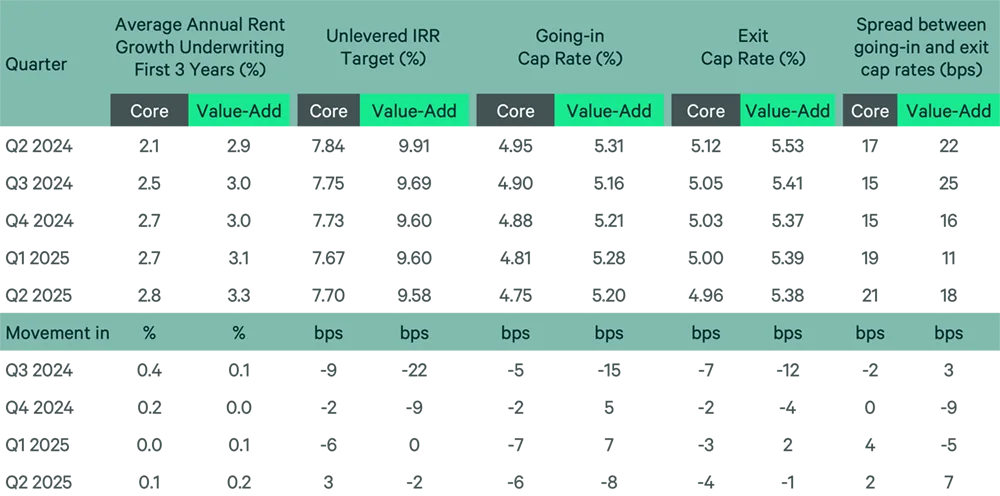

- Core multifamily going-in cap rates fell by 6 bps to 4.75%, while value-add cap rates dropped 8 bps to 5.20%, reflecting cautious optimism among buyers.rn

- Value-add buyer sentiment improved significantly, while core buyer sentiment softened slightly despite improved fundamentals.rn

- Underwriting rent growth expectations rose modestly, with projections of 2.8% for core and 3.3% for value-add assets over the next three years.rn

- Cap rate spreads widened across both asset classes, indicating continued expectations for long-term price appreciation.rnrnrn

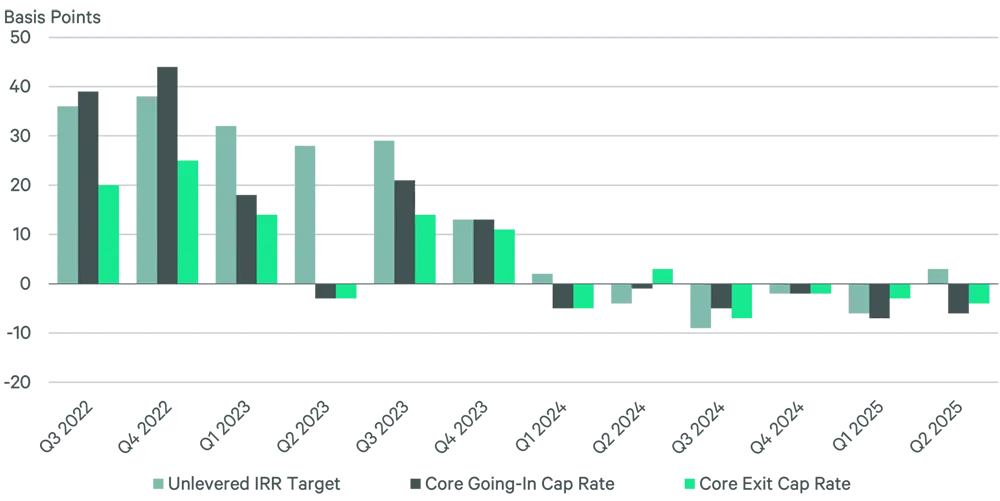

Cap Rate Compression Signals Optimism

Underwriting metrics for both core and value-add multifamily properties saw modest improvement in Q2, despite the Federal Reserve holding interest rates steady. According to CBRE, the average going-in cap rates for core assets compressed by 6 basis points (bps) to 4.75%, while exit cap rates declined 4 bps to 4.96%. For value-add assets, going-in cap rates dropped 8 bps to 5.20%.

Meanwhile, unlevered IRR targets for core assets rose slightly to 7.70%, influenced by a sharp 100-bp rise in Denver, where short-term oversupply concerns persist. Value-add IRR targets edged down to 9.58%, driven by improving fundamentals in key markets.

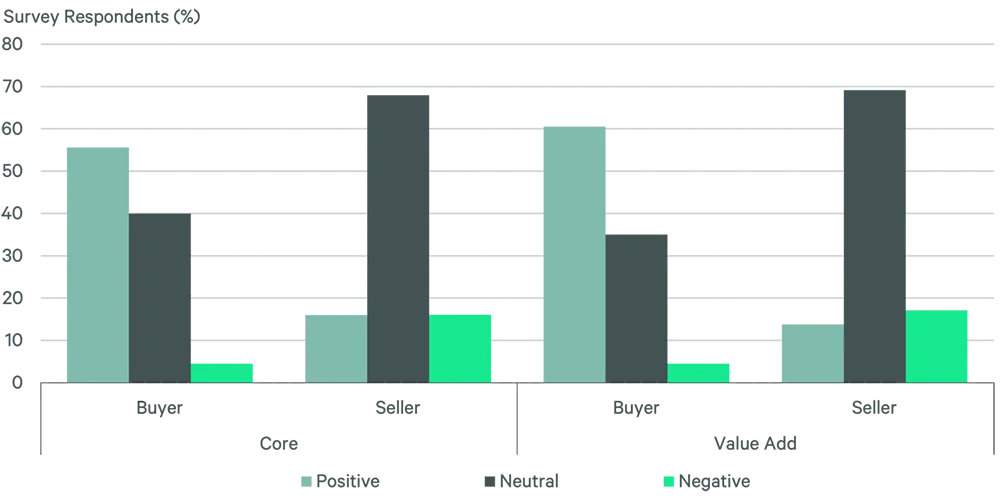

Diverging Sentiment: Core Softens, Value-Add Strengthens

Buyer sentiment for core assets showed signs of cooling, with 56% of CBRE respondents expressing positive views—down from 65% in Q1. Value-add buyer sentiment, on the other hand, surged to 61% from 48% last quarter, pointing to renewed investor appetite for repositioning opportunities.

Seller sentiment was generally more neutral but improved across several major metros, including Boston, Los Angeles, San Francisco, Seattle, and Houston. Investors continue to navigate pricing uncertainties, particularly in the core space.

Rent Growth and Market-Level Trends

Rent growth assumptions increased slightly to 2.8% for core and 3.3% for value-add assets, reflecting stabilization following a historic wave of new supply. cap rate spreads widened—rising to 21 bps for core and 18 bps for value-add assets—reversing the compression trend observed in prior quarters.

At the market level, going-in cap rates for core assets fell in five key metros: Austin, Chicago, Dallas, Los Angeles, and Tampa. Denver stood out with a slight increase, while also recording the highest value-add cap rate jump (63 bps).

Outlook: Monetization Likely in H2

Despite some hesitancy among sellers—particularly in the core segment—CBRE expects more multifamily investors to bring assets to market later in 2025. Compressed cap rates, improving rent growth, and narrowing bid-ask spreads may push owners to capitalize on increasingly favorable conditions.

As underwriting metrics stabilize and interest rate cuts loom, market fundamentals suggest a more active second half of the year for multifamily transactions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes