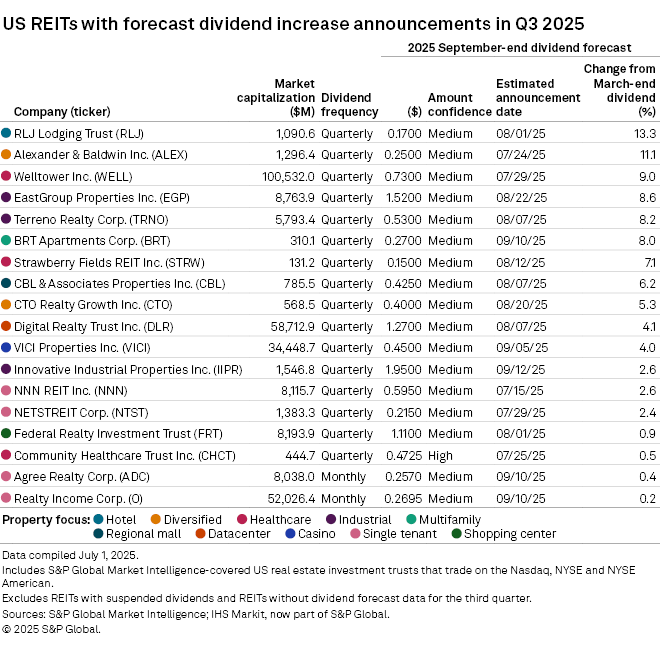

- 18 US REITs are expected to raise dividends in Q3 2025, while nearly 76% will keep payouts unchanged.

- RLJ Lodging Trust may lead the increases with a projected 13.3% jump to $0.17 per share.

- Alexander & Baldwin and Welltower are also forecast to raise payouts, based on improved earnings guidance.

- The increases span several sectors, including hotels, healthcare, malls, and data centers.

Dividend Growth Signals Stability

REITs are showing signs of confidence heading into Q3 2025. According to S&P Global Market Intelligence, 18 real estate investment trusts plan to raise their dividends this quarter. Analysts based their forecasts on earnings trends, debt levels, and recent company guidance.

RLJ Lodging Trust Tops the List

Hotel REIT RLJ Lodging Trust is expected to post the largest dividend increase. Analysts predict a 13.3% hike, which would bring its dividend to $0.17 per share in August. On its May earnings call, the company emphasized plans to invest in growth projects while continuing to return capital to shareholders through dividends and stock buybacks.

The former CFO, Sean Mahoney, highlighted that RLJ is focused on managing debt costs, extending maturities, and keeping a flexible balance sheet.

Alexander & Baldwin, Welltower Also Expected to Raise Payouts

Alexander & Baldwin Inc. could raise its dividend by 11.1% to $0.25 per share. The diversified REIT lifted its full-year FFO guidance due to stronger land sales in Q1, which supports a higher payout.

Meanwhile, healthcare REIT Welltower Inc. is also on track to boost its dividend. Analysts expect a 9.0% increase to $0.73 per share. CEO Shankh Mitra said during the April earnings call that strong gains in its senior housing portfolio and recent acquisitions helped drive 19% FFO growth.

Other Notable Dividend Increases

Several other REITs from various sectors are forecast to raise their dividends:

- Digital Realty Trust Inc. may raise its payout by 4.1% to $1.27 per share.

- VICI Properties Inc., which focuses on casino assets, could boost its dividend by 4.0% to $0.45 per share.

- CBL & Associates Properties Inc., a regional mall REIT, may lift its dividend by 6.2% to $0.425 per share.

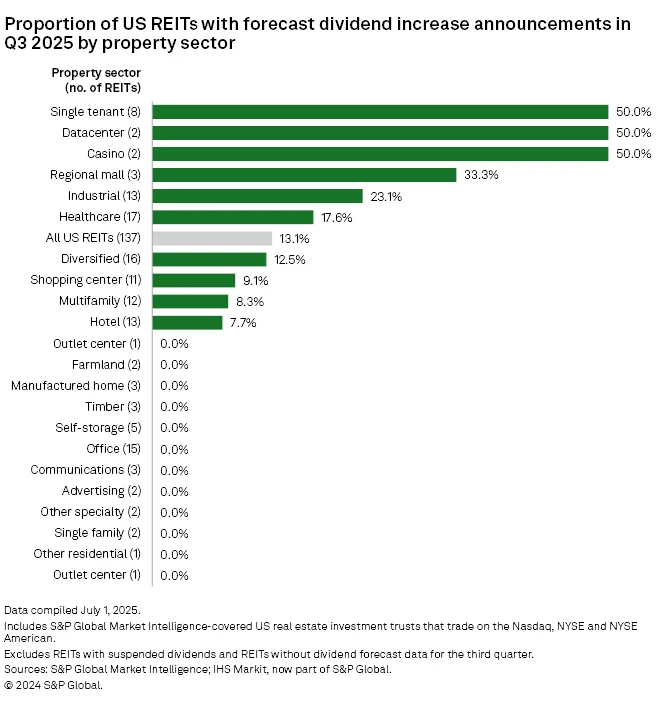

About 23% of industrial REITs included in the analysis are also expected to announce increases this quarter.

Most REITs to Hold Dividends Steady

While 18 REITs plan to raise payouts, most are taking a more cautious path. Roughly 76% of public REITs in the study are projected to maintain their current dividend levels through the third quarter.

Still, the number of planned hikes reflects a positive outlook for parts of the real estate sector, especially in areas like hospitality, healthcare, and technology infrastructure.

What It Means for Investors

Dividend growth is often a sign of strong financial health. REITs that raise payouts are likely seeing stable cash flow and better access to capital. For income-focused investors, these increases may point to attractive opportunities as the market steadies.

Looking ahead, future hikes will likely depend on earnings trends in the second half of the year. If conditions stay favorable, more REITs may follow suit in Q4.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes