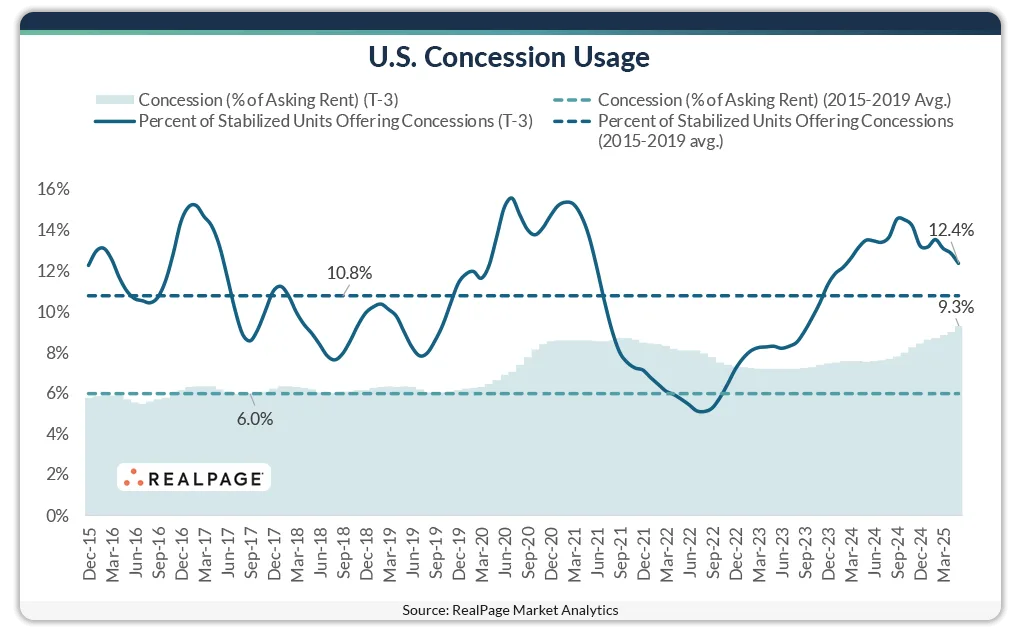

- Only 12% of stabilized conventional apartment units are currently offering concessions, down from recent years, but average discounts have increased to 9.3%—equivalent to about 30+ days of free rent.

- Unlike the 2008–2009 recession, today’s concessions are driven by heavy supply volumes, not weak demand.

- National apartment deliveries are expected to drop 25% in 2025 compared to 2024, potentially reducing the need for incentives if demand holds strong.

- Seasonal fluctuations remain, with concessions expected to rise into fall and winter, then decline during spring and summer, with significant reductions forecasted for 2026’s peak leasing season.

Concessions Narrow in Scope, Grow in Value

According to RealPage, apartment concession activity is evolving. Currently, just 12% of stabilized apartments across the US are offering rent discounts, but those who do are offering deeper cuts—averaging a 9.3% discount, or about a month’s free rent. That’s slightly more generous than post-COVID averages and marks some of the highest levels of rent relief seen in over a decade

Supply, Not Demand, Drives Discounts

Unlike the 2008–2009 financial crisis, today’s incentives don’t reflect weak demand. Instead, developers continue to deliver a surge of new apartments. This added supply forces property managers to offer apartment concessions to stay competitive.

Deliveries Are Slowing

RealPage Market Analytics expects new apartment completions to drop 25% in 2025 compared to 2024. If renter demand remains strong, most markets will see a decline in the need for concessions—especially during next year’s busy leasing season.

What to Watch

Seasonal patterns will still influence discount trends. Concessions typically rise during fall and winter and fall off in spring and summer. But with fewer units coming online, many markets will likely pull back on concessions more aggressively in 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes