CRE Prices Frozen as Market Awaits Rate Relief

The U.S. commercial property market remains locked in a stalemate, with limited sales keeping values from moving meaningfully in either direction.

Good morning. A lack of liquidity, not plunging demand, is keeping U.S. commercial property values frozen near current levels.

Today’s issue is brought to you by Bequest Asset Management—earn 10–12% annually from diversified real estate and energy assets.

🎙️This week on No Cap: $50M in pension fund backing was just the start—Jon Siegel reveals how RailField fought to stay in the multifamily game through one of the toughest market cycles in years.

Market Snapshot

|

|

||||

|

|

*Data as of 08/08/2025 market close.

STUCK IN LIMBO

CRE Prices Frozen as Market Awaits Rate Relief

With deals scarce and financing costly, commercial property values are stuck—18% below their 2022 peak and barely moving.

By the numbers: Green Street’s Commercial Property Price Index slipped just 0.1% in July and is up only 3.2% year-over-year—still nearly 18% below the 2022 peak. Office values have fallen 37% from the top, while strip retail and manufactured home parks remain relatively steady on light trading.

Green Street’s Commercial Property Price Index

What’s driving it: Elevated interest rates and high borrowing costs are stifling transactions. With few distressed owners, sellers are largely waiting out the turbulence rather than accepting steep discounts—a “shadow freeze” where liquidity, not traditional supply-and-demand, is setting the tone.

Zoom in: This inertia is preventing a full price reset, leaving uncertainty about where values would settle if forced sales returned. Analysts say movement is unlikely until rates fall or an external shock forces more assets to market.

What to watch: J.P. Morgan now expects a 25 bp Fed rate cut in September—pulled forward from December—citing softer jobs data and political shifts at the central bank. CME FedWatch puts the odds near 90%.

➥ THE TAKEAWAY

The big picture: CRE valuations are boxed in—floor supported by patient owners, ceiling capped by borrowing costs. Without a shift in rates or distress, sideways is the new normal.

TOGETHER WITH BEQUEST ASSET MANAGEMENT

Earn 10-12% Annual Preferred Returns Backed by Real Estate & Energy – Without the Volatility

The Bequest Legacy Fund combines real estate and energy for predictable growth. Offering 10-12% annual returns, monthly distributions, or compounding options. Backed by a diversified portfolio of U.S. performing mortgage notes, commercial real estate, and energy assets, it provides stability and cash flow.

Open to both accredited and non-accredited investors. Five-year track record with zero missed payments.

What Makes Bequest Different?

-

Fiduciary-backed, with full transparency

-

Steady cash flow from every investment

-

Proprietary controls for sourcing & asset management

-

Focus on assets that benefit communities and the future

-

State-licensed Registered Investment Advisor

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Attention Texas Multifamily Investors: Join 400+ investors at the 9th annual Old Capital Conference on October 8–9 in DFW. Meet the top listing brokers, lenders, and seasoned owners—all in one deal-focused event.

(sponsored)

-

Steady momentum: July’s CRE Activity Index eased from June’s peak but stayed strong on solid deal flow and rising appraisals.

-

Cap compression: Heavy new apartment deliveries are keeping vacancies elevated and rent growth muted in the South and West, even as sales tick up and cap rates fall.

-

Turning point: Fed Governor Lisa Cook warned that July’s weak jobs data may mark an economic shift, fueling speculation over near-term rate cuts.

-

Tragic succession: Blackstone named Rob Harper interim CEO of its $53B BREIT after Wesley LePatner’s death in last week’s NYC office tower shooting.

-

Guidance gap: REITs are topping forecasts, but modest guidance hikes and investor apathy are keeping shares stagnant.

🏘️ MULTIFAMILY

-

Renter divide: Renter growth is surging at the high and moderate-low ends, squeezing the lowest-income share.

-

Steady builds: 2025 multifamily starts match last year, lifting Yardi’s 2027 forecast to 360K units.

-

Outlook bright: July saw slow multifamily rent growth, but easing expenses and solid demand signal a brighter outlook.

-

REIT rush: Public REITs are ramping up seniors housing acquisitions at below replacement cost amid strong demand and limited supply.

-

Local resistance: Texas cities, led by Arlington, are adding costly new rules to blunt a state law easing multifamily development in commercial zones.

-

Developer dispute: Michael Shvo is demanding $85M from German pension fund BVK amid stalled projects and defaults.

🏭 Industrial

-

Reshoring investment: Apple is adding $100B to its U.S. manufacturing plans, launching a program to reshore suppliers and create 20,000 jobs.

-

Storage play: Barings and Brennan launched a $150M JV targeting industrial outdoor storage in growth markets.

-

Cloud campus: Blackstone secured $550M in CMBS refinancing for a 1.7M SF, 10-property Virginia data center portfolio fully leased to AWS.

-

AI backbone: Meta is teaming with Pimco and Blue Owl on a $29B financing deal to build a massive Louisiana data center and speed up its AI ambitions.

🏬 RETAIL

-

Retail resilience: Prime centers saw strong leasing in H1 2025, but closures and softer big-ticket spending added pressure.

-

Flex factor: Gyms are driving DFW’s retail rebound, set to lease nearly 1M SF in 2025 and helping push vacancy to a near-record 4.8%.

-

Luxury lift: Prime Manhattan corridors like SoHo and the Upper East Side saw notable rent gains in H1 2025 despite broader headwinds.

-

Retail record: A Rodeo Drive property leased to Tom Ford, Moncler, and Balenciaga sold for over $400M, setting a street record.

🏢 OFFICE

-

Policy enforcement: More US companies are monitoring and enforcing office attendance, with hybrid schedules trending toward more in-office days.

-

Space shrinkage: Manhattan’s coworking space fell 400K SF in Q2, its first drop, driven by oversupply, high costs, and WeWork closures.

-

Midtown refi: Paramount Group landed $900M to refinance its 97%-leased 1301 Avenue of the Americas and cover future leasing costs.

-

Fit-out flare: Law firm office buildout costs are up 7% in 2025, driven by pricier materials, labor shortages, and demand for high-end, amenity-rich spaces.

-

Hybrid harmony: Employers and staff are aligning on attendance, boosting demand for culture-driven, amenity-rich prime offices.

🏨 HOSPITALITY

-

Steady stakes: Gaming REITs returned 9.7% through July, buoyed by strong consumer demand, rising dividends, and stable cash flows from concentrated casino and entertainment assets.

-

Brand divide: CBRE says more hotel brands haven’t boosted RevPAR, with upper-midscale leading and economy lagging.

-

Hotel handoff: Republic Investment and Capstone bought the 100-room Smyth Tribeca for $39.8M, with plans for 2026 upgrades to boost its luxury profile.

-

Prime pick: Sunny’s in Miami topped Robb Report’s best new restaurants list for its live-fire steaks and chic courtyard setting.

📈 CHART OF THE DAY

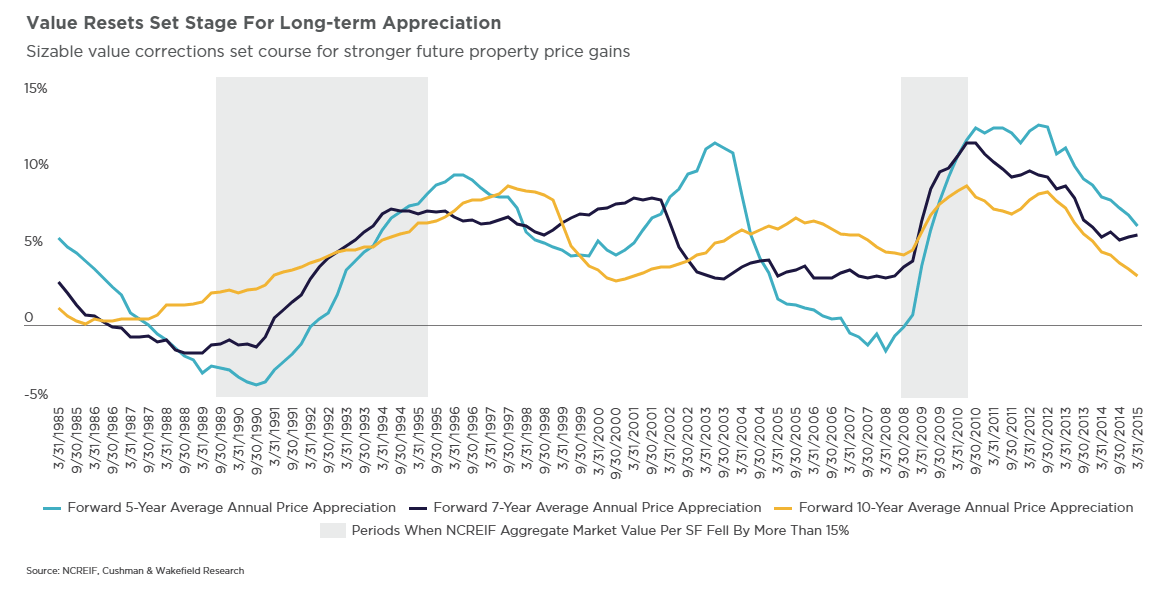

Past steep CRE value drops have historically led to strong long-term gains, and today’s 13–21% decline sets a similar stage for future appreciation.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |