- NYC could gain 17,400 new apartments from 44 office-to-residential conversions, absorbing over one-third of pandemic-era office vacancies.

- The 2024-passed 467-m tax exemption has catalyzed conversions by offering up to 90% property tax breaks in exchange for 25% affordable housing units.

- The program’s long-term fiscal impact could total $5.1B in lost tax revenue, with critics warning it’s overly generous in areas that may not need such incentives.

Office Buildings Go Residential

New York City’s post-pandemic office glut has opened a door for tackling its housing shortage, reports NY Post. A new report from NYC Comptroller Brad Lander highlights a major shift in the city’s real estate landscape. It shows that 15.2M SF of office space are being — or could be — converted into residential use. These conversions are expected to produce around 17,400 new apartments, primarily located in Manhattan below 59th Street.

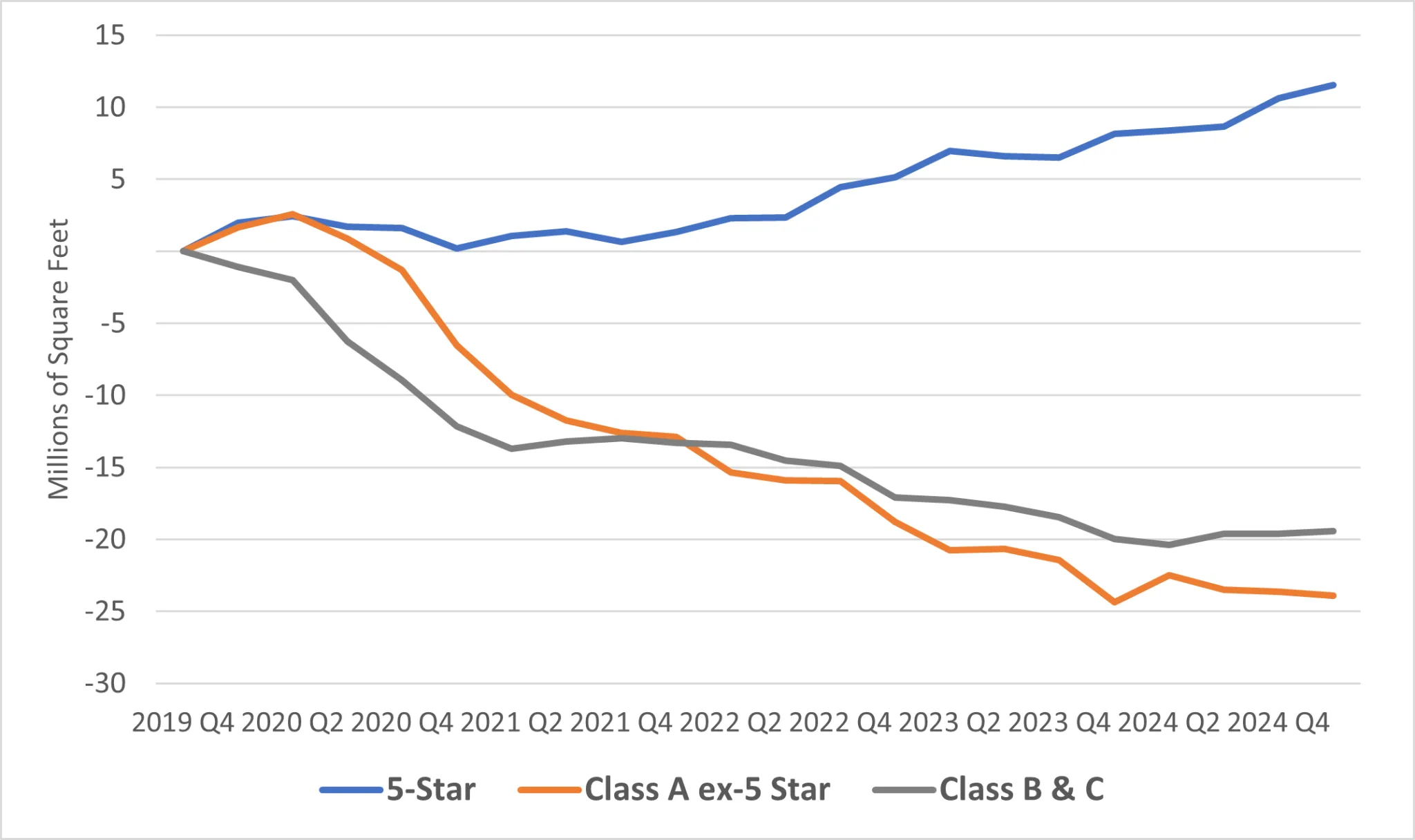

Change in Occupied Manhattan Office Space 2019 Q4 – 2025 Q1

Among the major projects:

- 25 Water Street (former JPMorgan Chase HQ): 1,300 units

- Pfizer’s Midtown campus: 1,500 units

- 40 Exchange Place: 382 units

- 55 Broad Street: 571 units

Developers are also eyeing conversions of 5 Times Square (1,250 units) and a 72-story tower at 395 Flatbush Ave. in Brooklyn.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The 467-m Incentive

Passed in 2024, the 467-m tax exemption offers:

- Up to 35 years of property tax relief

- In exchange, 25% of units must be permanently affordable, averaging 80% of Area Median Income

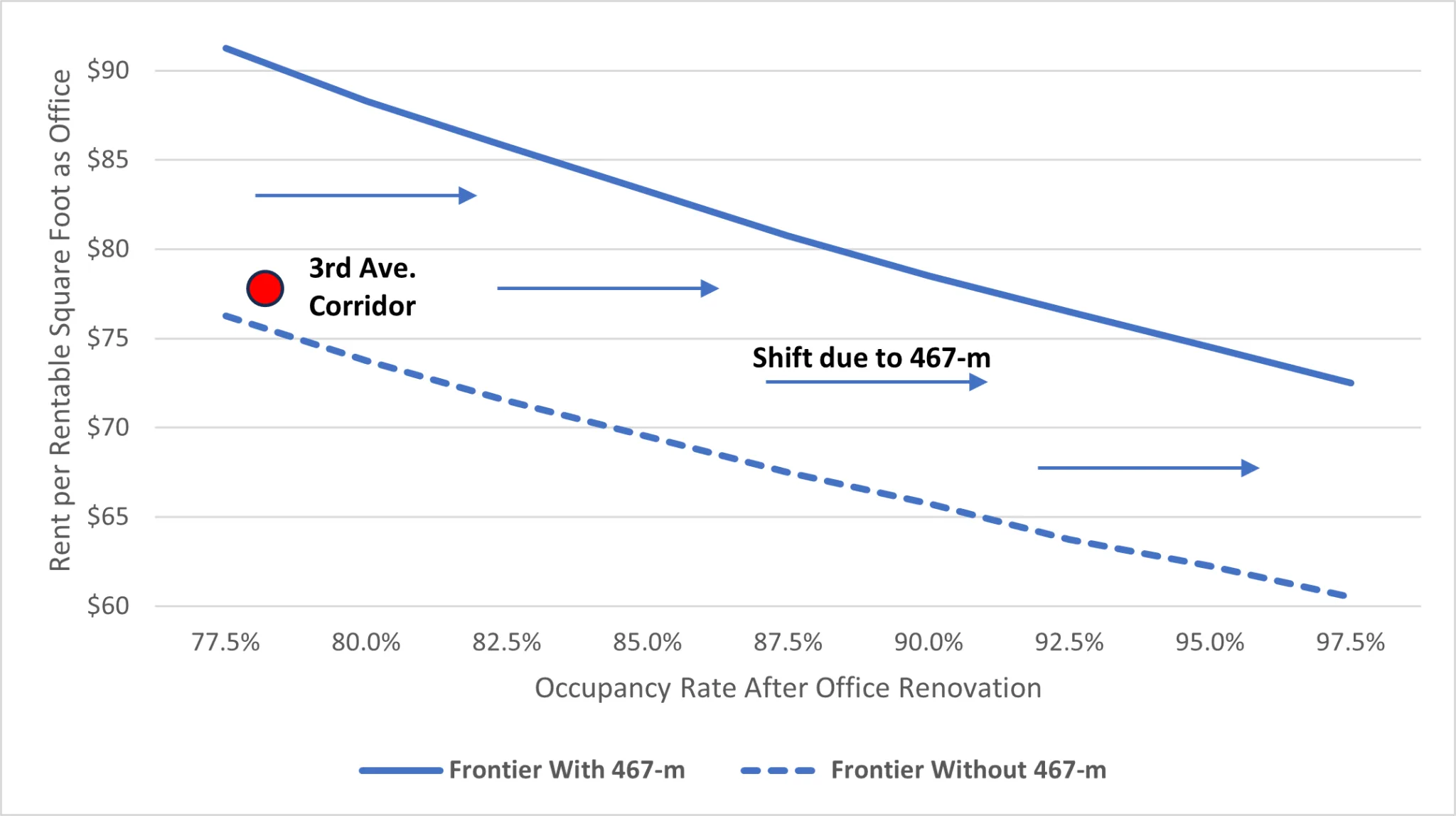

Office Rent/Occupancy Frontiers with and Without 467-m

This incentive structure has accelerated conversions across Manhattan, especially in the Financial District and Midtown East. The Comptroller’s office estimates that 12.2M SF of conversions could qualify for these benefits by June 2026.

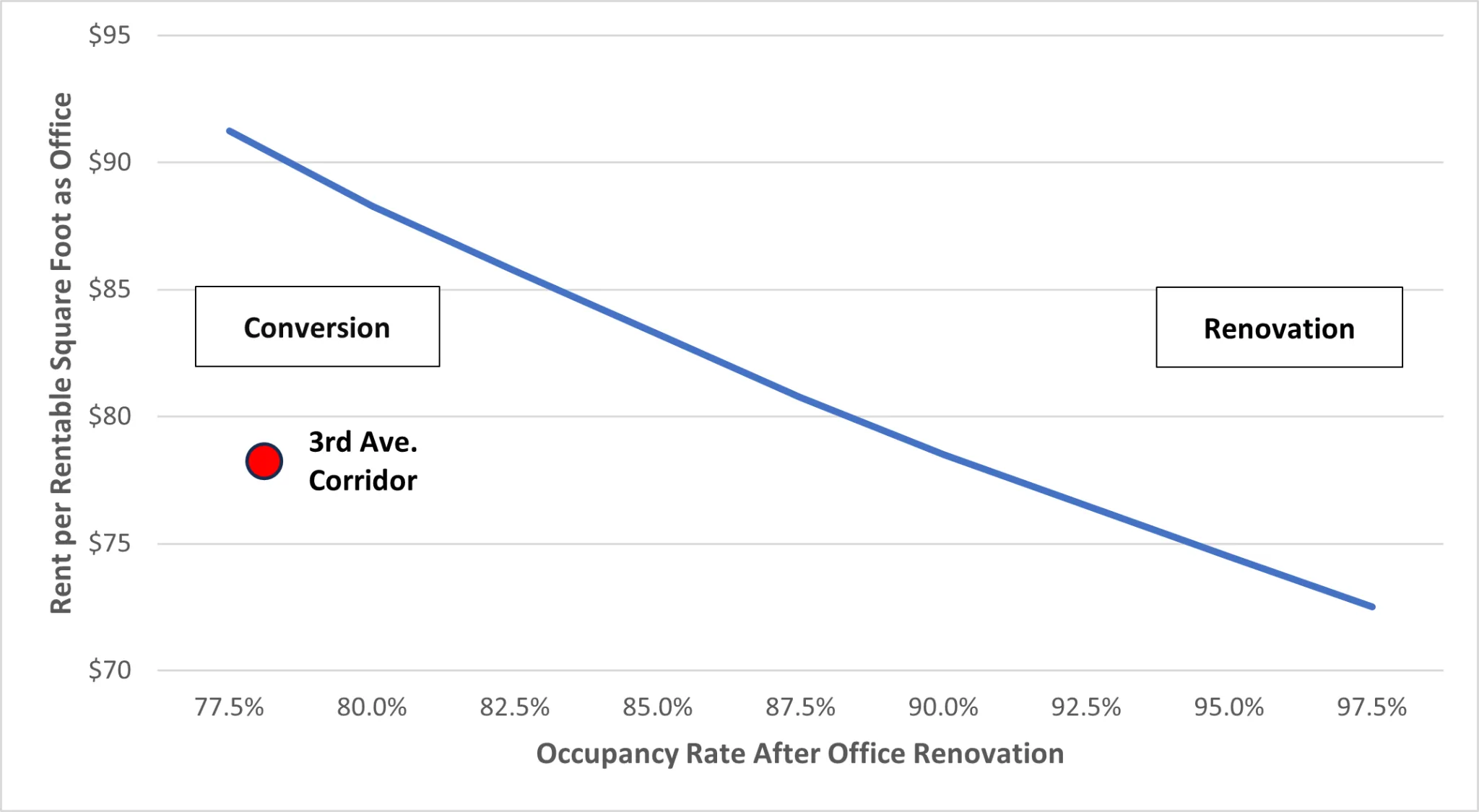

Office Rent/Occupancy Frontier with 467-m

Fiscal Impact And Criticism

While 467-m is helping fast-track conversions, it comes at a steep price. The estimated $5.1B in lost tax revenue over 37 years could have major implications for the city’s finances.

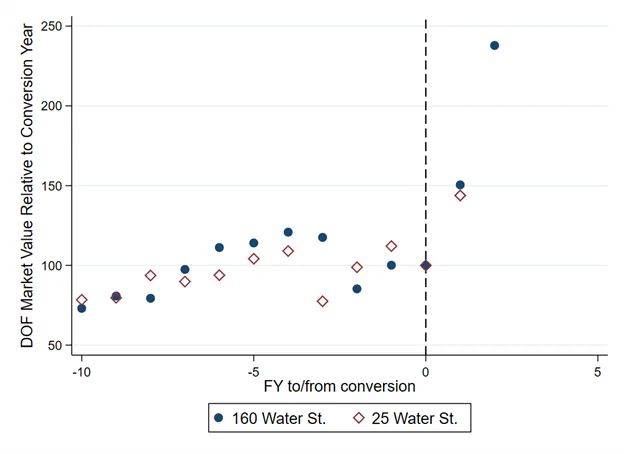

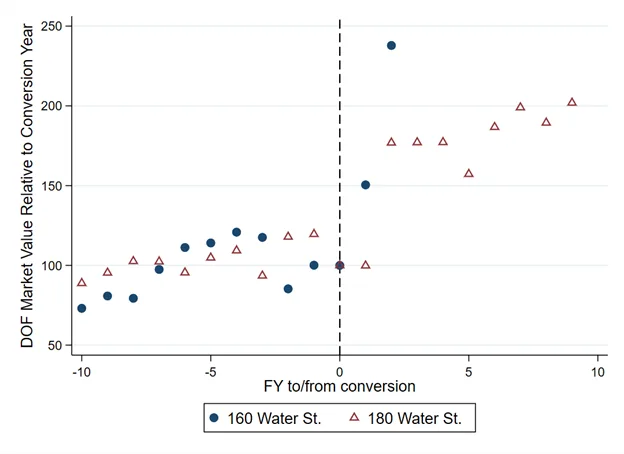

DOF Market Value Relative to Conversion Date: 160 and 25 Water Street

DOF Market Value Relative to Conversion Date: 160 and 180 Water Street

Key concerns:

- Overly generous in Lower Manhattan, where conversions were likely feasible without tax breaks

- Average cost to the city: $1.4M per income-restricted unit

- 81% of the fiscal cost is attributed to subsidizing affordable housing units—not to increased developer returns

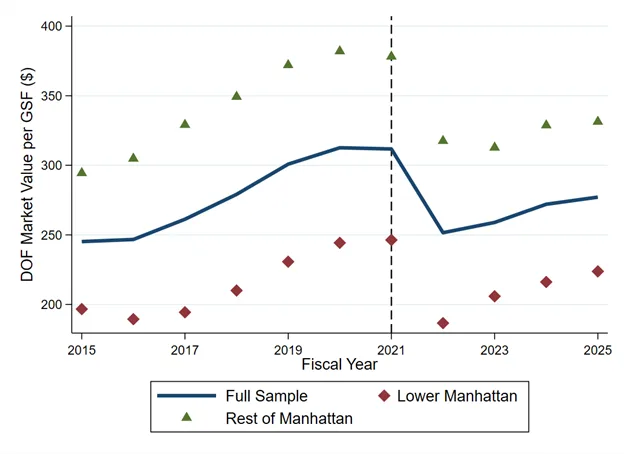

DOF Market Value per Gross Square Foot in the Sample

The Bigger Picture

The conversions mark a turning point for NYC’s housing and office markets:

- rental apartments dominate the pipeline, mostly studios and 1-bedrooms

- 5-star office buildings are recovering, but lower-tier office space remains underutilized

- As of Q1 2025, 43M SF of office space remain vacant outside top-tier buildings

City-led zoning changes and recent lifts to the state FAR cap are making adaptive reuse projects easier to pursue. Developers such as SL Green and Metro Loft are actively driving this trend. Capital firms like TF Cornerstone are also playing a key role in funding these conversions.

What’s Next

The office-to-resi trend shows no signs of slowing. With early-mover incentives in place and a clear market gap in housing supply, developers are rushing to secure conversion permits before deadlines tighten.

However, the city will need to continually balance housing production, affordability, and fiscal sustainability—especially as it reassesses the effectiveness of 467-m in different submarkets.

For now, the repurposing of office towers stands as both a creative urban solution and a costly policy experiment.