- The Trepp CMBS special servicing rate declined nine basis points in July to 10.48%, after hitting a 12-year high in June.

- Office posted the largest decline among major property types, down 17 basis points to 16.21%. Multifamily was the only sector to rise.

- New transfers to special servicing totaled just over $1.0B in July, far below the recent $3.4B monthly average.

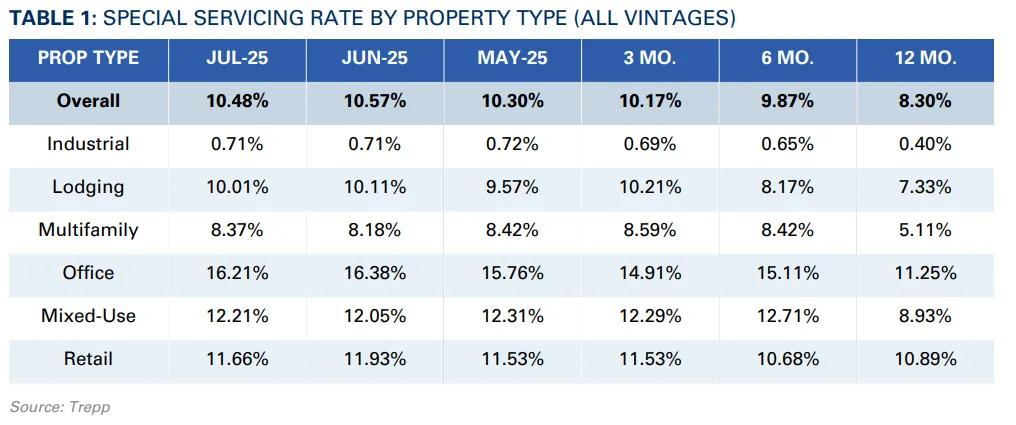

After climbing for three months in a row, the US CMBS special servicing rate moved lower in July. It fell to 10.48% from June’s 12-year high of 10.57%, according to Trepp. Although the drop was small, it broke the recent upward trend. The rate is still well above historical norms.

Property Type Breakdown

In July, four of the five major property sectors posted declines. Retail saw the biggest improvement, falling 29 basis points to 11.66%. Office followed with a 17-basis-point drop to 16.21%, easing from last month’s record. Lodging dipped 10 basis points to 10.01%, while industrial stayed flat at 0.71%. However, multifamily rose 19 basis points to 8.37%, reversing its recent declines.

Loan Transfers Slow

The volume of new transfers to special servicing dropped sharply. July saw just over $1.0B in new loans transfer, well below the $3.4B average of the previous three months. Office made up half the new volume. Retail loans accounted for 24%, and multifamily represented 15%. The largest new transfer was a $146M office loan tied to two Washington, D.C. properties. It is now more than 90 days delinquent.

Notable Retail Case

The second-largest new transfer was the $120M Mall St. Matthews loan in Louisville, KY. It moved to special servicing due to a maturity default. The 670,000 SF mall is anchored by JCPenney, Dave & Busters, Cinemark, and Forever 21. Its appraised value has plunged from $280M in 2013 to $83M in 2021.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

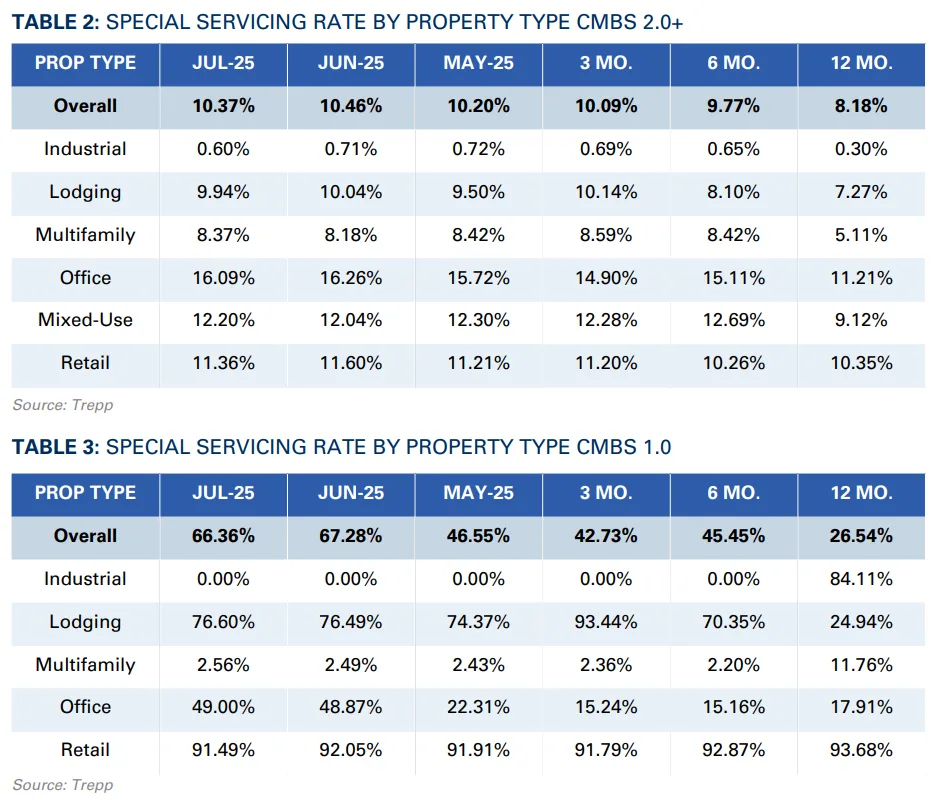

CMBS 1.0 vs. 2.0+

Older CMBS 1.0 loans, issued before the 2008 financial crisis, remain far more distressed. Their special servicing rate was 66.36% in July. By comparison, CMBS 2.0+ loans, issued after the crisis with stricter underwriting, posted a rate of 10.37%.

Why It Matters

The July decline offers a brief reprieve after months of increases. Nevertheless, distress remains elevated in certain sectors, especially office and retail. The slower pace of new transfers is a positive sign, but property fundamentals still face headwinds.