- Net absorption surged to 100,600 units in Q1, dropping the national vacancy rate to 4.8%.rn

- Average rents increased 0.9% year-over-year, with stronger gains expected ahead.rn

- Multifamily investment volume rose 33% year-over-year to $28.8B, the highest since 2022.

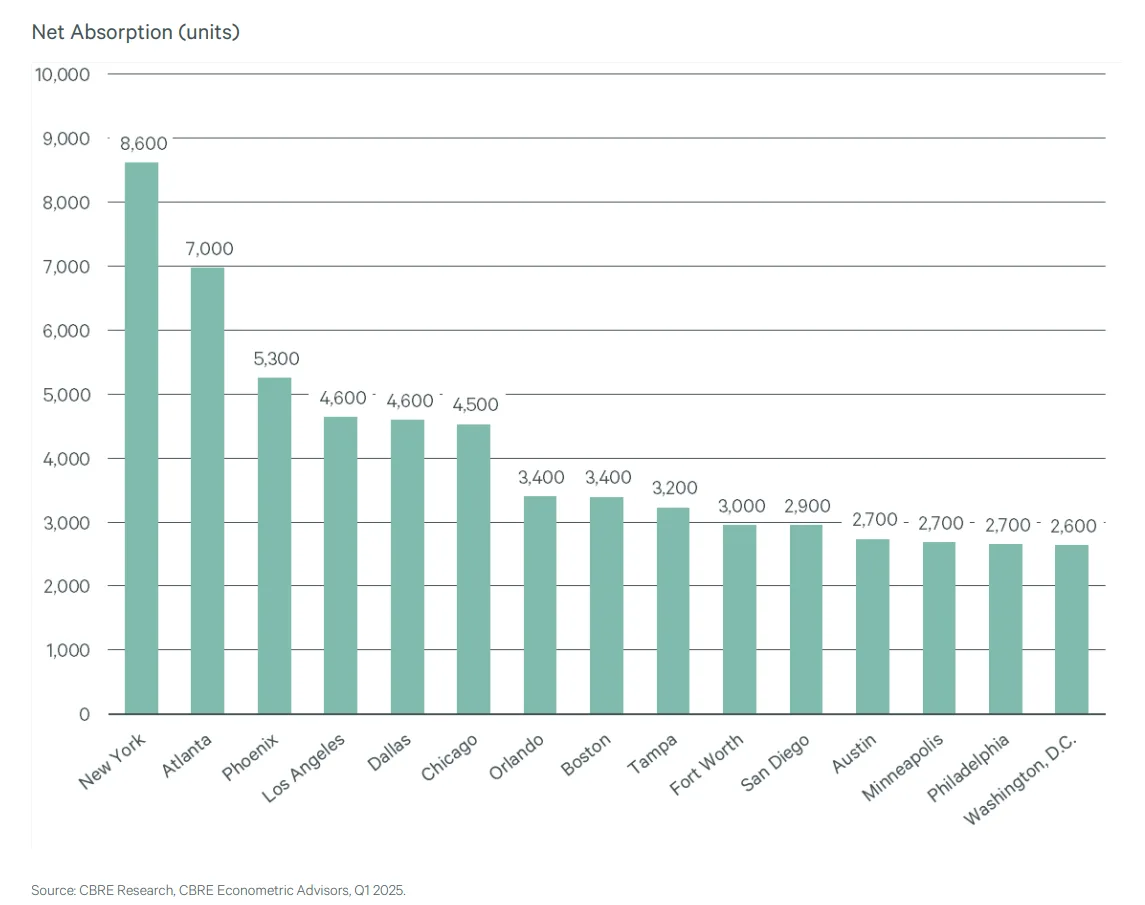

- New York, Dallas, and Phoenix dominated in both absorption and investment performance.rn

The US multifamily market started 2025 on strong footing, according to CBRE’s latest research. A surge in renter demand combined with reduced new deliveries pushed the national vacancy rate down to 4.8%, while investment volume reached $28.8B—the highest first-quarter total in three years.

Demand Outpaces Supply

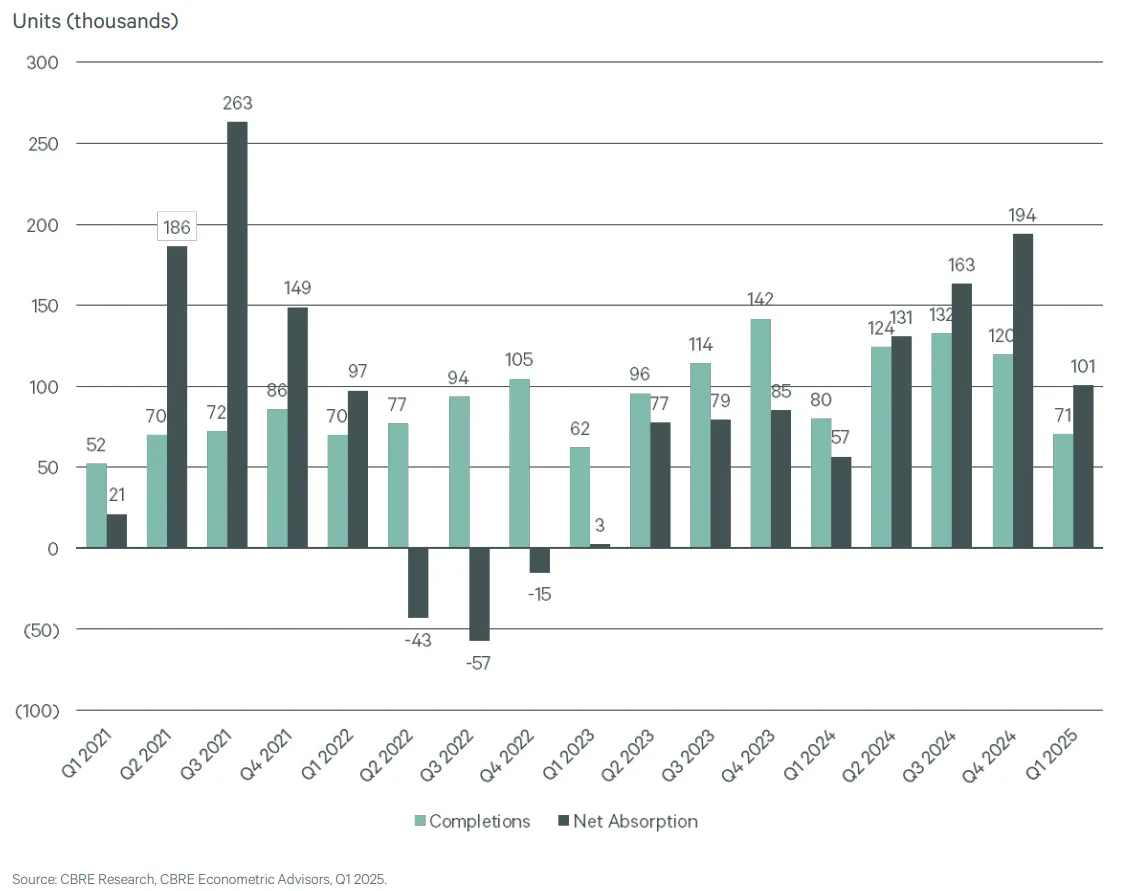

In Q1, net absorption rose by 77% year-over-year, totaling 100,600 units, significantly outpacing the 70,600 units delivered. This marks the fourth consecutive quarter where demand exceeded supply, resulting in the largest Q1 vacancy decrease on record.

Rent Growth Gains Momentum

The average national rent grew by 0.9% year-over-year to $2,184 per unit, the first Q1 rent increase since 2022. The Midwest region led rent growth at 3.3%, while Southeast and Mountain regions faced slight declines.

Investment Activity Strengthens

Investors poured $28.8B into the multifamily market, a 33% year-over-year increase. The multifamily sector accounted for 33% of total commercial real estate investment volume, with average cap rates tightening slightly to 5.6%.

Market Leaders

New York led the nation in net absorption (8,600 units) and investment volume ($10.6B over four quarters). Dallas, Phoenix, and Atlanta also posted strong net absorption, while Los Angeles, Washington, D.C., and San Francisco saw major investment gains.

Why It Matters

Tightening vacancies, improving rent growth, and renewed investor interest suggest a healthy outlook for US multifamily housing in 2025. Markets with balanced supply-demand dynamics could see further rent acceleration and strong investment returns.

What’s Next

With fewer deliveries expected, CBRE anticipates continued vacancy reductions and accelerating rent growth in coming quarters. Additionally, buyer and seller sentiment in the multifamily sector is improving, signaling robust activity for the rest of 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes