- LA office visits remain 46.6% below pre-pandemic levels, with declines in both visitors and visits.

- Century City posts visits just 28.1% under 2019, outperforming other LA submarkets.

- Premium amenities and proximity to Westfield Century City boost commuter engagement.

- Affluent, educated young professionals sustain higher office attendance in the submarket.

LA’s RTO Slump VS. SF’s Stabilization

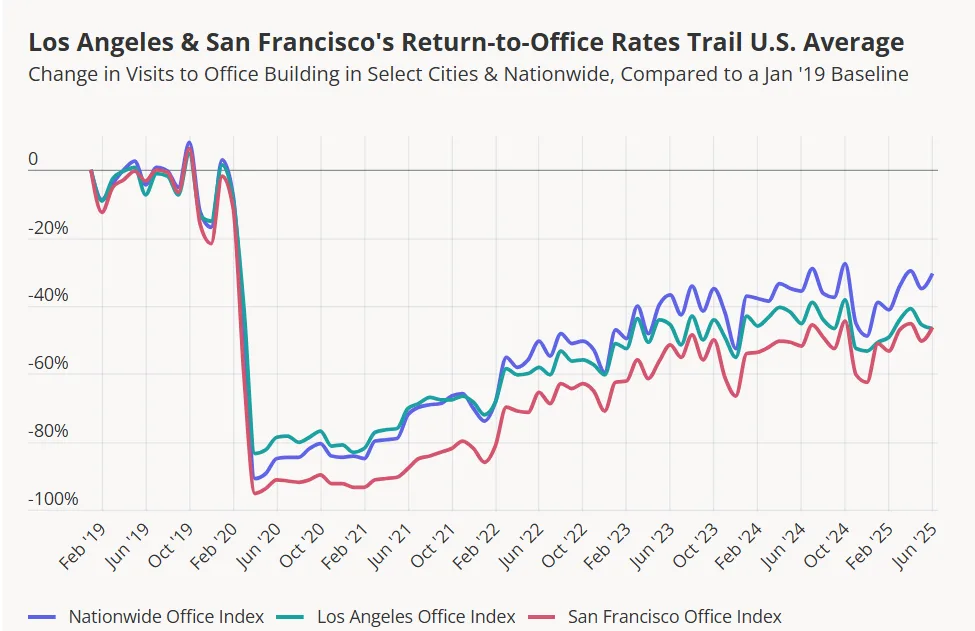

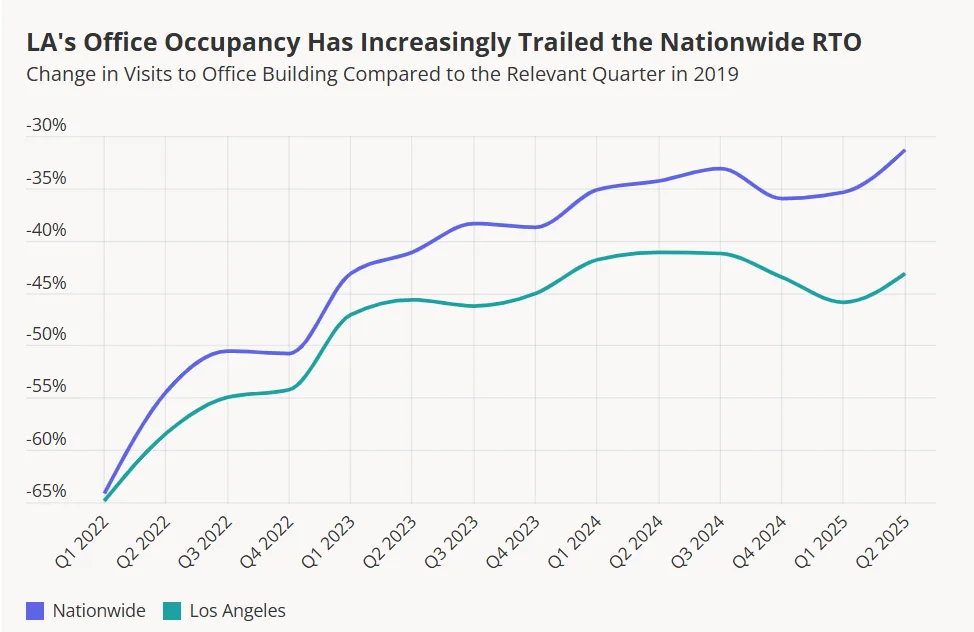

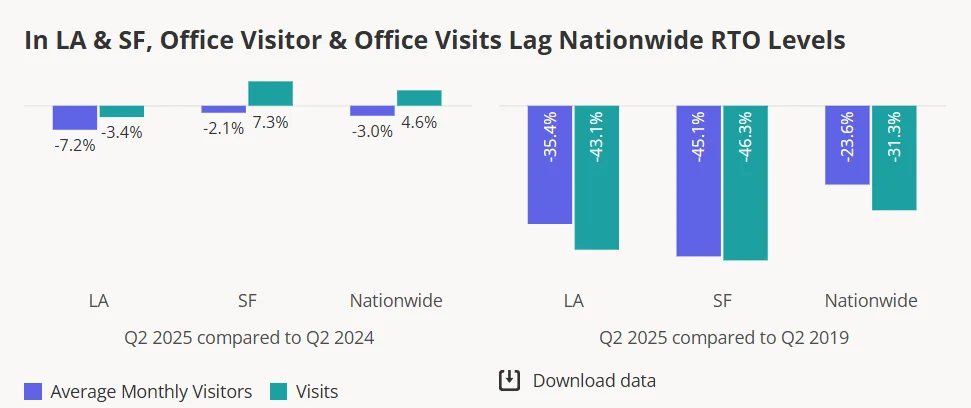

Nationwide, office visits in June 2025 were 30.5% below January 2019 levels, reports Placer.ai. Both LA and SF trail that benchmark, but their recovery paths differ. SF has maintained a slow but steady climb from pandemic lows. LA, however, tracked closely with national trends until mid-2022, when it began a sustained decline.

Commuter Patterns Reveal Deeper Issues

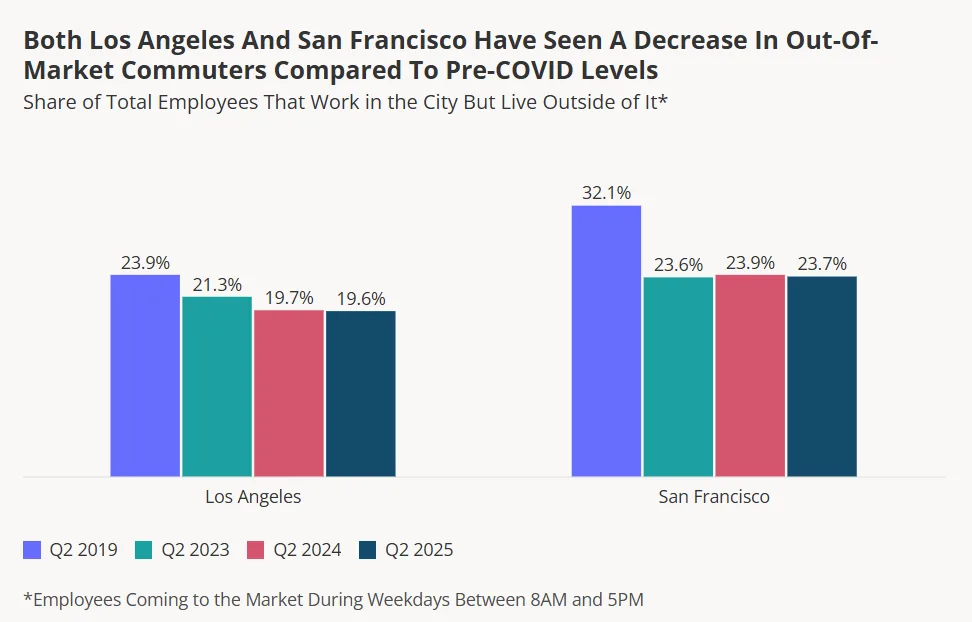

Both cities lost significant out-of-market commuters after 2019, but SF has clawed back some share since 2023. LA’s out-of-market commuter base continues to shrink—undercutting both visitor counts and visit frequency.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why LA’s Visits Keep Falling

In many US cities, hybrid work has resulted in fewer visitors but more frequent visits from those who return. SF fits that pattern, with visits up YoY despite fewer unique visitors. LA does not: both visits and visitors fell in Q2 2025 compared to last year, hinting at workforce retention challenges and weaker in-office engagement.

Century City Defies The Trend

Despite LA’s broader weakness, Century City’s inbound commuter visits were just 24.7% below Q2 2019 and slightly higher than Q2 2024. Its premium Class A and Trophy offices are attracting tenants from weaker submarkets, driving the highest rental rates in West LA.

- Leasing Activity: 27% of West LA’s YTD leasing, more than double any other submarket.

- Amenity Effect: 45% of Century City weekday commuters also visited adjacent Westfield Century City mall during Q2 2025—suggesting lifestyle integration drives office attendance.

A Demographic Edge

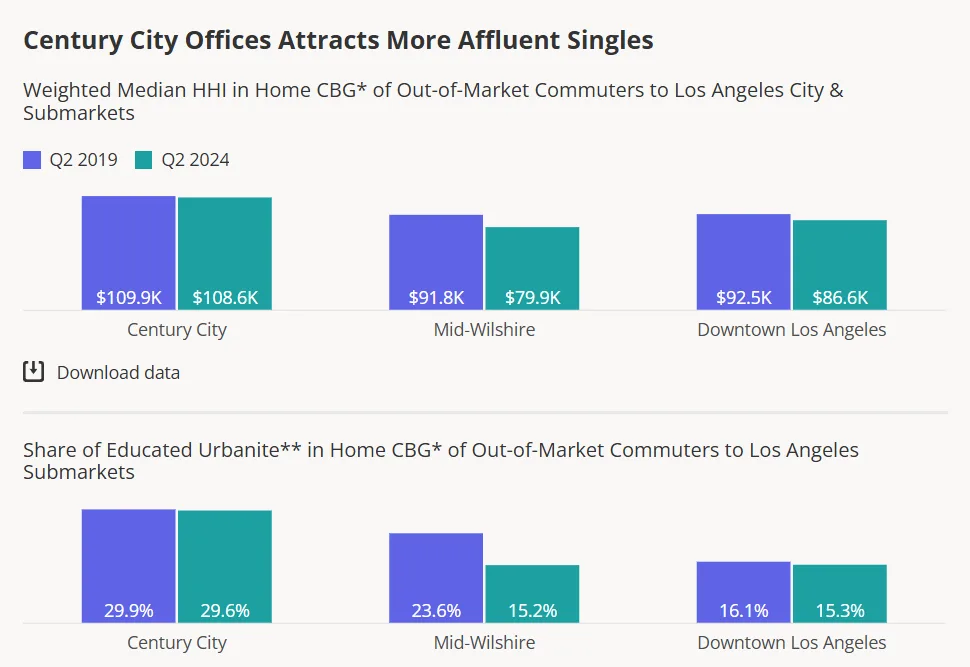

Century City outpaces mid-Wilshire and Downtown LA in median household income. It attracts a high concentration of “Educated Urbanites,” defined as young, affluent professionals. This group is more likely to maintain regular office attendance in hybrid work arrangements. This demographic’s career-focused priorities align with the submarket’s premium, amenity-rich environment.

Polarization Of LA’s Office Market

The performance gap between high-end, amenity-rich submarkets and older, less differentiated office districts is widening. This trend underscores a key CRE takeaway. In hybrid work markets, quality and integration matter more than quantity of space. Century City’s model—targeting affluent, mobile professionals with lifestyle-driven office ecosystems—may be the blueprint for post-pandemic office resilience in Southern California.