- A new Fed study estimates a 9% chance the federal funds rate will hit the zero lower bound (ZLB) over the next seven years.

- The forecast is driven by high interest-rate uncertainty, despite expectations of elevated rates in the near term.

- The study relies on interest-rate derivatives like the Secured Overnight Financing Rate (SOFR) to assess risks tied to Fed policy expectations.

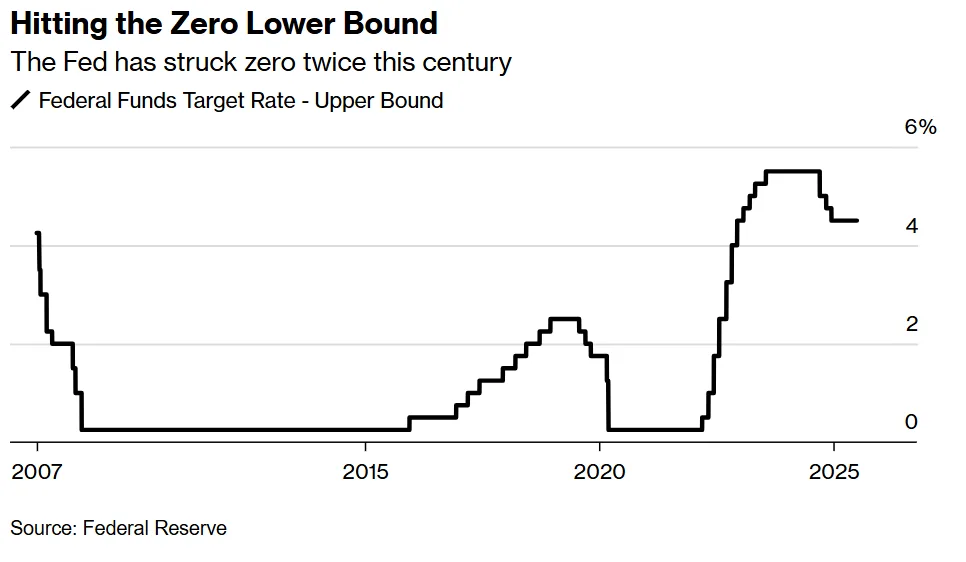

- Historically, the Fed has dropped rates to near zero twice this century—during the 2008 financial crisis and again in 2020 amid the Covid-19 pandemic.

Risk Still Lingers Despite High Rates

Bloomberg reports that in a recent blog post, researchers from the New York and San Francisco Fed—including NY Fed President John Williams—argue that the probability of interest rates returning to zero rates—or hitting the zero lower bound (ZLB)—is “significant” over a medium-term horizon. The study pegs that likelihood at 9% over seven years, citing continued uncertainty in rate expectations as a primary driver.

While short-term expectations for interest rates remain elevated, the authors note that the underlying volatility keeps ZLB risk comparable to levels seen in 2018, despite today’s stronger economy and higher inflation environment.

Methodology and Market Signals

The Fed study used derivatives markets tied to short-term rates—especially the SOFR—as a forward-looking gauge for interest rate risk. The same model estimated a 1% probability of hitting the ZLB within the next two years.

ZLB History and Implications

The Fed first took rates to zero in 2008 during the Great Financial Crisis, keeping them there for seven years. The second drop occurred in 2020, lasting two years during the Covid-19 crisis.

While some policymakers believed post-pandemic dynamics might reduce the likelihood of a return to ZLB territory, this study indicates that the shadow of ultra-low rates still looms over future monetary policy planning.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Even a modest probability of hitting zero interest rates again forces the Fed and markets to consider unconventional monetary tools, like asset purchases or forward guidance. It also impacts risk pricing in real estate, bond markets, and other rate-sensitive sectors.

As uncertainty remains elevated, investors and policymakers alike must prepare for multiple rate path scenarios—including those that revisit the zero lower bound.