Vacancy is no longer just a temporary setback. It’s becoming a structural challenge in multifamily. What once looked like seasonal slowdowns or brief lease-up gaps is now showing up across stabilized assets, forcing owners and operators to rethink what “normal” occupancy really means.

Many properties that previously ran near full occupancy are now sitting on 10 to 20 empty units, even during peak leasing season. Developers point to oversupply, higher interest rates, and a market flooded with concessions. Whatever the cause, one thing is clear: the old playbook isn’t working.

In response, operators are leveraging furnished mid-term stays—a fresh solution that’s turning vacancy into a proven income driver.

The Hidden Cost of Vacancy

Vacancy doesn’t just mean lost rent. It leads to higher marketing costs, dents investor confidence, and often forces operators to offer concessions that compress long-term revenue.

These so-called “soft vacancies”—a few empty units scattered throughout—might not trigger alarms, but still erode overall performance.

The Traditional Fixes Are Falling Short

Traditionally, property owners relied on a familiar toolkit to fight vacancy: rent concessions, increased ad spend, and low-effort ancillary revenue streams. But each approach has its diminishing returns:

- Rent concessions might fill the unit, but they degrade rent rolls and make it harder to push pricing in the future.

- Leasing spend—from ILS platforms to social media campaigns—has ballooned as competition intensifies.

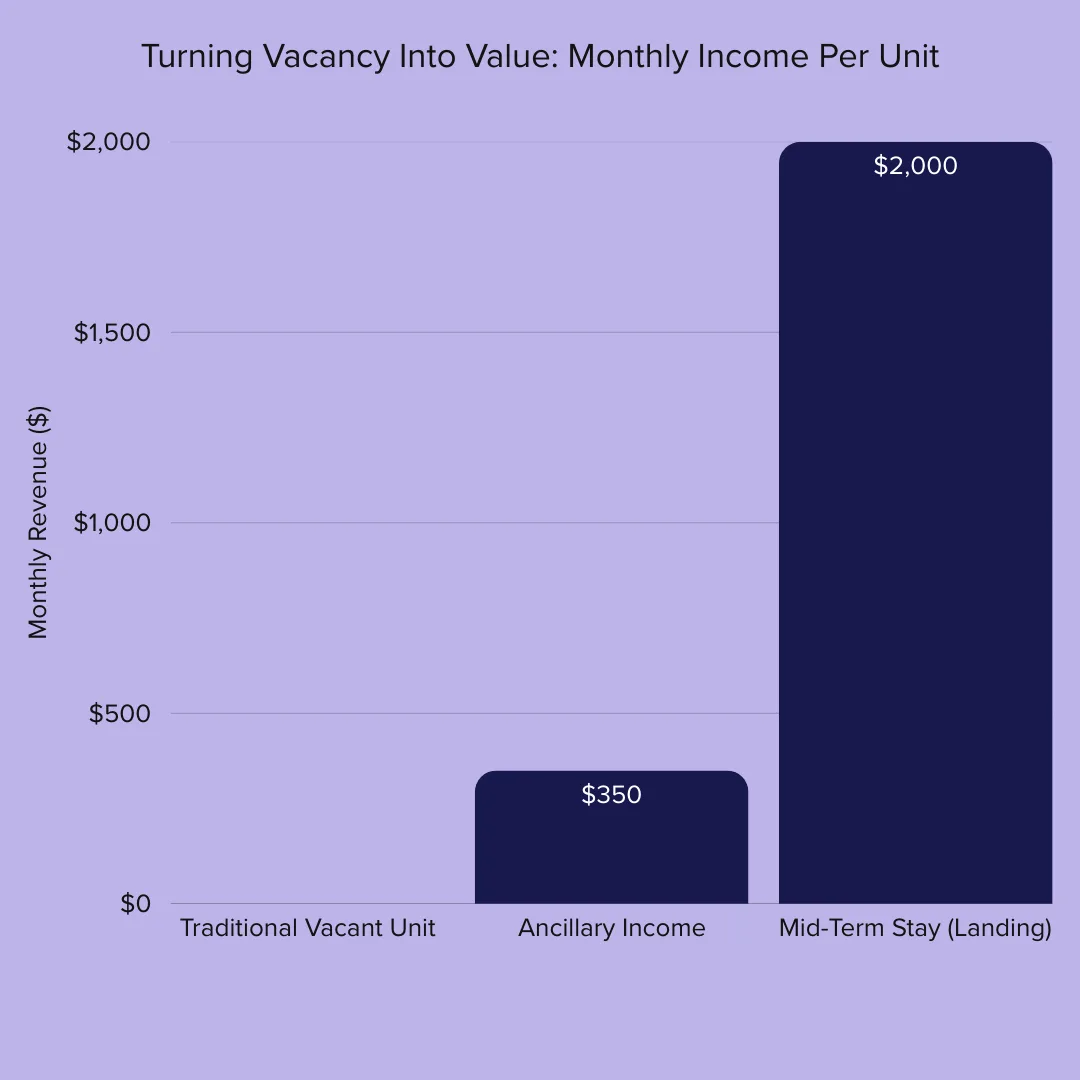

- Ancillary income strategies like EV charging or pet washing stations rarely yield more than $1,500/month and require ongoing management and oversight.

It’s an expensive game of catch-up. And many units still sit empty.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Turning Vacancy Into Income

That’s why platforms like Landing are grabbing the attention of many multifamily owners and operators. Rather than chasing short-term renters or waiting out long-term lease demand, Landing places screened professionals into fully furnished units for mid-term stays.

Unlike corporate housing providers or Airbnb-style listings, the model is tailored to multifamily assets. Property teams don’t furnish the units or manage turnover. Landing handles it all, from furnishings to guest placement to support. Operators receive fixed monthly income, similar to standard rent, without increasing their workload.

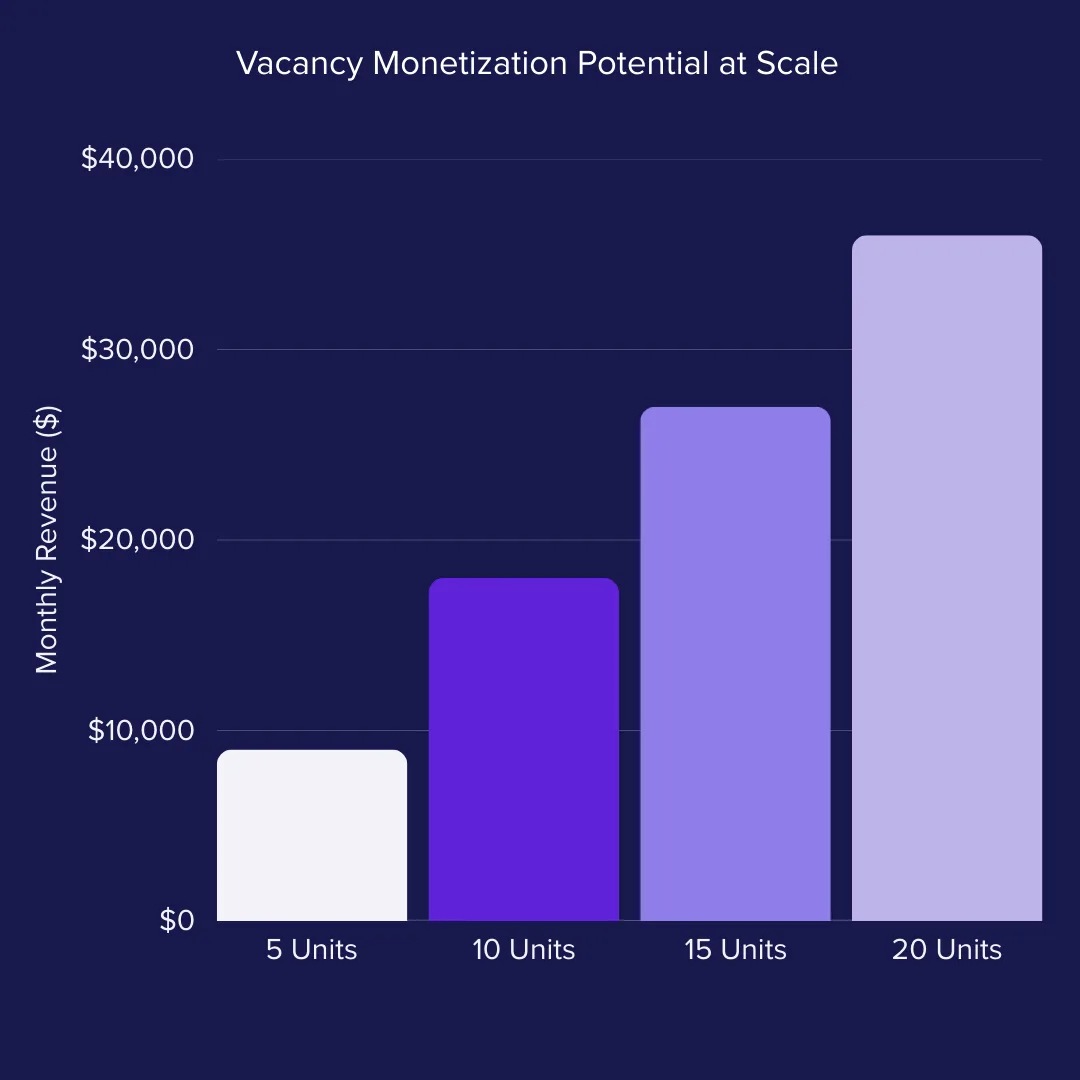

According to Landing, properties using this model often earn an additional $1,500–$2,000/unit/month, turning chronic vacancy into an NOI stream. One 300-unit property in a Sun Belt metro recently monetized 12 empty units this way, recouping over $23,000 in monthly income that would have otherwise been written off.

Why Mid-Term Works Better

Mid-term stays offer the scale, stability, and operational ease that short-term rentals often lack:

- Not short-term rental, not a hotel. These aren’t weekend tourists. They’re vetted professionals staying for extended assignments, relocations, or life transitions.

- No disruption to operations. There’s no front desk, no increased noise complaints, and no additional burden on the onsite team.

- A better fit for multifamily. The model is designed to work within the structure of long-term rental properties, not around them.

- No other provider offers this model at scale across the U.S. with the same level of infrastructure and support.

Landing is the only provider offering this solution at a national scale, backed by the infrastructure and support needed to make it effortless for operators.

Put simply, this isn’t Airbnb with a longer lease. It’s a fundamentally different approach to maximizing NOI with institutional efficiency.

For many owners and operators, untapped potential is hiding in their rent rolls. Persistent vacancy doesn’t have to be written off. It can be repurposed. Platforms like Landing offer a compelling path forward: real income, results, and simplicity.

Repurposing, Not Writing Off

Persistent vacancy doesn’t need to be a sunk cost. For operators, it’s now a potential revenue stream hiding in plain sight. Mid-term stays don’t just plug holes; they reshape portfolio performance, especially in lease-up phases or urban cores with sluggish absorption.

By partnering with providers like Landing, multifamily owners can reduce concessions, boost renewal rates, and improve portfolio performance, without taking on more work.

In today’s multifamily market, where every basis point counts, strategic vacancy management might just be your next NOI lever.

See What Your Vacant Units Could Earn

Curious about how much revenue your property could generate through furnished mid-term stays?