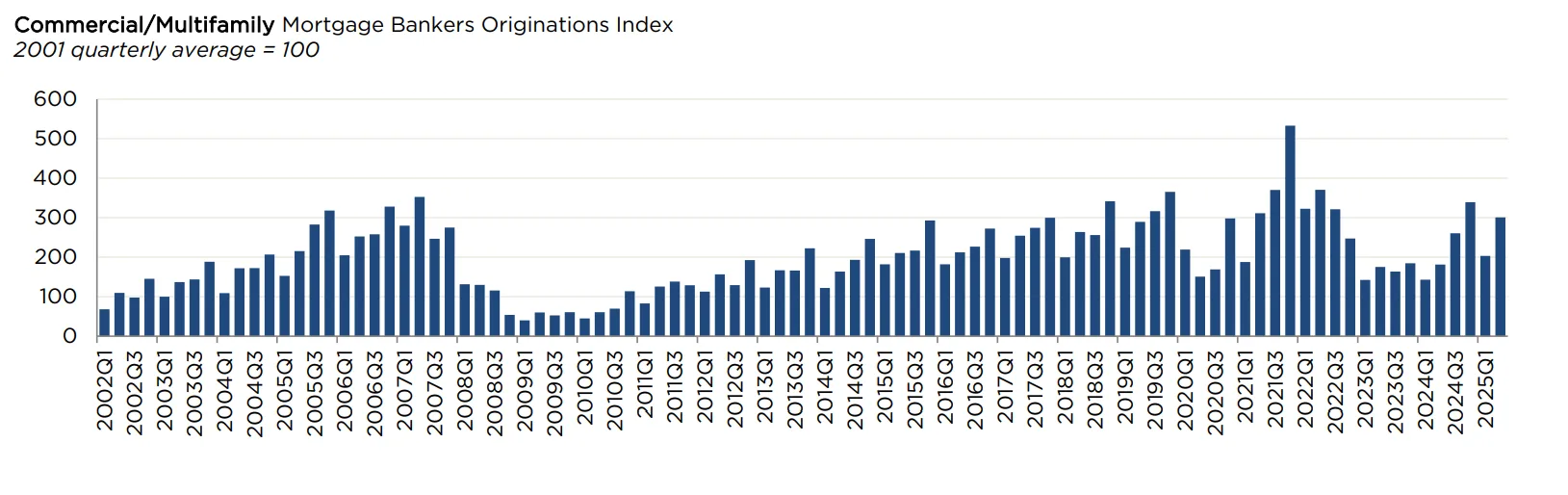

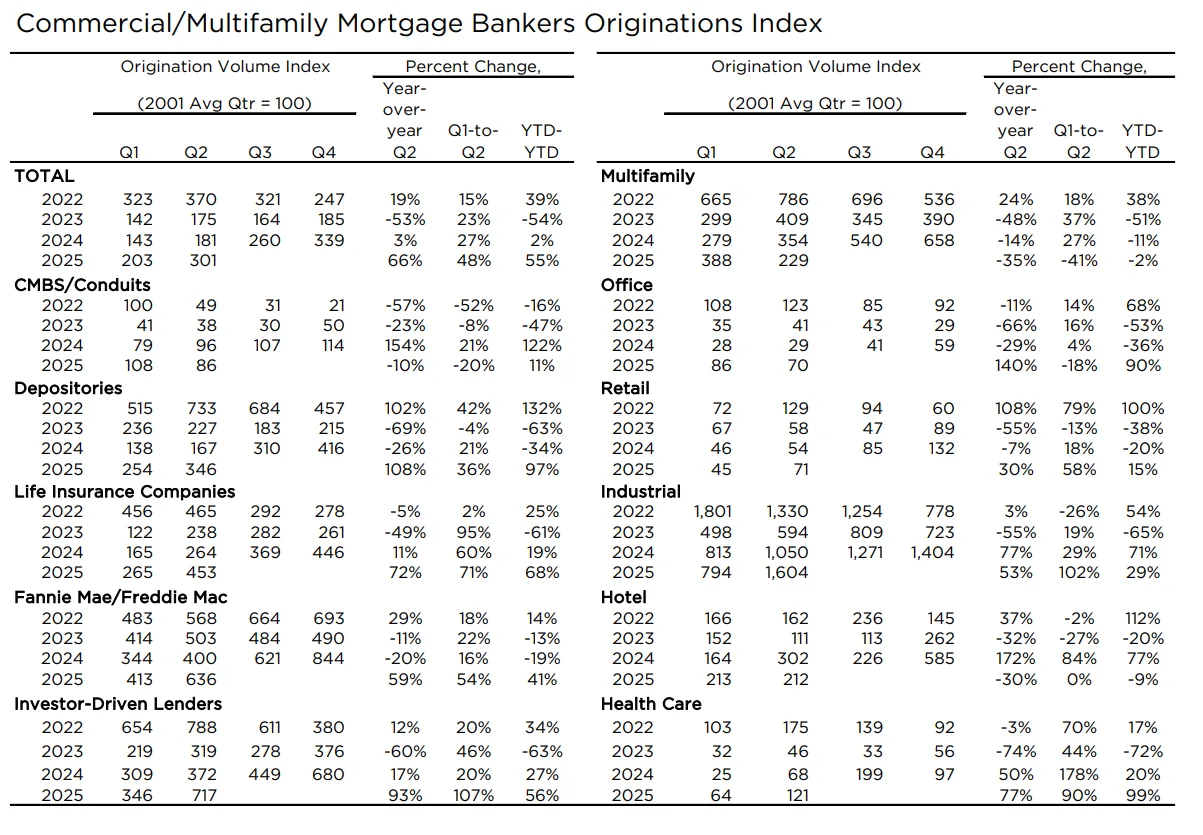

- CRE loan originations rose 66% year-over-year and 48% quarter-over-quarter in Q2 2025, marking a significant recovery from last year’s sluggish activity.

- Office lending spiked 140% year-over-year, while healthcare and industrial saw gains of 77% and 53%, respectively, underscoring renewed demand in previously challenged sectors.

- Depository and investor-driven lenders re-entered the market, with originations from investor-driven capital increasing 93% YoY and banks more than doubling activity.

- Multifamily and hotel sectors lagged, with originations falling 35% and 30% YoY, reflecting lingering caution in these asset classes.

Lending Recovery Gains Momentum

Bisnow reports that commercial and multifamily CRE lending surged in Q2 2025, as lenders and investors reengaged with select corners of the commercial real estate market, according to the Mortgage Bankers Association (MBA). The overall lending volume was up 66% year-over-year and 48% compared to the previous quarter.

This rebound follows a notably quiet 2024, when capital markets were still reeling from the aftershocks of multiple regional bank failures and persistent economic uncertainty.

Office Leads Year-Over-Year Growth

Despite broader concerns around office viability, the sector posted a 140% year-over-year increase in loan originations — the largest among all property types. Healthcare followed closely with a 77% increase, and industrial lending rose 53%.

Retail also saw a modest 30% gain, but lending in multifamily and hospitality declined by 35% and 30%, respectively, reflecting investor caution or pricing disconnects in those sectors.

On a quarter-over-quarter basis, industrial lending surged 102%, while office lending dipped 18%, suggesting that short-term dynamics remain in flux.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Capital Sources Reengage

Investor-driven lenders and traditional institutions alike ramped up activity:

- Investor-driven loan originations jumped 93% year-over-year

- Life insurance companies increased originations by 72%

- Government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac rose 59%

- CMBS lending continued to contract, dropping 10%

“Lending by depositories more than doubled,” said Reggie Booker, MBA’s Associate VP of Commercial Research. “The return of private capital signals renewed confidence in market fundamentals, albeit selectively.”

Market Context and Outlook

The sharp increase in CRE lending originations reflects both a rebound from depressed 2024 activity and selective optimism in high-performing sectors. The banking sector has spent much of 2025 offloading underperforming assets, a consequence of riskier loans made during the zero-interest-rate era.

“We’re going through somewhat of a purgatory process right now for those loans that were originated at the height of market exuberance,” said Tom Taylor, Senior Manager of Research at Trepp. “Charge-off rates will likely increase — particularly in office — but I don’t suspect that many others will increase.”

Why It Matters

The Q2 lending surge signals a slow but steady return to CRE market normalcy, particularly for asset classes with strong fundamentals or growing demand like industrial and healthcare. However, the divergent performance between sectors suggests that lenders are still being selective, with many keeping a close eye on distressed assets and broader economic signals.

If momentum continues, the second half of 2025 could see more robust capital flows — but caution remains the rule, not the exception.