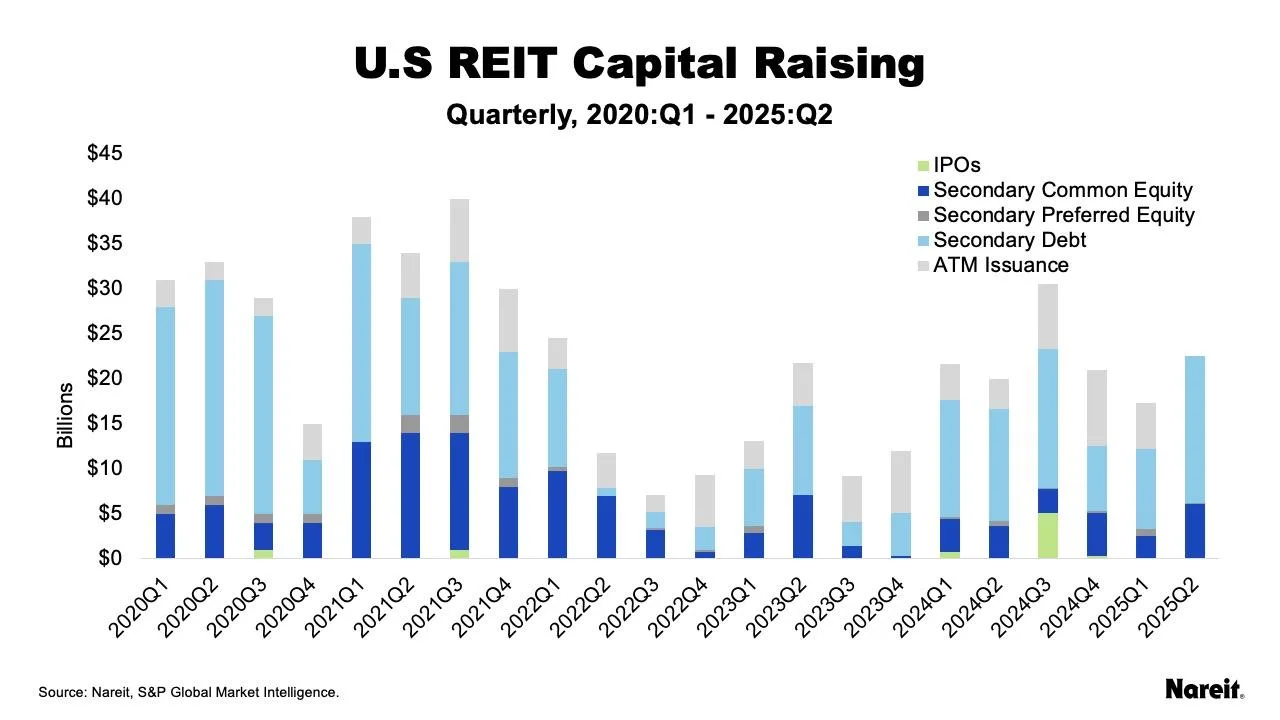

- US REITs raised $22.5B in capital in Q2, with $16.3B from debt and $6.1B from common equity.

- Total capital raised in the first half of 2025 reached $39.7B.

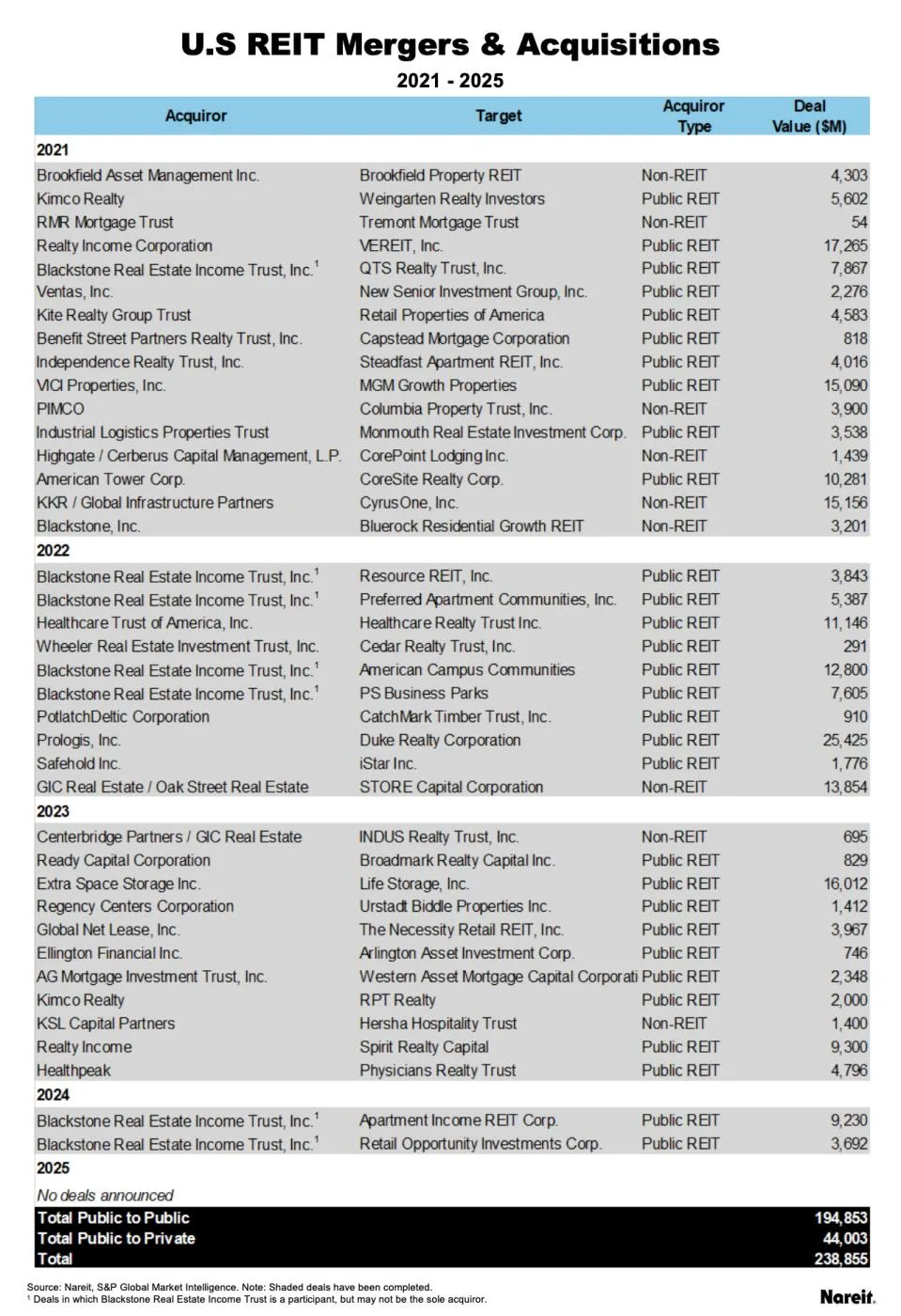

- No REIT M&A deals were announced in the first six months of the year.

- Health care, retail, and industrial sectors led property acquisitions in early 2025.

Capital Markets Stay Active

As reported by Nareit, REIT capital fundraising reached $22.5B in Q2 2025. Debt offerings led the way, accounting for $16.3B. Common equity contributed $6.1B, while preferred equity added $100M.

So far this year, REITs have raised $39.7B. That includes $25.2B from debt, $8.7B from common equity, and $800M from preferred equity. They also raised $5B through at-the-market (ATM) offerings in Q1, following $23.1B in ATM offerings in 2024.

M&A Hits a Standstill

There were no public REIT M&A deals announced in the first half of 2025. That’s a sharp contrast to $12.9B in deals in 2024 and $44B across 11 deals in 2023.

Between 2019 and 2024, REITs announced $272B in M&A transactions. More than half of that value came from deals within the same property sector.

Since 2021, REITs have completed or announced 37 acquisitions, totaling $225B. About 81% of that amount came from public REITs acquiring other public REITs.

Focused Property Activity

In Q1 2025, REITs acquired $11.2B in properties and sold $5.4B. Three sectors led acquisitions:

- Health care: $3.7B

- Retail: $3.1B

- Industrial: $1.4B

In 2024, REITs posted $46.5B in acquisitions and $39.1B in dispositions, showing a more active pace than early 2025.

Why It Matters

Debt continues to be the main funding tool for REITs. The capital raised suggests they are positioning for growth or refinancing amid high interest rates. On the other hand, the lack of M&A deals points to valuation gaps or strategic caution.

What’s Next

REITs may begin deploying more capital in the second half of 2025. Acquisition trends hint at focused investment rather than broad market moves. M&A activity could return if pricing expectations align and market conditions improve.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes