- REITs weathered market volatility in H1 2025, thanks to disciplined balance sheets and efficient capital access, and are positioned for accretive growth in H2.

- Recent trade policy shifts and fluctuating interest rates had varied impacts across REIT sectors, but overall effects have been milder than feared.

- Regional REIT performance reversed in 2025, with Europe and Asia outperforming North America, reinforcing the value of global allocation.

Halfway There, Still Holding Steady

As reported by Nareit, after a volatile start to 2025 driven by shifting trade policies and economic uncertainty, REIT performance, along with broader financial markets, has largely returned to where it began the year. While recession fears and frozen credit markets created early headwinds, current signals suggest a more stable, if still cautious, second half of the year.

The Interest Rate Disconnect

Coming into 2025, many hoped REIT performance might finally decouple from its inverse relationship with interest rates. While a brief economic jolt derailed early momentum, the resilience of REITs remains clear: year-to-date through June 30, the FTSE Nareit All Equity REITs Index returned 1.8%, trailing the Russell 1000’s 6.1%, but still in positive territory despite uncertainty.

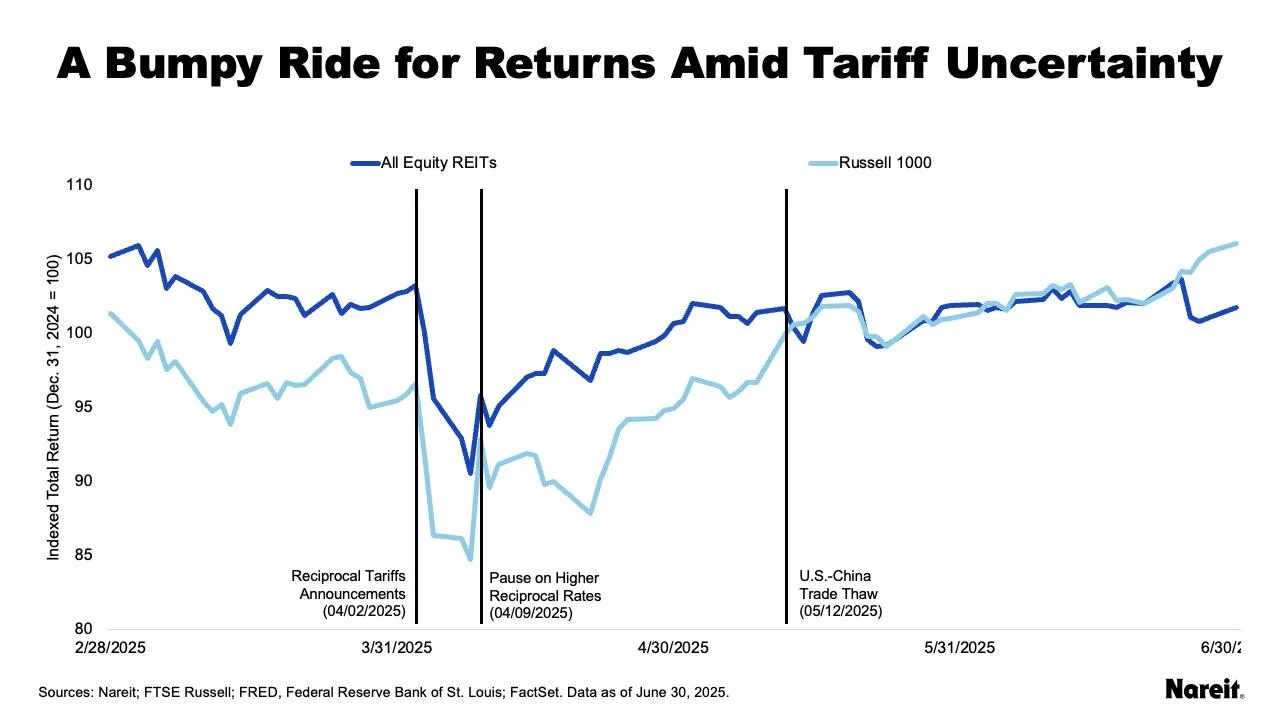

Trade Tensions Return—With a Twist

The announcement of reciprocal tariffs in early April sparked a brief market selloff. REITs and equities dipped in tandem, but quickly rebounded with a temporary suspension of tariff hikes and a thaw in US–China trade relations.

- April 2–8: REITs and equities declined; industrial and lodging/resorts were hit hardest, while telecom and data centers were more resilient.

- April 9–15: Markets rebounded across the board, though not enough to fully recover earlier losses.

Despite the volatility, REIT performance across sectors has been more muted than anticipated, reflecting investor confidence in sector fundamentals.

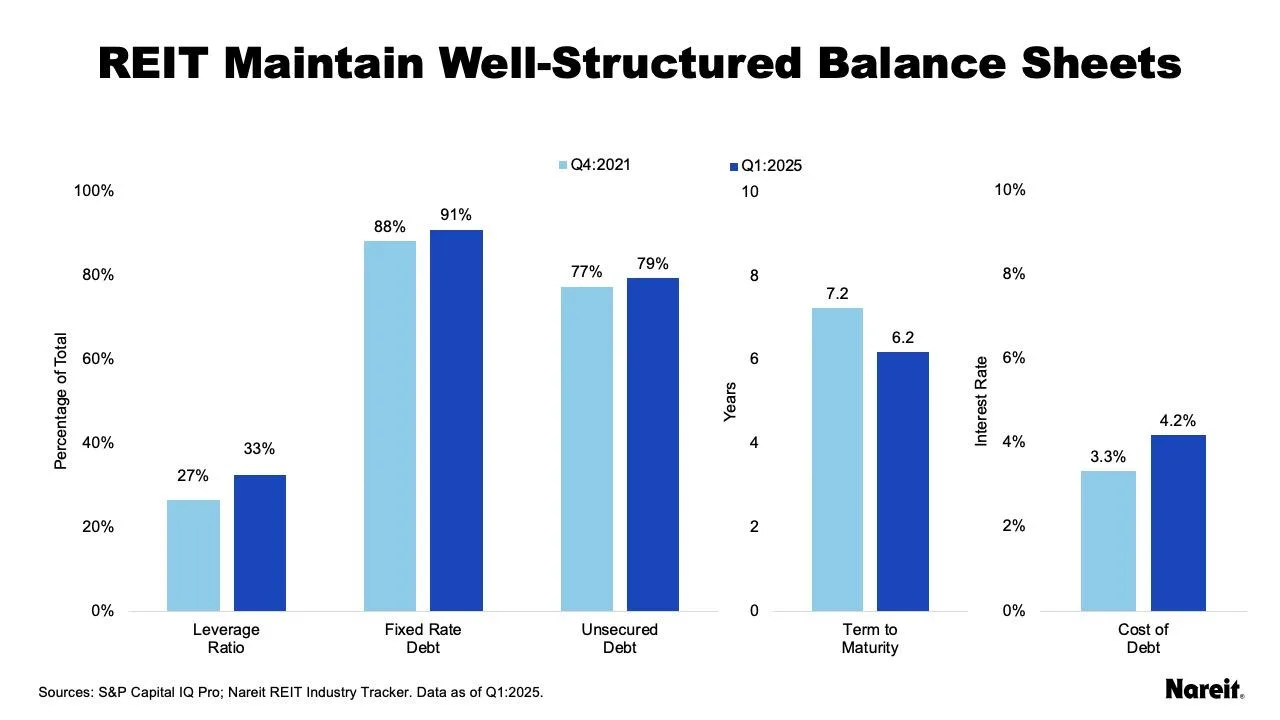

Strong Foundations: Balance Sheets Still Solid

One of the clearest advantages for REITs this year has been their continued financial strength:

- Average debt costs rose just 0.9% from Q4 2021 to Q1 2025, even as the 10-year Treasury yield surged by 2.9%.

- Emphasis on fixed-rate, long-term debt has insulated REITs from rate volatility.

- Access to unsecured and cost-effective capital continues to provide operational flexibility.

A Global Rotation in Returns

After dominating performance for most of the past decade, North American REITs have taken a backseat in 2025. Through June:

- Europe REITs: +24.6%

- Asia REITs: +14.7%

- North America REITs: +0.8%

A weaker US dollar has boosted overseas returns, highlighting the long-term benefits of global diversification for REIT investors.

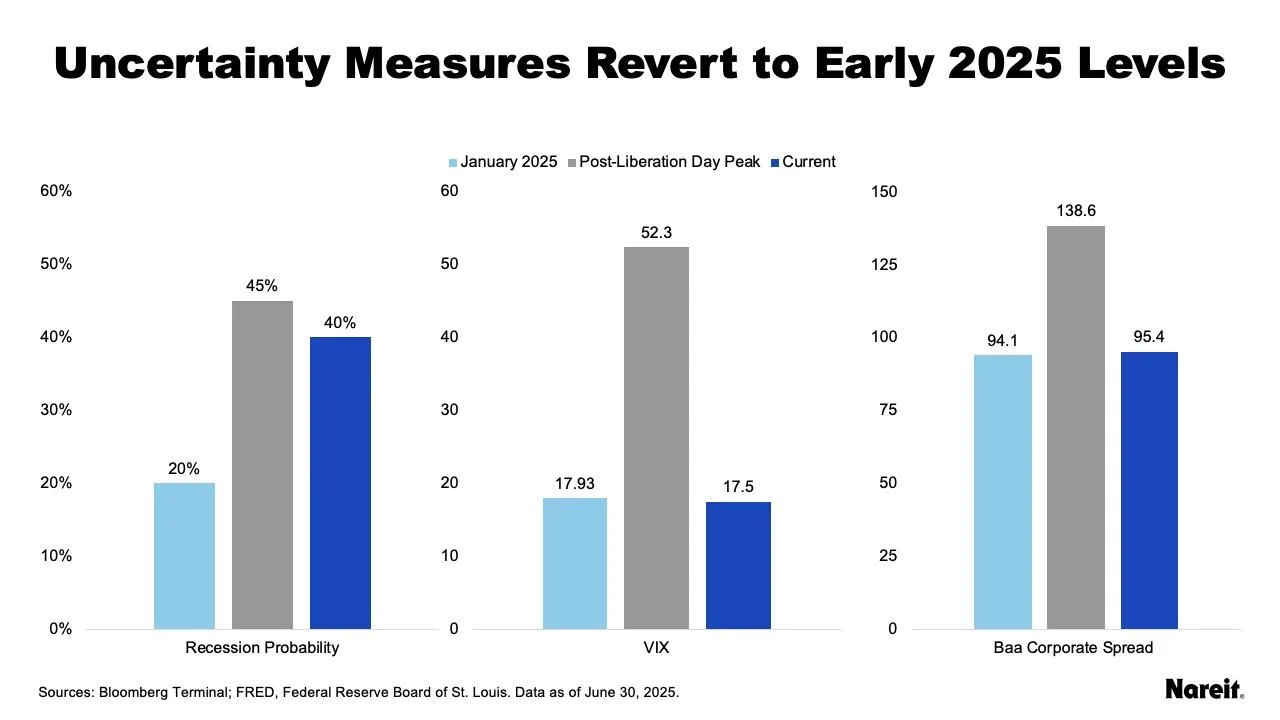

Signs of Stability—or Another Dip?

Market indicators such as the VIX and corporate bond spreads suggest that mid-year uncertainty has receded to early 2025 levels. Still, the recession probability remains elevated, reflecting cautious sentiment despite improving fundamentals.

What’s Ahead?

REITs enter the second half of 2025 with renewed confidence. Solid economic growth, better-aligned public and private valuations, and reawakening transaction markets could create fertile ground for acquisitions and accretive growth.

With global megatrends such as specialization, innovation, scale, and sustainability driving investor interest, REITs remain a compelling option for institutions seeking efficient access to commercial real estate.

Bottom Line

Whether the market roller coaster continues or steadies, REITs appear equipped to weather further volatility—and capitalize on what’s next.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes