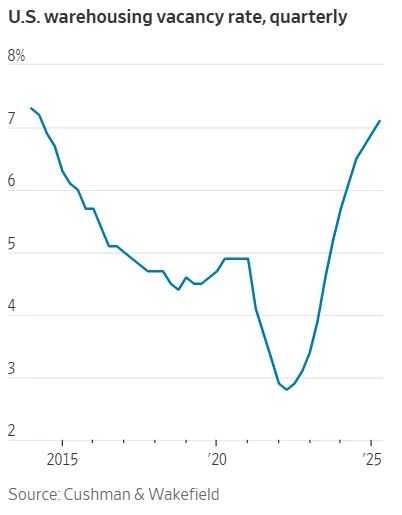

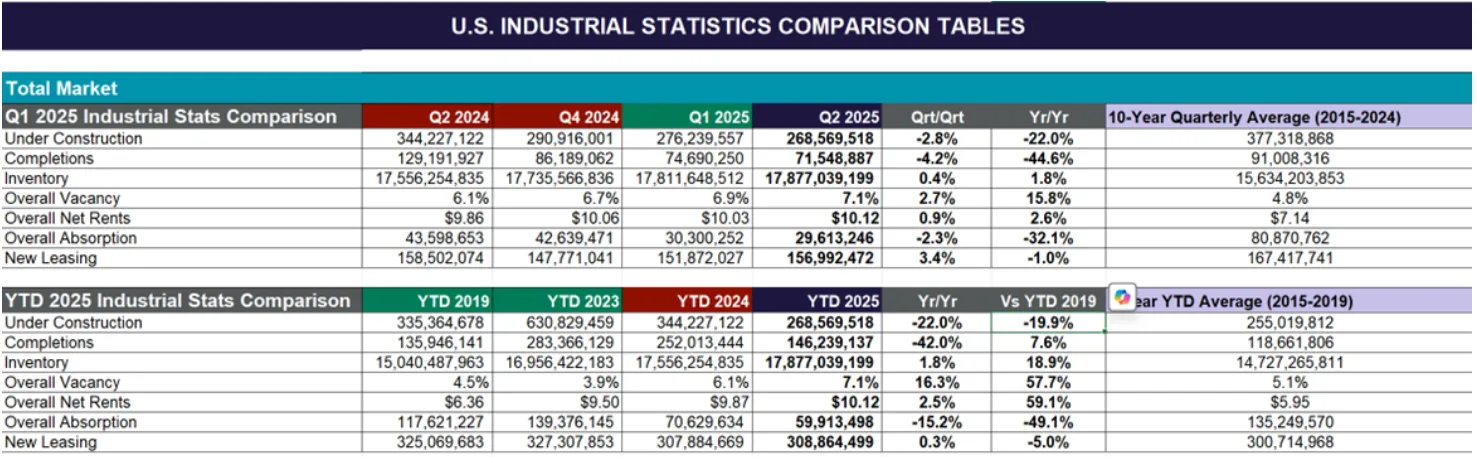

- US warehouse vacancy rose to 7.1% in Q2 2025, the highest level since 2014.

- Trade policy uncertainty caused companies to pause leasing decisions.

- Rent growth persisted, with average rates up 2.6% year-over-year.

- Developers slowed construction as sublease space hit record highs.

A Market In Flux

Warehouse availability surged in Q2 2025, with national vacancy reaching 7.1%, up from 6.1% a year ago—the highest level since 2014, reports WSJ. The spike reflects a complex mix of slowing leasing activity, excess space, and shifting trade dynamics. According to Cushman & Wakefield, trade-related uncertainty led companies to pull back on new space commitments, particularly as tariff policies fluctuated in the first half of the year.

Supply-Demand Mismatch

Demand remained steady overall—net absorption reached 29.6M SF—but new supply still outpaced it. More than 71.5M SF of industrial space was delivered in Q2, particularly in the South and West, contributing to rising vacancy. While activity in major markets like Dallas/Ft. Worth and Chicago remained strong, regions like the Inland Empire saw negative absorption.

Despite the slowdown, year-to-date leasing activity (309 msf) slightly outpaced the same period in 2024, buoyed by large block deals in key logistics hubs.

Rent Growth Defies Vacancy Trends

Even as vacancies rise, rents continue to edge upward. The national average rent hit $10.12 PSF in Q2, up 2.6% year-over-year. Smaller warehouses saw the strongest pricing, averaging $13.51 PSF—over 30% higher than large-format spaces. This price resilience is fueled by long-term leasing strategies and a continued “flight to quality” among large occupiers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sublease Surplus And Developer Pullback

A record-setting 225M SF of warehouse space is now on the sublease market, as tenants offload excess capacity accumulated during the pandemic. In response, developers have scaled back. Q2 completions fell 44.6% year-over-year, and speculative construction dropped to its lowest share since 2020.

Opportunities Ahead

Despite short-term headwinds, industry experts remain cautiously optimistic. “Demand for logistics space remains resilient,” said Jason Tolliver of Cushman & Wakefield. He expects fundamentals to stabilize as supply slows and tenant activity picks up.

For tenants, the current environment—with softening demand and a rising supply of high-quality space—may represent the best leasing conditions in years.

Why It Matters

The industrial sector is navigating a critical inflection point. While vacancy is rising, the underlying fundamentals show that tenant demand—especially for new, high-spec product—remains intact. For investors and occupiers alike, the next 6–12 months could prove pivotal in shaping long-term strategy.