- Hotel stocks rose 3.7% in June, marking back-to-back monthly gains.

- The sector underperformed the S&P 500 and remains down 3.7% YTD.

- Hotel brands outpaced REITs, with Hilton leading year-over-year gains.

- Analysts remain cautious due to weak summer demand and soft RevPAR.

Two Months Of Gains, But Still Behind

Hotel stocks continued their recovery in June, with the Baird Hotel Stock Index rising 3.7%, reports CoStar. That followed a 9.3% jump in May — marking the first back-to-back monthly gains since October and November of last year. Still, the index remains down 3.7% on the year, underperforming broader markets.

In comparison, the S&P 500 rose 5% in June and is now up 5.5% year-to-date, fueled by tech gains and improving investor sentiment.

Mixed Fundamentals

While investor sentiment has turned more positive, hotel sector fundamentals remain uneven.

“Macroeconomic and trade policy headwinds have moderated further… [but] domestic RevPAR trends have been uninspiring,” said Michael Bellisario, senior analyst at Baird, citing sluggish inbound international travel and weaker leisure demand.

Expectations for the summer travel season remain muted, adding caution to what would typically be a high-performing quarter for the industry.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

REITs Lag, Brands Lead

Breaking down the Baird Index:

- Hotel brand stocks were up 4.2% in June.

- REITs gained a modest 0.6%.

- The broader MSCI U.S. REIT Index (RMZ) dropped 1.3%, underscoring challenges for real estate investors.

Among REITs, Summit Hotel Properties jumped 16.2%, followed by Pebblebrook Hotel Trust (+8.8%) and Braemar Hotels & Resorts (+7.5%). On the downside, Sunstone Hotel Investors saw its stock fall 3.1%.

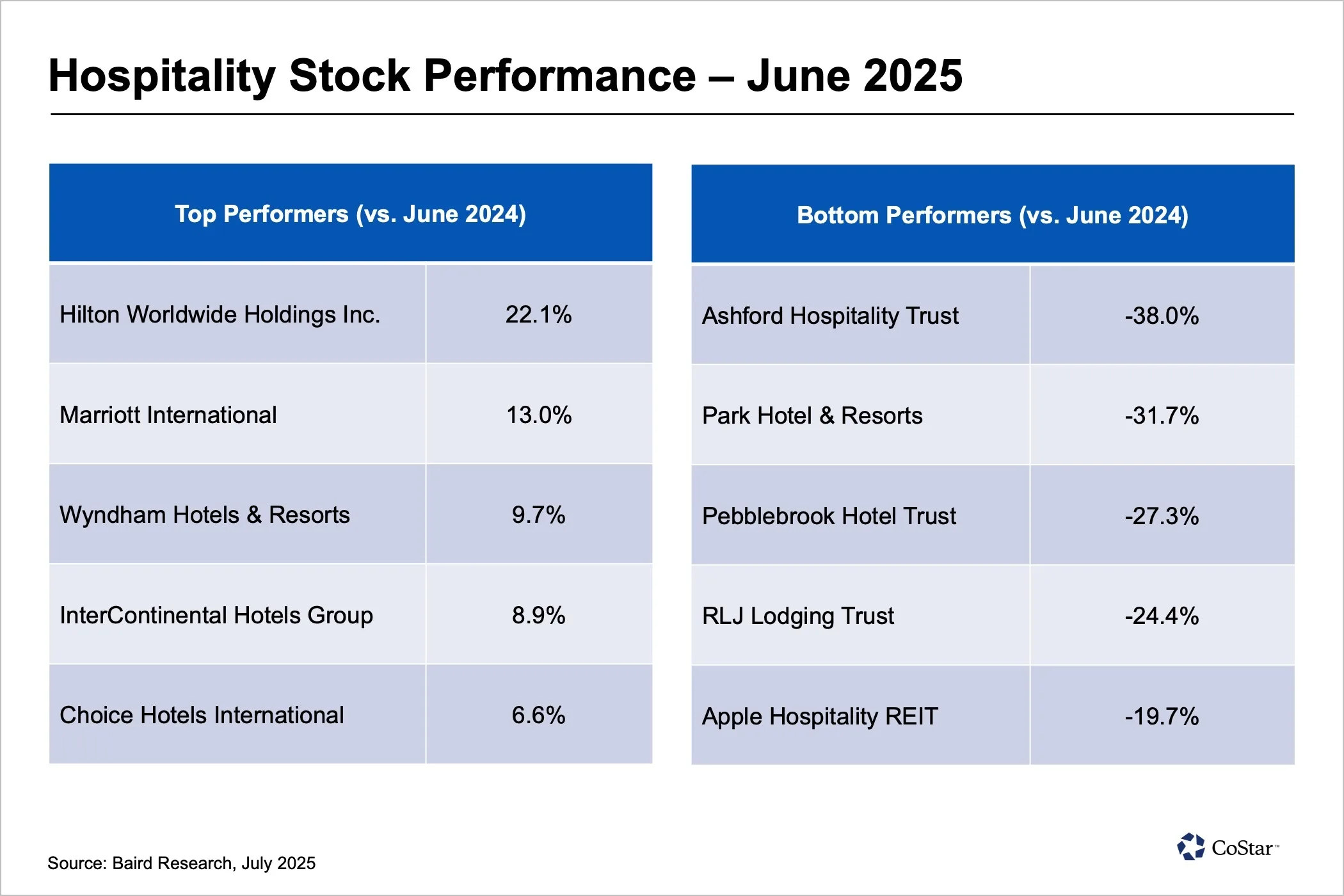

Year-Over-Year Leaders And Laggards

Over the past 12 months:

- Hilton leads all stocks, up 22.1%.

- Marriott International (+13%) and Wyndham Hotels & Resorts (+9.7%) also posted solid gains.

- Conversely, Ashford Hospitality Trust and Park Hotels & Resorts reported steep declines, down 38% and 31.7%, respectively.

Outlook

Despite recent momentum in sector stocks, the sector faces continued headwinds from softer travel demand and economic uncertainty. Analysts remain cautious heading into the second half of the year, particularly for REITs exposed to underperforming leisure markets.

For now, brands with stronger balance sheets and diversified portfolios — like Hilton and Marriott — appear best positioned to weather the seasonal softness.