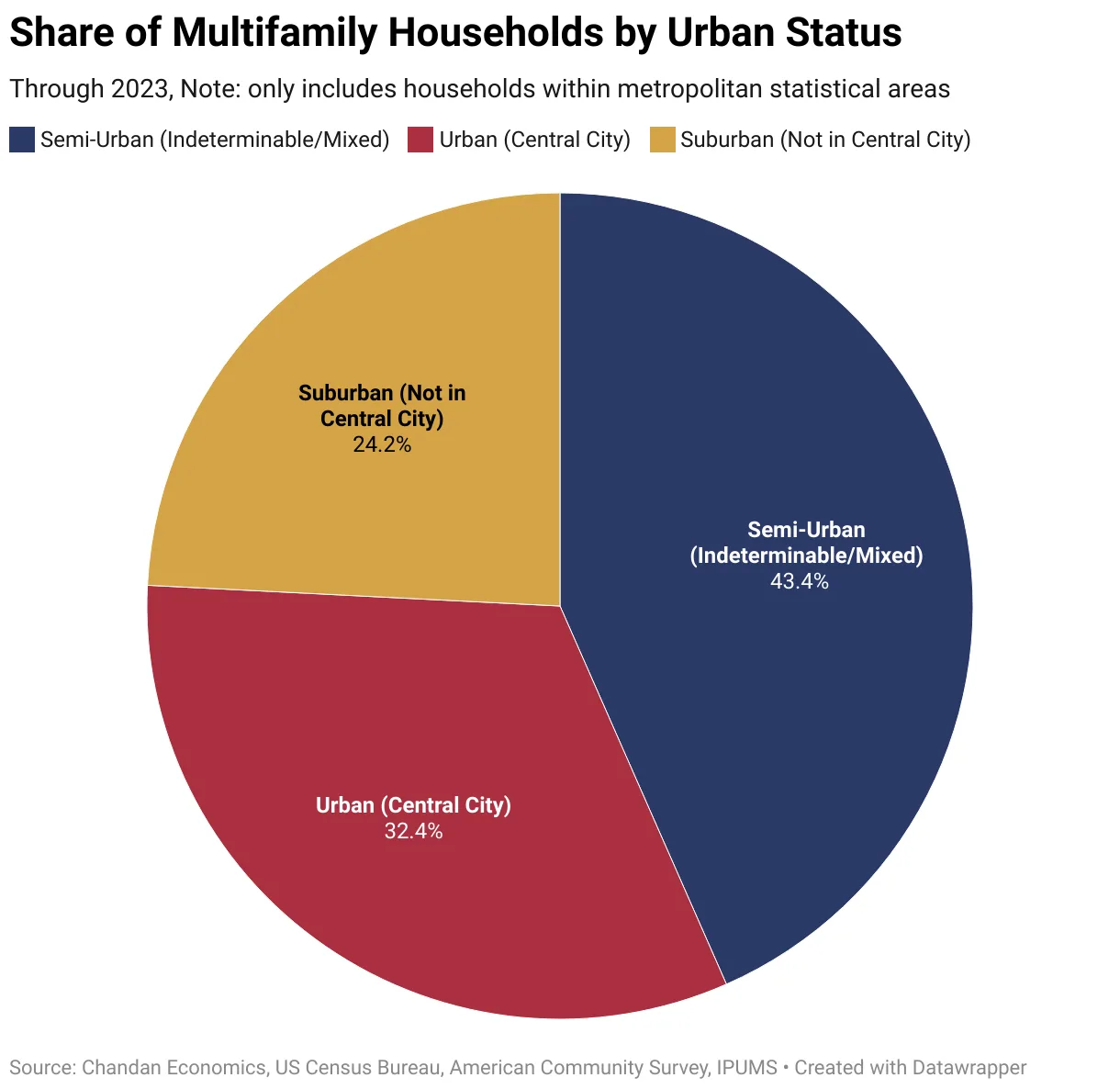

- Semi-urban areas now hold the largest share of multifamily homes, with 43.4% — more than both city centers (32.4%) and suburbs (24.2%).

- From 2013 to 2023, semi-urban areas saw a 25.5% jump in multifamily homes, outpacing growth in cities (+23.7%) and suburbs (+15.0%).

- These areas offer both city-like benefits and lower costs, making them a top choice for renters and developers, especially after the pandemic.

A Decade of Shifting Demand

Chandan Economics reports that over the last ten years, the US rental market has changed in big ways. While cities used to dominate, demand has moved outward — not just to the suburbs, but to the in-between areas. These semi-urban neighborhoods — places that blend city and suburban features — are now leading the way in multifamily growth.

The Numbers Tell the Story

According to the Census Bureau’s American Community Survey, metro areas fall into three groups: city centers, suburbs, and a mixed group between the two. For this report, that mixed group is called semi-urban.

Here’s how multifamily households are spread out today:

- Semi-urban areas: 8.7M households (43.4%)

- City centers: 6.5M (32.4%)

- Suburbs: 4.8M (24.2%)

Clearly, semi-urban areas now hold the largest piece of the pie. In fact, these areas added 1.7M more households between 2013 and 2023 — a growth rate of 25.5%. In comparison, city centers grew by 23.7%, and suburbs by 15.0%. Even so, suburban growth still beat the overall US household growth rate of 13.5%.

What’s Behind the Trend

Several factors explain why semi-urban zones are gaining ground.

First, housing costs in major cities have gone up sharply in the past decade. As a result, many renters have looked to nearby neighborhoods for relief. These areas still offer access to jobs, transit, and culture — but at a lower price.

Then, the COVID-19 pandemic changed how people work and live. With more jobs allowing remote or hybrid work, renters had greater freedom to live farther from downtown — as long as they could still enjoy a high quality of life.

At the same time, developers also found these areas appealing. Land tends to be cheaper, and there’s often more space to build. That makes it easier to add new apartments while keeping costs in check.

Why This Matters

For those in real estate, this shift has big implications. Semi-urban areas now offer some of the best opportunities for growth. They strike a balance between convenience and cost, making them attractive to both renters and builders.

In addition, these areas often face fewer zoning rules than dense city cores, which helps speed up projects. As housing demand keeps growing, especially in major metro regions, these middle-ground neighborhoods may hold the key to meeting future needs.

Looking Ahead

As housing patterns continue to change, expect semi-urban areas to play an even bigger role in multifamily development. Their mix of city-like features, lower costs, and flexible space makes them a smart bet for the years to come.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes