- US apartment sales totaled $30B in Q1 2025 across 1,277 properties — a 36% year-over-year increase, but down from Q4 2024’s $48.2B.

- The average price per unit held strong at $211,356, marking the 13th quarter in 15 where pricing exceeded $200K.

- Cap rates averaged 5.65%, the highest in nearly nine years, yet apartments still offer the lowest cap rates across major CRE asset types.

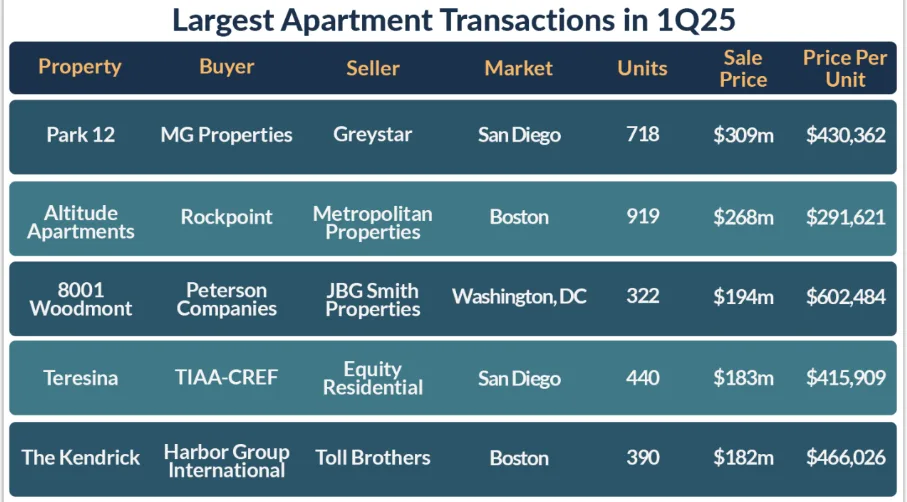

- Five notable single-asset deals each exceeded $180M, with San Diego’s Park 12 leading the list at $309M.

Seasonal Slowdown, Annual Growth

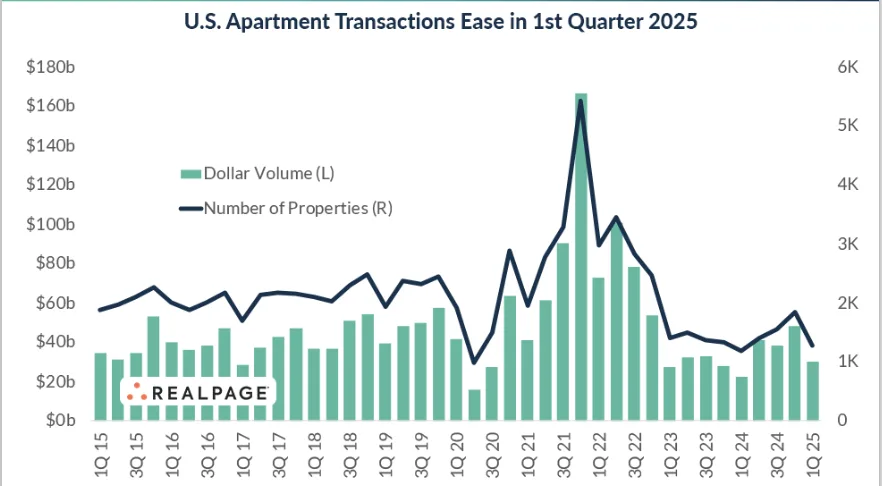

US apartment transaction volume slowed in Q1 2025, aligning with historic seasonal trends, reports RealPage. Roughly $30B in assets changed hands — down from the nearly $48.2B transacted in Q4 2024, according to MSCI Real Capital Analytics. However, that still represented a 36% increase over Q1 2024, signaling renewed investor confidence in multifamily assets.

In total, 1,277 apartment properties were sold during the first quarter. While that’s a drop from the 1,848 traded in the final quarter of 2024, the activity remains higher than recent annual averages, excluding the post-pandemic surge of 2021.

High Pricing, Higher Cap Rates

The average price per unit for apartment transactions stayed elevated at $211,356 in Q1 2025 — holding above the $200K mark for the 13th time in the past 15 quarters. Prior to 2021, that pricing threshold had never been breached, highlighting the continued strength of multifamily valuations.

Cap rates for apartment transactions also continued their upward trajectory, averaging 5.65%, the highest level since 2016. That’s a notable increase from the pandemic-era low of 4.67% in Q2 2022. Even so, apartment cap rates remained the lowest among all major commercial real estate property types, reinforcing the sector’s appeal as a stable investment option.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Annual Trends Remain Positive

In the 12 months ending Q1 2025, nearly 6,078 apartment properties changed hands for a total of $157.7B. That’s a 36% increase in total dollar volume and an 8% rise in properties sold compared to the prior 12-month period.

While well below the 13,400-property, $359B peak of 2021, the numbers reflect a stable market rebounding from its 2023 slowdown.

Top 5 Transactions Of Q1 2025

- Park 12 | San Diego

- Price: $309M | Units: 718 | Price/Unit: $430,400

- One of the largest multifamily deals in San Diego history, Park 12 was acquired by MG Properties from Greystar. The high-rise includes 43K SF of retail space and sits near Petco Park.

- Price: $309M | Units: 718 | Price/Unit: $430,400

- Altitude Apartments | Boston Area

- Price: $268M | Units: 919 | Price/Unit: $291,600

- Rockpoint acquired this 13-building community in Malden. Previously sold in 2007 for $181M, the property includes extensive amenities like courts, pools, and lounges.

- Price: $268M | Units: 919 | Price/Unit: $291,600

- 8001 Woodmont | Bethesda, MD

- Price: $194M | Units: 322 | Price/Unit: $602,500

- Peterson Companies bought the JBG Smith-built high-rise featuring luxury amenities and ground-floor retail anchored by Trader Joe’s.

- Price: $194M | Units: 322 | Price/Unit: $602,500

- Teresina | Chula Vista, CA

- Price: $183M | Units: 440 | Price/Unit: $415,900

- TIAA-CREF purchased the 2000-built complex from Equity Residential. The property last sold in 2007 for $91.2M.

- Price: $183M | Units: 440 | Price/Unit: $415,900

- The Kendrick | Needham, MA

- Price: $182M | Units: 390 | Price/Unit: $466K

- Price: $182M | Units: 390 | Price/Unit: $466K

Harbor Group International acquired the Toll Brothers-built community, which includes a rock climbing wall, rooftop deck, and game lounge.

Why It Matters

Despite a quarterly cooldown, the apartment sector remains a stronghold in commercial real estate. Investor interest continues to be driven by resilient pricing, favorable cap rates, and strong demand fundamentals. The volume of high-value, single-asset deals in Q1 points to ongoing confidence in premium multifamily properties.

What’s Next

While Q2 may bring a slight rebound in quarterly volume, broader market trends — including interest rate movements, cap rate compression, and rental demand — will shape investment strategies for the remainder of 2025. With annual volumes on the rise and pricing holding firm, apartments are likely to remain a preferred asset class for institutional investors.