- Self storage rents stabilize, with national rates down just 0.1% YoY and monthly gains of 0.7% in June.

- Chicago leads in rent growth, up 2.9% YoY, driven by limited new supply and strong housing demand.

- Las Vegas sees highest construction activity, with 6.6% of inventory under development.

- Sun Belt markets struggle, including Austin and San Diego, due to oversupply and slower in-migration.

A Market Rebound Takes Shape

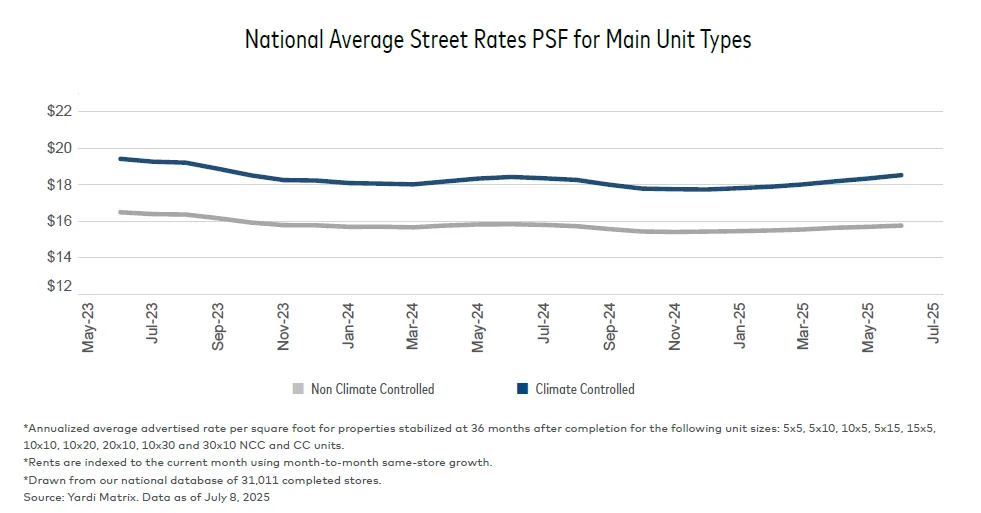

The US self storage sector is showing signs of stabilization after over two years of uneven recovery, reports Yardi Matrix. National average street rates dipped just 0.1% YoY in June to $16.90 PSF, while sequential monthly rates rose 0.7%—a notable improvement over prior years. REITs led the rebound, with same-store rents rising 1.3% YoY across stabilized assets.

Midwest Momentum

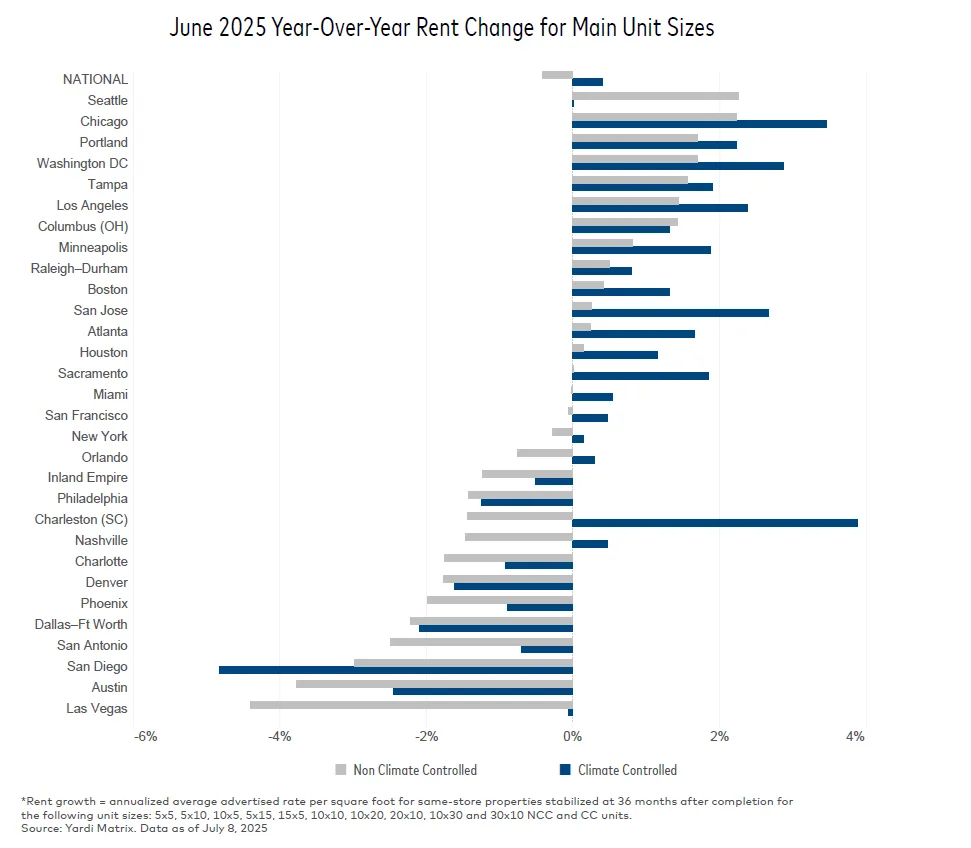

Chicago led all major markets with a 2.9% annual rate increase, thanks to constrained new supply and strong multifamily fundamentals. Minneapolis also showed renewed strength, with rents up 1.3% year-over-year. New development dropped sharply, from over 20% of inventory in 2022 to just 4.1% today.

Construction Still Active, But Concentrated

Nationwide, 53.4M SF of new space was under construction in June, representing 2.7% of existing inventory. Las Vegas led all metros with 6.6% of inventory under construction, followed by Phoenix and Orlando. Notably, San Antonio posted the biggest month-over-month surge in new development, likely in response to local flood-related demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Trouble Spots Persist

Sun Belt markets such as Austin (-3.1%), San Diego (-3.2%), and Las Vegas (-2.5%) saw the steepest rent declines. Elevated supply and waning migration trends drove the drop. Charlotte and Denver also struggled with divergent pressures: while Charlotte faces oversupply (15.3% of inventory built in 3 years), Denver’s slowdown is tied to cooling housing demand.

Outlook

Investor interest remains strong despite muted transaction volumes, as interest rates and bid-ask spreads keep deal flow sluggish. Yet, with REITs raising rents and supply pipelines moderating, signs of a more balanced market are emerging. Yardi Matrix reports that nearly half of tracked metros posted YoY rent gains for climate-controlled units—a potential turning point for the sector.