- June CPI showed modest growth, but tariff-impacted goods like toys and appliances saw sharp price increases.

- Treasury yields rose as hopes for near-term Fed rate cuts faded.

- Tensions grow between President Trump and Fed Chair Powell, with rumors of Powell’s possible removal.

- JPMorgan CEO Jamie Dimon warns that threats to Fed independence could hurt US credibility and raise borrowing costs.

Inflation Data Reveals Early Tariff Effects

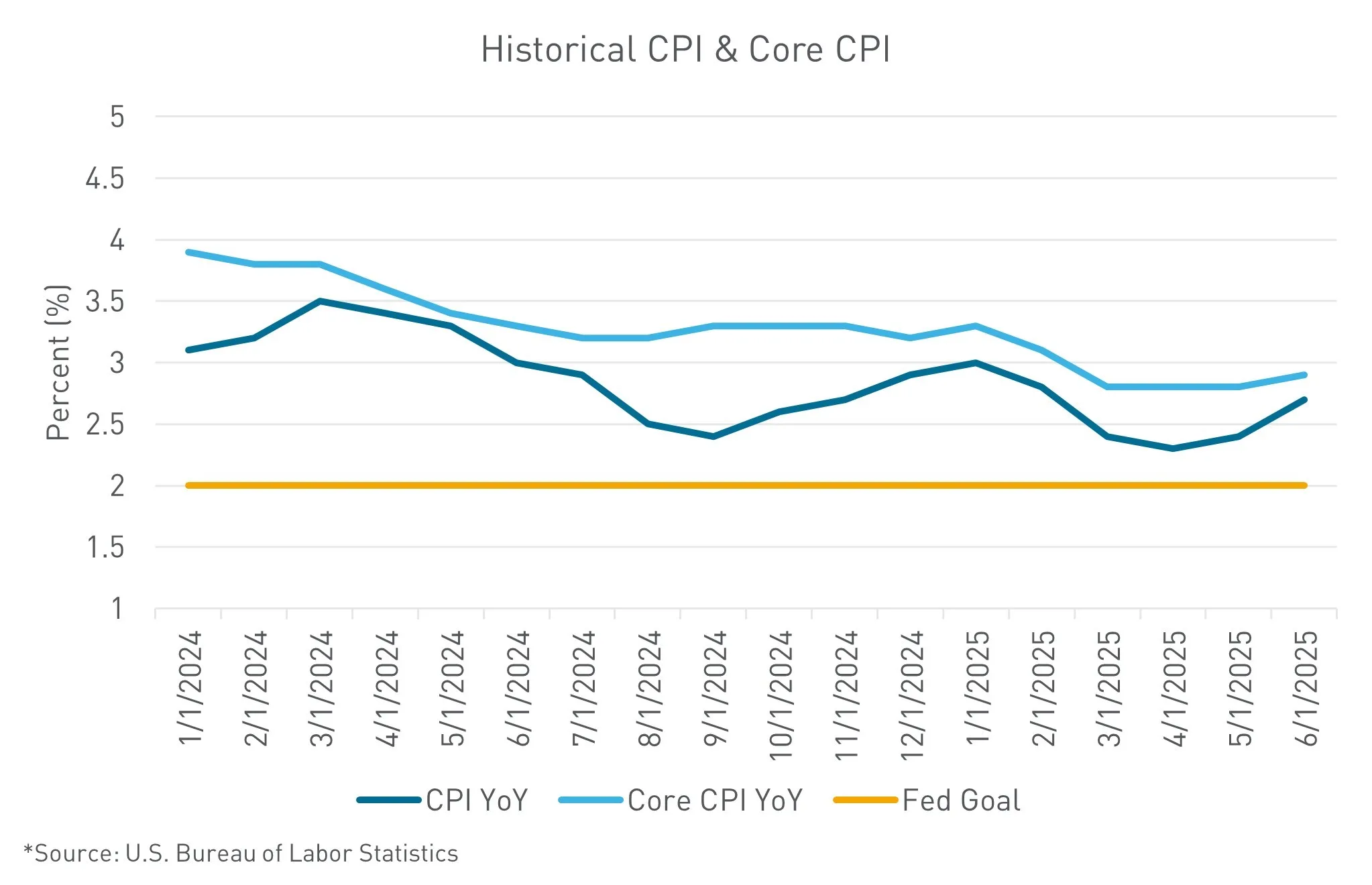

The June Consumer Price Index (CPI) pointed to early signs of tariff pressure, per Berkadia. While overall inflation remained soft, goods tied to tariffs saw notable price jumps. Core CPI, which excludes food and energy, rose 0.2% month-over-month—slightly below expectations.

Still, prices for toys, appliances, and other tariff-sensitive items increased at their fastest pace in years. The data suggests companies are starting to pass on higher costs to consumers.

Treasury Yields Rise as Rate Cut Odds Slip

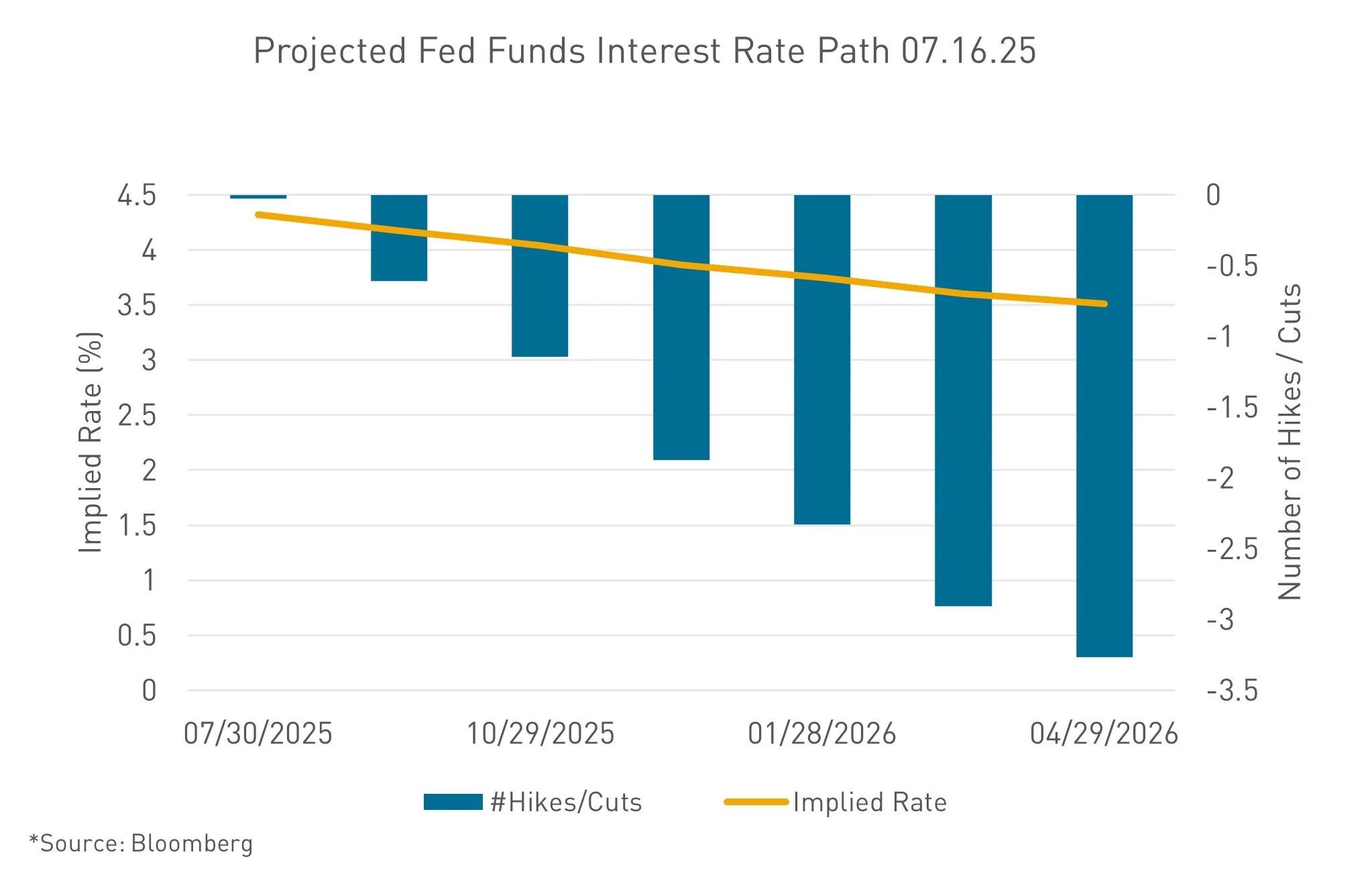

Despite muted inflation overall, Treasury yields rose after the CPI release. Investors read the increase in tariff-affected goods as a signal that tariff pressure may be fueling inflation more than expected. As a result, markets dialed back expectations for rate cuts in the near term.

The print gave little clarity on what the Federal Reserve might do next. The Fed continues to wait for clearer signs on how tariffs will affect the broader economy.

Fed in the Political Spotlight

Fed Chair Jerome Powell has held rates steady, preferring to wait as fiscal policies play out. But the White House is growing restless. President Trump has voiced frustration with Powell’s approach and reportedly floated the idea of replacing him.

Although Trump later denied those reports, tensions remain. Treasury Secretary Scott Bessent described Trump’s strategy as “working the refs”—publicly pressuring Powell to act without formally removing him.

According to Bessent, a process is already underway to identify a possible successor before Powell’s term ends in May 2026.

Wall Street Defends Fed Independence

JPMorgan Chase CEO Jamie Dimon spoke out against the political pressure. He emphasized that Fed independence is critical to economic stability. “Playing around with the Fed can have adverse consequences,” Dimon said.

He was the first major US bank leader to publicly defend Powell in this context.

Why It Matters

Political interference could erode trust in US monetary policy. If investors question the Fed’s independence, Treasury yields may rise. Higher yields would push up borrowing costs across all asset classes, including real estate and corporate debt.

What’s Next

With Powell’s term ending next May, the search for his replacement is gaining attention. Market watchers are focusing on each candidate’s views on central bank independence. Their positions could shape the yield curve and influence credit markets in the months ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes