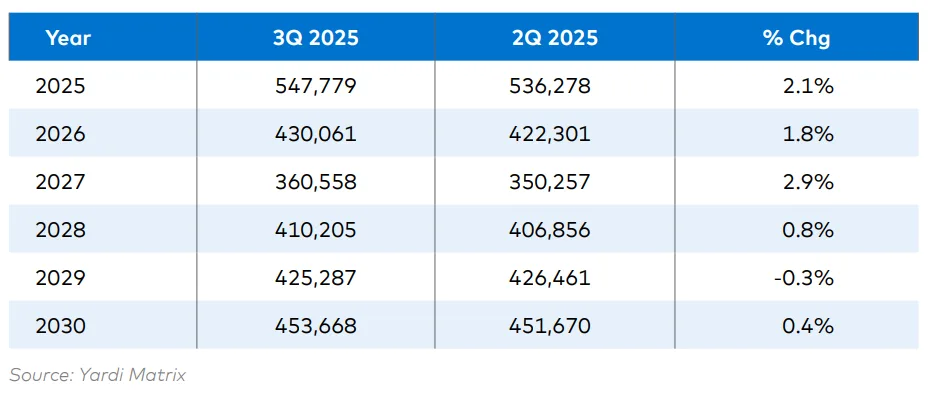

- Q3 2025 update increases completions forecasts by 2.1% for 2025, 1.8% for 2026, and 2.9% for 2027, driven by stronger-than-expected mid-year pipeline data.

- Under-construction units fell 16.4% year-over-year to 1.027M, yet remain historically high enough to support elevated deliveries through 2026.

- 2028–2030 projections remain unchanged, with expectations for supply to climb above 450,000 units by 2030 as construction starts rebound in 2026.

Yardi Matrix’s Q3 2025 Multifamily Supply Forecast shows a slight but notable upward revision to near-term completions, fueled by a larger-than-expected under-construction pipeline at mid-year. Despite a 16.4% annual drop in units under construction, the 1.027M-unit pipeline is still substantial enough to sustain elevated deliveries in 2025 and 2026.

Near-Term Shifts

The 2025 forecast now calls for 547,779 units, up 2.1% from last quarter. For 2026, completions are expected to reach 430,061 units, a 1.8% lift. The 2027 outlook also improved, rising 2.9% to 360,558 units. Stronger construction starts in the first half of 2025 drove this change. Yardi still expects a slowdown in starts for the rest of the year. If starts hold steady with 2024 levels, the 2027 forecast may rise again.

Market Breakdown

- Market-Rate and Partially Affordable: 421,647 units forecast for 2025, dropping to 278,196 in 2027.

- Affordable Housing: 75,496 units expected in 2025, supported by new federal funding and eased bond-financing rules.

- Senior Housing: Modest 2025 delivery of 9,888 units, falling to 8,512 in 2027.

- Single-Family Rentals (SFR): 40,748 units in 2025, down to 24,819 in 2027.

Pipeline Watch

The under-construction pipeline is shrinking, but the prospective pipeline is growing. It rose 11.1% year-over-year to 3.48M units. This growth shows developers still have strong long-term interest, even as near-term completions cool from the 2024 peak of almost 670,000 units.

Long-Term Outlook

Multifamily forecast for 2028–2030 remains unchanged. Completions are projected at 410,000 units in 2028, rising above 450,000 units by 2030. Lower interest rates, steady job growth, and government support are expected to lift construction starts beginning in 2026.

Why It Matters

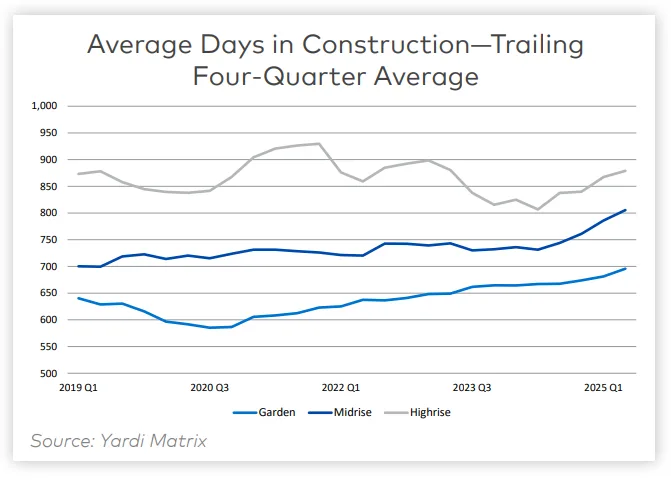

The multifamily sector is easing after a record 2024 delivery pace. Still, the current pipeline can support high levels of new supply for several years. Developers are watching interest rate moves, construction timelines, and new housing policies as they plan for the next growth cycle.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes