- National self storage rents declined just 0.4% year-over-year in April 2025, with signs of sequential improvement and strong spring leasing activity.

- Chicago led the top 30 US metros with 3.0% annual rent growth, while markets like Austin and San Diego saw steep rent declines.

- Construction is slowing, with new supply in April equaling 2.8% of existing inventory, suggesting supply-demand dynamics may rebalance.

Industry Stabilizing After Flat Q1

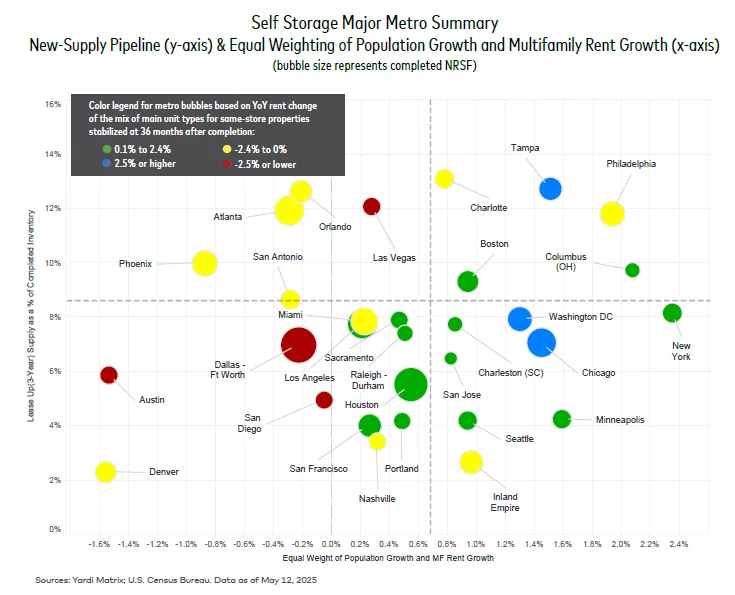

The US self storage sector entered Q2 2025 with a cautiously optimistic outlook following mixed results in Q1, reports Yardi Matrix. Although revenue and NOI were mostly flat—at 0.1% and -1.1% year-over-year—rising rents and seasonal demand suggest momentum is returning. Urban markets like Chicago and New York outperformed, while Sun Belt metros continued to face supply pressures.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

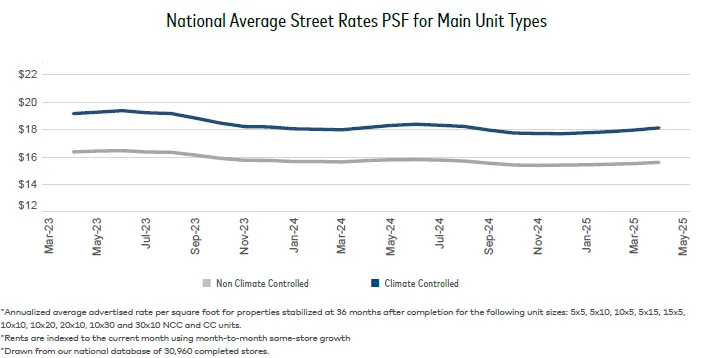

Rents Begin To Rebound

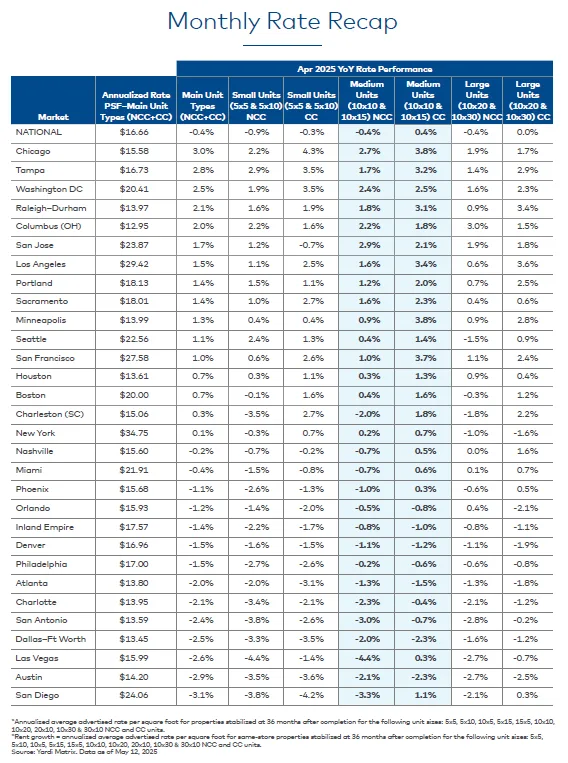

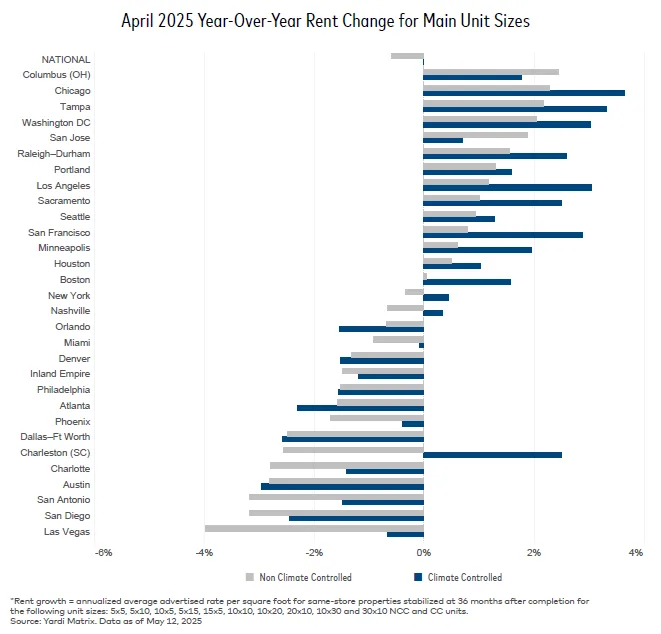

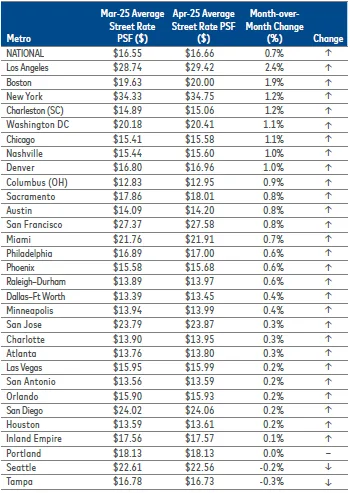

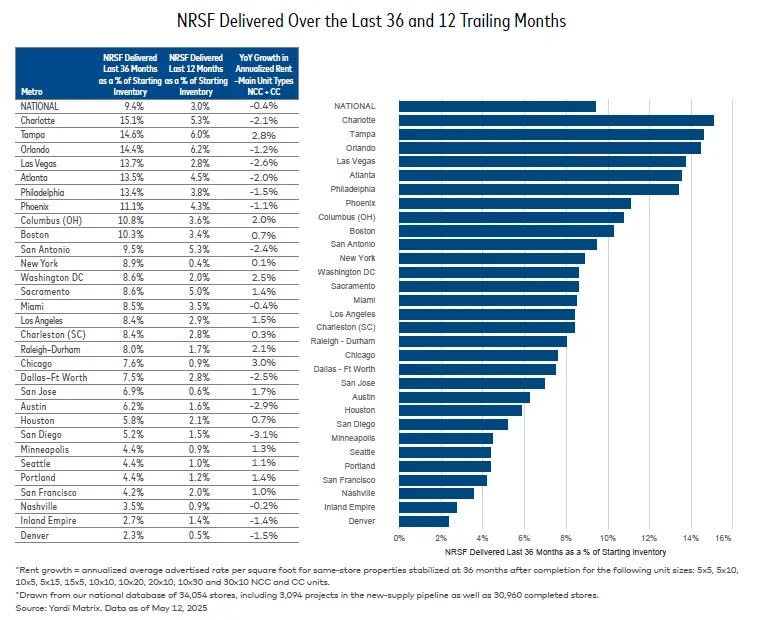

National advertised self storage rents fell just 0.4% in April, improving from prior months. Notably, rates rose month-over-month by 0.7%, with gains in 27 of the top 30 metros. Chicago (+3.0%), Tampa (+2.8%), and Washington DC (+2.5%) were top performers, driven by constrained supply and strong multifamily demand.

Supply Growth Slows

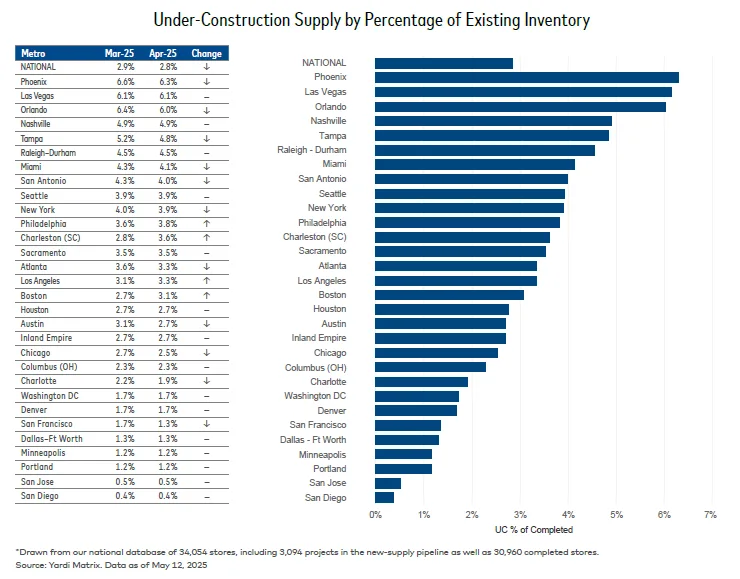

New self storage construction has decelerated. Only 2.8% of national inventory was under construction in April—down 10 basis points from March. The pipeline is shrinking, with projected supply falling to 2.3% of stock in 2026 and 2.0% in 2027. Charleston saw the largest month-over-month spike, increasing its construction activity by 0.8%.

Market Performance Diverges

Markets like San Diego (-3.1%), Austin (-2.9%), and Dallas–Fort Worth (-2.5%) posted the largest self storage rent drops, coinciding with elevated new supply. Meanwhile, Chicago, with only 0.9% of self storage inventory delivered over the last year, benefited from a more balanced market, multifamily rent growth, and low storage competition.

Outlook

REITs are more aggressively raising rents than their non-REIT peers, especially in smaller markets. While challenges remain in oversupplied regions, trends point to a possible return to normalized performance by late 2025. Developers are taking a more cautious approach, which could further support rent stabilization.