- Most multifamily investors expect moderate rent growth (1–3%) in 2025, driven by stabilized occupancy and slowing new supply.

- Core-Plus and Value-Add strategies are favored for their balanced risk-return profiles, while 65% of investors plan to moderately expand portfolios.

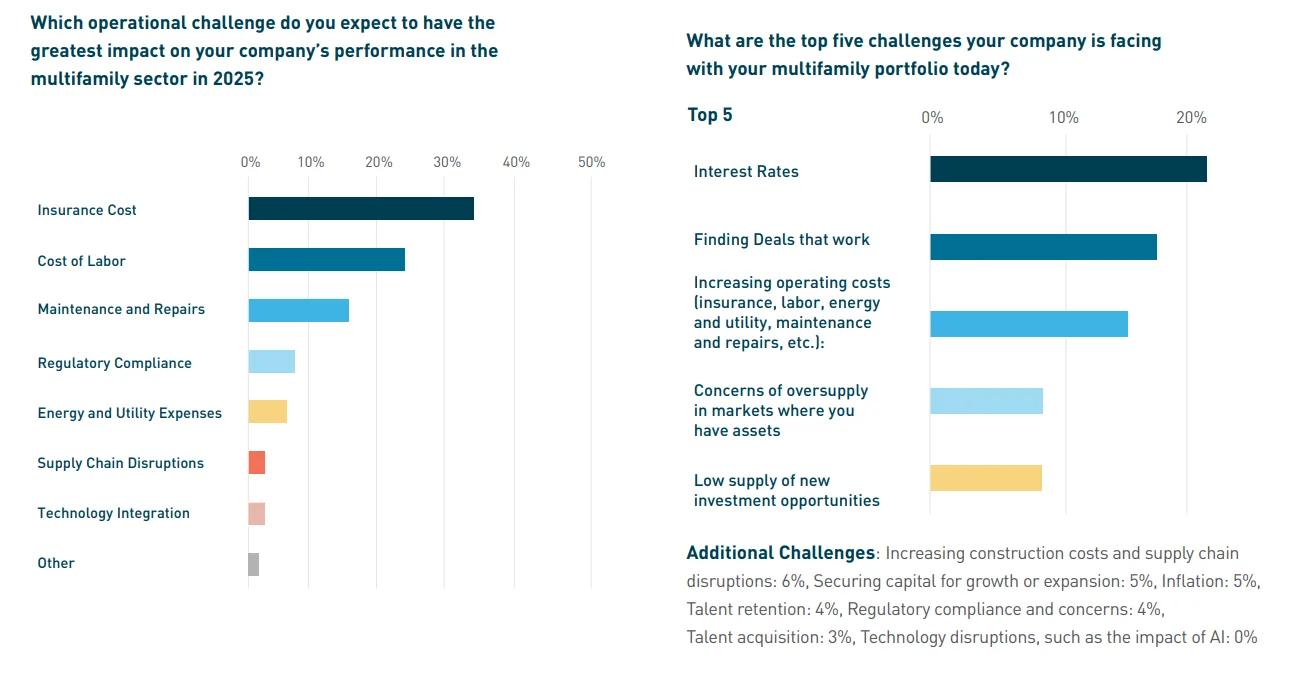

- Top challenges include rising insurance and labor costs, underwriting difficulties, and elevated interest rates.

- Investors expect two Fed rate cuts and a 10-Year Treasury yield between 4.0–4.5% by year-end, improving deal flow in the second half of the year.

Investor Outlook Stabilizing

Berkadia’s first Multifamily Investor Sentiment Survey, conducted in January 2025, reflects a market adjusting to change. It includes insights from 240 senior-level real estate professionals, most managing over $2.5B in assets. The findings show a shift from post-pandemic volatility to a focus on long-term multifamily investment stability.

Moderate Growth Expected

Multifamily investment confidence is on the rise despite some ongoing challenges. About 83% of respondents plan to either moderately or aggressively grow their portfolios. Rental growth is expected between 1–3%, supporting steady multifamily investment returns. National occupancy remains solid at 94.8%, signaling healthy demand as new supply slows.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Risk-Adjusted Returns Front of Mind

Core-Plus multifamily investments are the top choice for 43% of respondents, followed by Value-Add at 30%. These strategies blend steady income with the chance for gains. Still, deals remain hard to underwrite—93% of investors say the numbers are tough to make work.

Rate Cuts and Market Timing

More than half of respondents expect two 25-basis-point Fed rate cuts in 2025. They also see the 10-Year Treasury yield landing between 4.0% and 4.5% by year-end, which may improve multifamily investment conditions. While the first half of the year may stay soft, investors are more hopeful about activity in the second half and into 2026.

Persistent Operational Headwinds

Insurance leads the list of concerns in multifamily investment, followed by labor and maintenance costs. These issues continue to pressure net income and make deals harder to close. Investors are especially focused on assets acquired between 2020–2022 with high leverage and floating-rate debt.

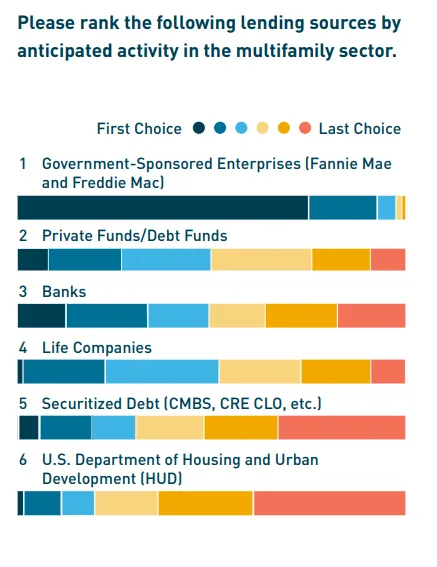

Geographic and Lending Trends

The Southeast, Midwest, and Texas are top targets for multifamily investment. These regions benefit from strong migration, lower costs, and business-friendly rules. Fannie Mae and Freddie Mac are expected to stay the leading lenders in 2025, with $73B loan caps for each.

Final Word

Most investors remain cautious but hopeful. Rent growth, steady demand, and lower rates may open new opportunities. As the market shifts, investors are ready to adapt—seeking well-located, quality assets with the potential for long-term multifamily investment value.