- US manufacturing activity surged in July 2025 as companies raced to produce and ship goods before new tariffs took effect on August 1.

- The uptick was driven by increased employee and logistics visits, pointing to full-capacity production lines and urgent inventory movement.

- Auto manufacturing, industrial machinery, and metals processing were among the most active sectors, rapidly stockpiling tariff-sensitive materials and parts.

July’s Pre-Tariff Production Rush

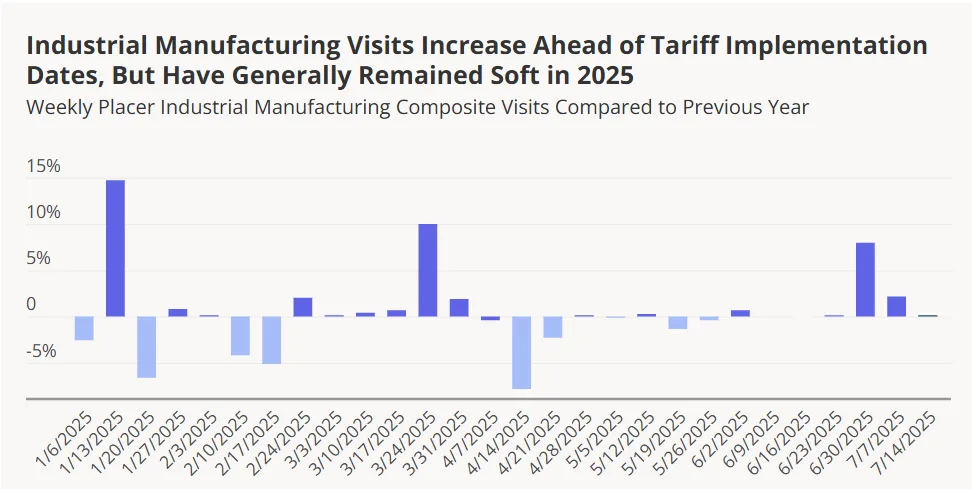

After a brief lull in May and June, industrial facilities across the US experienced a sharp increase in activity throughout July 2025, reports Placer.ai. With new tariffs scheduled to take effect on August 1, manufacturers across the country moved quickly to get ahead of anticipated cost increases.

This urgency followed earlier efforts in March and April, when manufacturers front-loaded inventory to prepare for possible trade disruptions. But as the tariff deadline approached, July brought a renewed and intensified production cycle. This was visible in the data through a spike in employee visits to manufacturing sites. There was also a noticeable increase in visits from logistics partners, reflecting heightened shipping and distribution activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Chains Race Against The Clock

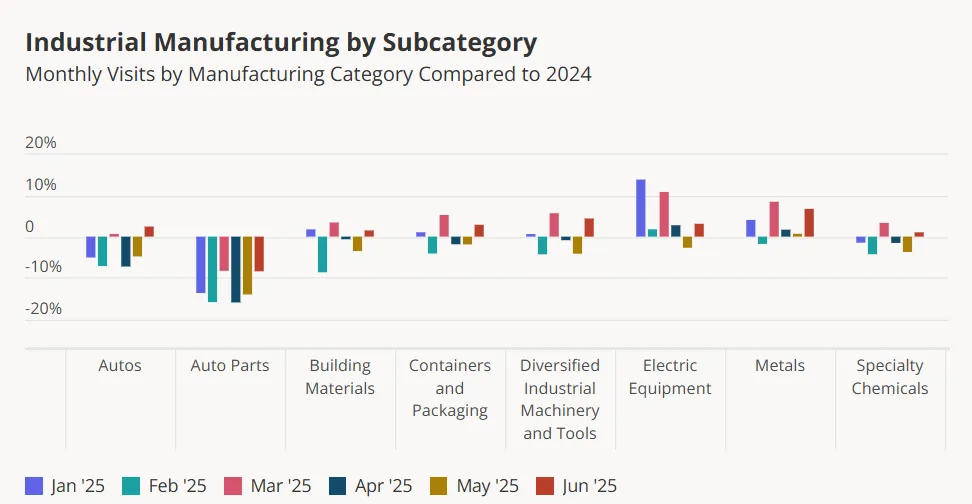

The sectors most affected by this surge were those with the deepest ties to global supply chains — particularly auto manufacturing, industrial machinery, and metals processing. Facilities in these industries ramped up production to take in vulnerable imports and convert raw materials before tariffs inflated their costs.

Metals processors sped up use of imported steel and aluminum, while manufacturers rushed to turn materials into products. Auto and machinery producers worked overtime to secure parts, boosting shipments and straining logistics networks.

The pattern was clear: more employee activity meant production lines were running longer shifts. Increased logistics traffic pointed to a race to move goods before the tariff wall came down.

Why It Matters

This pre-tariff rush underscores the significant operational and financial pressure manufacturers face amid shifting trade policies. Companies are not only adjusting inventory strategies but also rethinking supply chain dependencies in anticipation of long-term cost impacts.

What’s Next

With tariffs active August 1, experts expect a short-term slowdown as supply chains adjust to higher costs. However, longer-term shifts are likely to emerge in the months ahead. These include onshoring strategies, supplier diversification, and increased pricing pressures.

As trade policy continues to evolve, July’s activity may serve as a blueprint for how manufacturers will respond to future geopolitical disruptions.