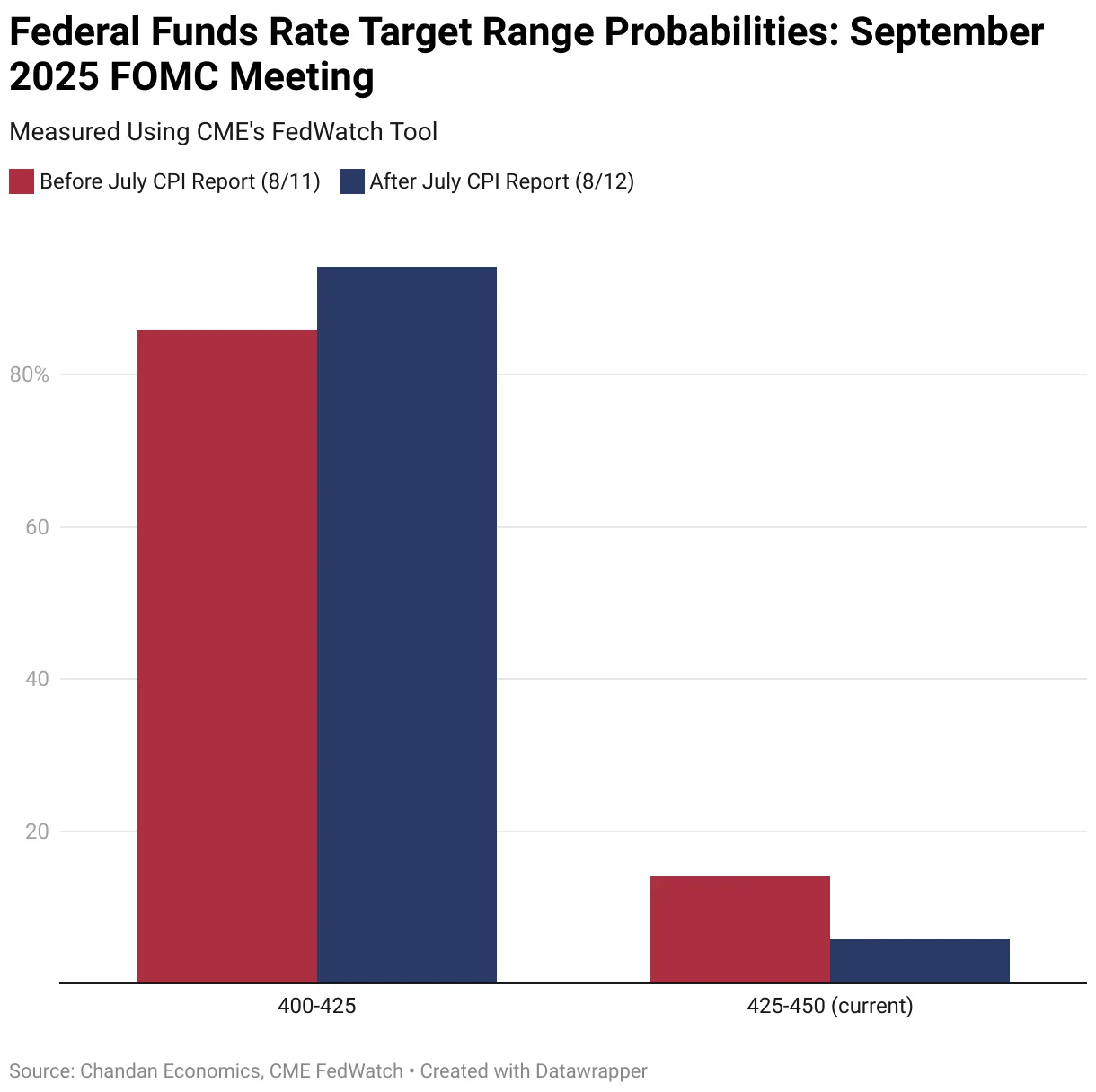

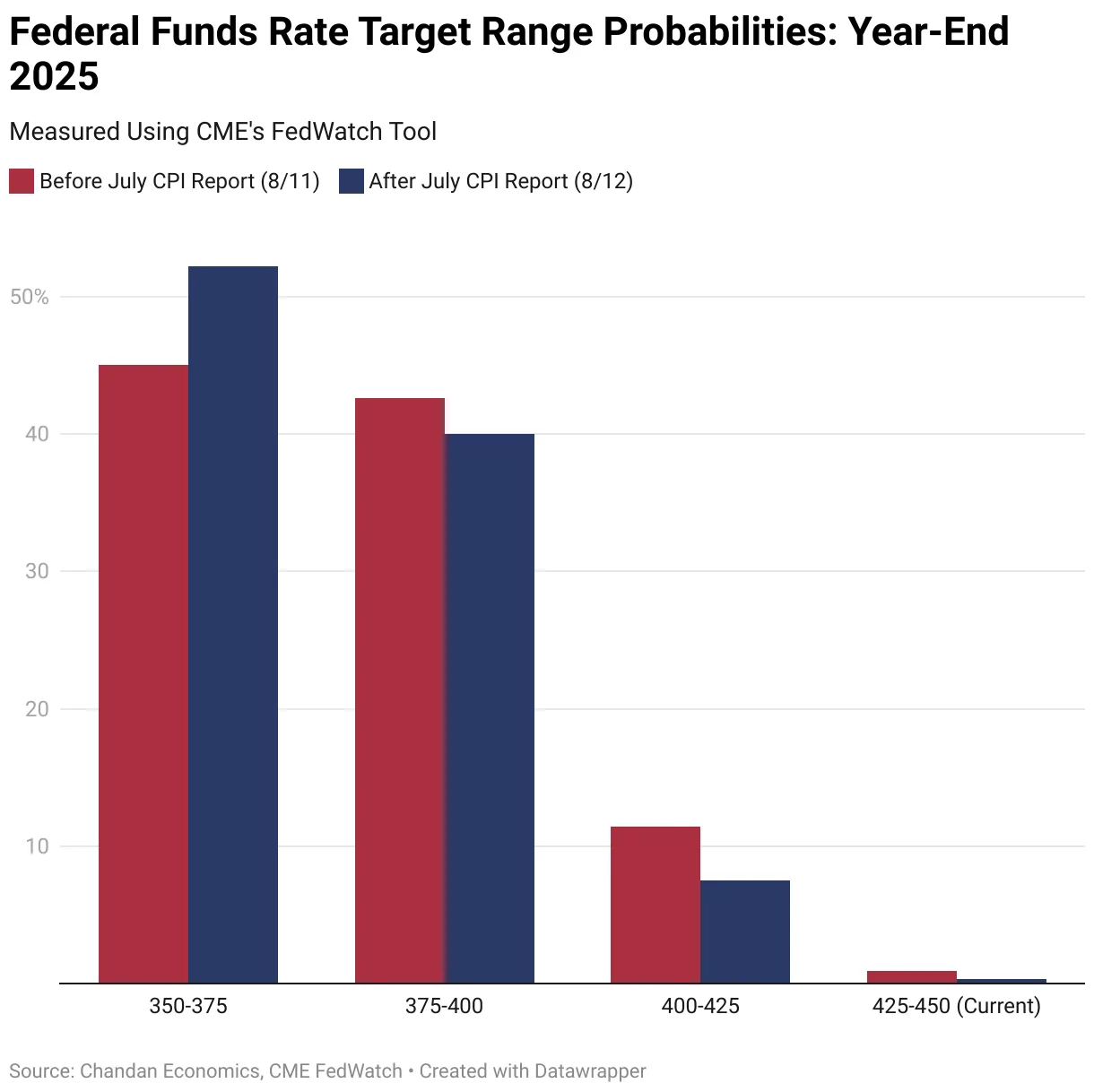

Following the CPI release, markets raised the odds of a September cut from 85.9% to 94.2%. Expectations for two or more cuts by year-end increased from 87.6% to 92.2%. Investors now see greater risk to employment than to price stability.

Rental Housing Outlook

For multifamily developers, a rate cut could bring welcome relief from high financing costs. Even before any move, expectations alone might encourage some projects to move forward. How much activity revives will depend on lender confidence and liquidity.

Risks remain for the rental housing sector. A weakening labor market could slow demand and rent growth, especially in affected metros. Rising construction input costs could also offset some benefits from cheaper borrowing. Still, if the Fed cuts rates in September, the medium-term impact is likely to be net positive.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes