- CMBS issuance rose 35% year-over-year to $59.55B—the biggest first-half total since 2007.

- SASB deals made up nearly 75% of all issuance, with Blackstone-linked deals accounting for 19% of the total.

- Wells Fargo led all bookrunners and loan contributors, followed by Citi and Goldman Sachs.

Strong First Half, Despite Q2 Dip

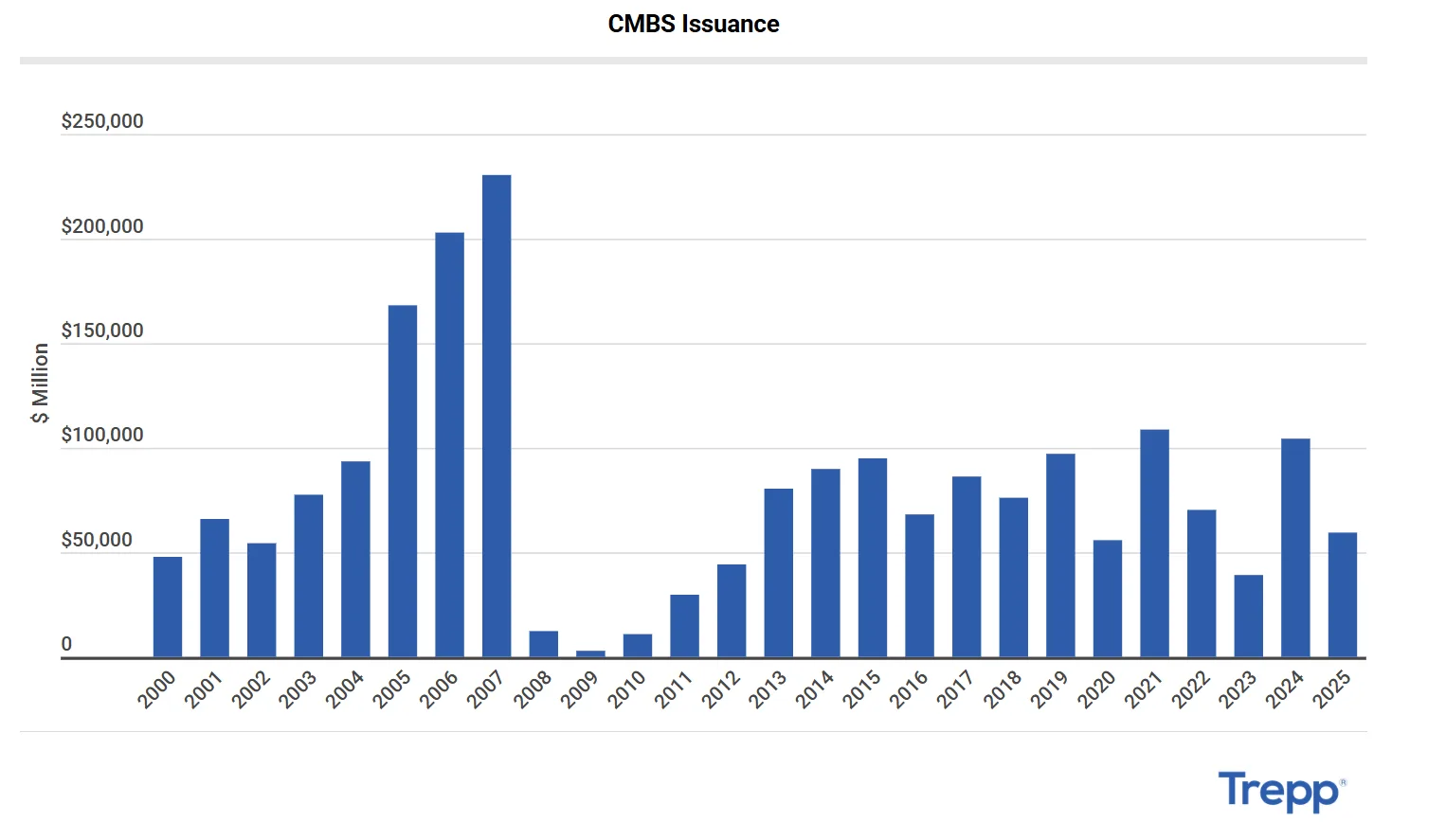

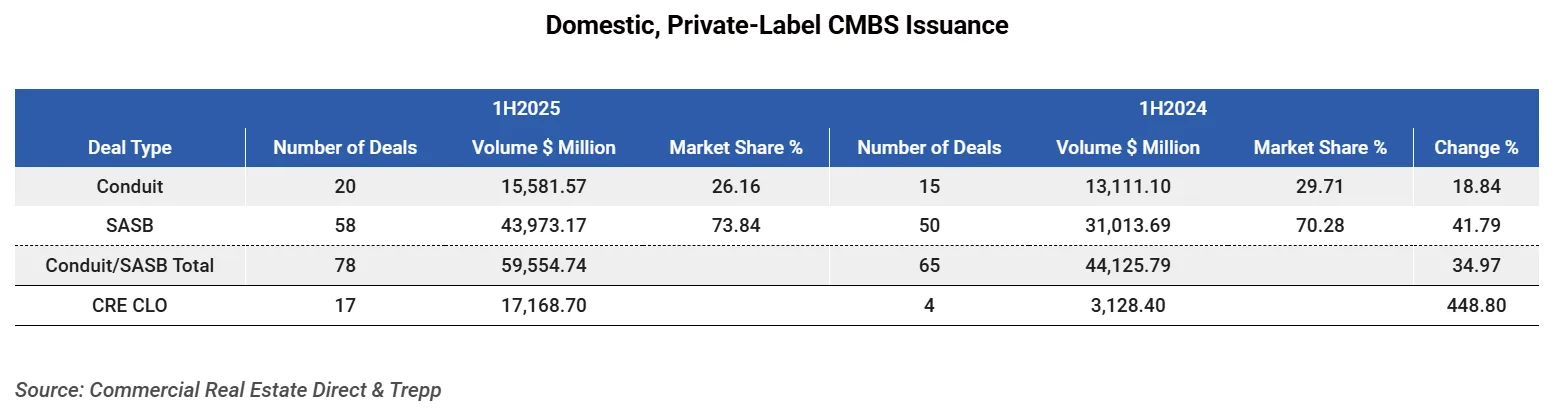

Private-label CMBS issuance reached $59.55B in the first six months of 2025, per Trepp. That’s up 35% from the same time last year. It’s also the highest mid-year total in over 15 years.

Q2 saw a drop in issuance to $22.01B. That’s down sharply from Q1’s $37.55B. Still, the first-half total marks a major recovery for the market.

SASB Deals Lead the Way

Single-asset, single-borrower (SASB) deals continued to dominate. They made up about three-quarters of total issuance. The average SASB deal was $758M. Eight deals were larger than $1B.

Nine SASB deals tied to Blackstone totaled $11.17B. That’s about 19% of the half’s total volume.

$120B Year Within Reach

CMBS issuance is now averaging just under $10B per month. If that pace holds, 2025 could end with nearly $120B in CMBS deals. That would be the strongest year since 2007.

Bond spreads have helped fuel the increase. Early in the year, spreads were near 80 basis points. They widened in April when the Trump administration announced new tariffs. That briefly slowed the market.

After a two-week pause, spreads narrowed again. As of last week, they sat around 88.5 basis points over the J-curve.

CRE CLO activity also surged. Seventeen deals priced in the first half, totaling $17.17B. That’s nearly five times more than the same time last year. Lenders appear to be adjusting to higher interest rates.

