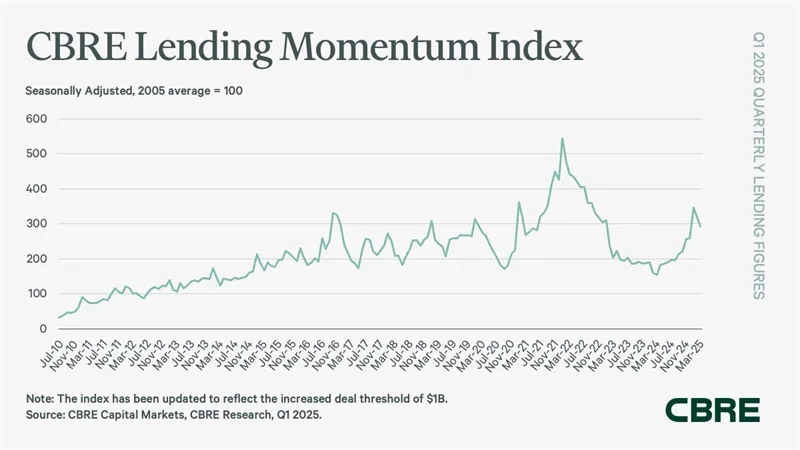

- The CBRE Lending Momentum Index jumped 13% from Q4 2024 and 90% year-over-year, marking its highest level since early 2023.

- Banks captured a 34% share of CBRE’s non-agency loan closings in Q1 2025, up from 22% in Q4 2024, reflecting a favorable regulatory climate.

- Commercial mortgage loan spreads averaged 183 bps in Q1 2025, down 29 bps year-over-year, allowing sponsors to pursue refinancings and acquisitions.

- Multifamily spreads hit their lowest point since Q1 2022, while office and data center financing gained momentum.

Resilient Lending Momentum Amid Market Headwinds

Commercial real estate lending saw a strong rebound in Q1 2025, with the CBRE Lending Momentum Index climbing by 13% from the previous quarter and a robust 90% year-over-year increase. This surge pushed the index above 300 for the first time since Q1 2023, driven primarily by heavy loan closings in January and February. Although lending slowed slightly in March due to market volatility, the quarterly performance signaled a resilient recovery.

Banks Lead Non-Agency Lending, CMBS Makes Big Gains

Banks emerged as the top lenders in the non-agency market, commanding a 34% share of CBRE’s non-agency loan closings, a sharp increase from 22% in the previous quarter. This dominance is attributed to a stronger regulatory environment and healthier balance sheets.

CMBS conduits also saw substantial growth, jumping to a 26% share from just 9% a year ago. Industrywide, private-label CMBS issuance was up 132% year-over-year, reflecting rising investor demand for securitized real estate debt.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Loan Spreads Tighten as Multifamily and Office Sectors Shine

Average commercial mortgage loan spreads tightened to 183 bps in Q1 2025, down 29 bps year-over-year, enabling more attractive financing terms. Multifamily loan spreads hit their lowest since early 2022 at 149 bps, while office financing saw a notable uptick, supported by successful single-asset, single-borrower (SASB) transactions. Data center construction loans remained strong, serving a diverse tenant base.

Alternative Lenders Face Headwinds

While alternative lenders like debt funds and mortgage REITs retained 19% of non-agency closings, their market share declined from 48% a year ago. Competitive pressures and a cautious lending approach contributed to a 17% decline in origination activity during Q1 2025.

Life companies maintained a steady 21% share of non-agency loan activity, mirroring last year’s performance.

Key Metrics Reflect Caution

- Cap Rates: Average underwritten cap rates rose 24 bps to 6.1% quarter-over-quarter.

- Debt Yields: Increased 90 bps to 10.3% in Q1 2025.

- LTV Ratios: Declined slightly to 62.2% from 63.0% in Q4 2024, signaling cautious lending practices.

Government agency lending for multifamily properties also saw a 15% year-over-year increase, reaching $22 billion in Q1 2025, despite a sharp quarter-over-quarter dip. CBRE’s Agency Pricing Index rose to 5.8%, reflecting a more challenging borrowing environment.

Outlook: Optimism Despite Volatility

Despite market volatility and economic uncertainty, commercial real estate lending remains resilient. Banks and CMBS conduits are expected to continue capitalizing on favorable conditions, while alternative lenders may face further consolidation. Multifamily and office sectors are positioned for steady growth as spreads remain attractive for acquisitions and refinancings.