Top Lenders and Bookrunners

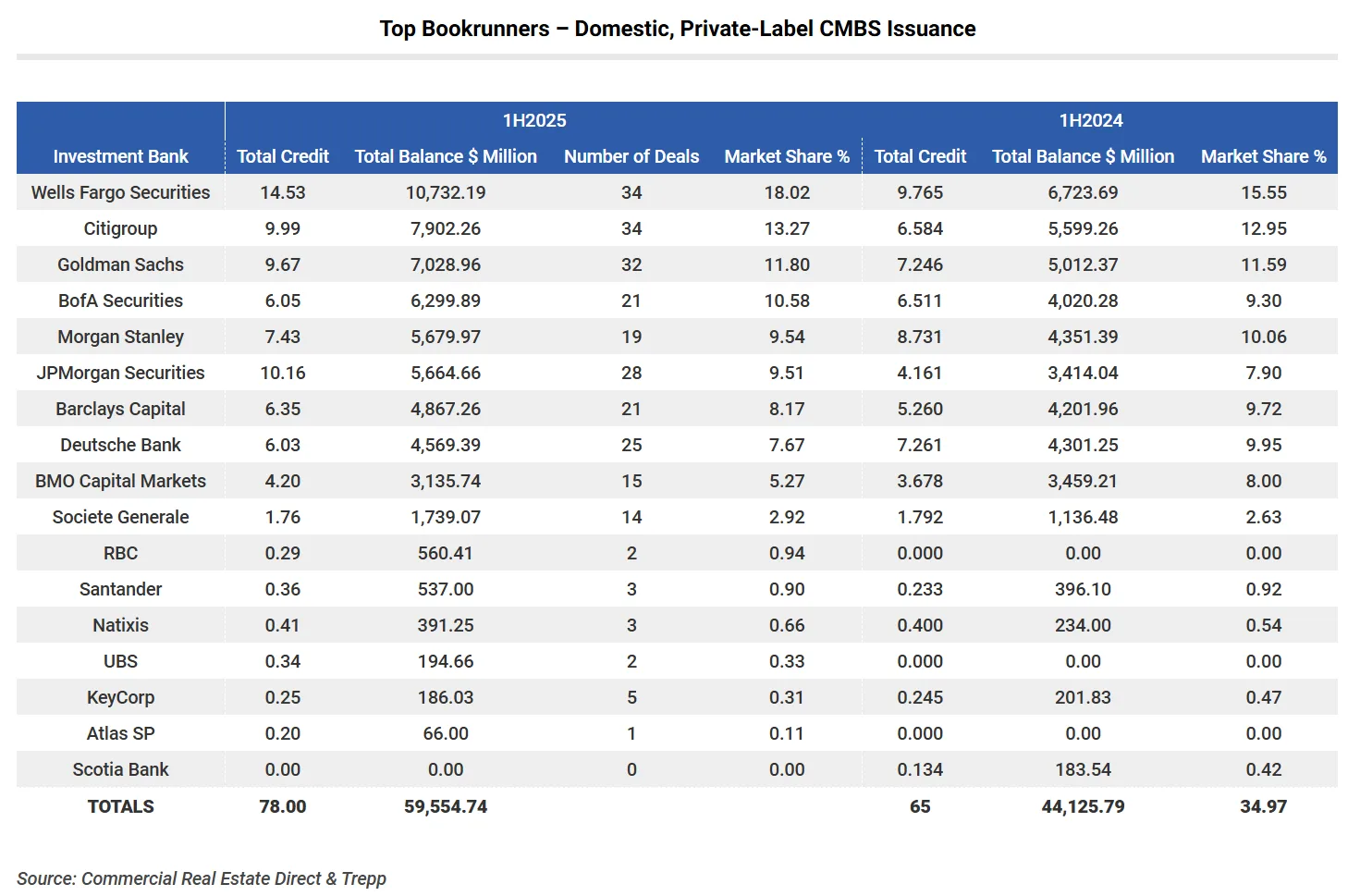

Wells Fargo Securities led the CMBS issuance market with 14.5 deals totaling $10.73B, capturing an 18% share of the private-label space.

Citi followed with $7.9B from 10 deals. Goldman Sachs came next with $7.03B across 9.7 deals. Together, these three banks handled 43% of the total issuance.

Wells Fargo also led in loan contributions. It provided $10.15B, with $1.43B going to conduit deals and $8.72B to SASB deals.

Why It Matters

The CMBS market is showing real strength. Rising CMBS issuance suggests lenders and investors are regaining confidence. It also shows that structured deals still work, even in a higher-rate world.

What’s Next

If current trends hold, 2025 could end with the highest issuance volume in nearly two decades. Continued demand, stable spreads, and large players like Blackstone will drive CMBS issuance through year-end.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes