- Florida condo owners are facing skyrocketing costs due to rising insurance premiums, special assessments, and new safety regulations.

- Older buildings are particularly affected, with some condo values dropping more than 20%.

- More than 1,400 Florida condos are currently blacklisted by Fannie Mae, making it harder for buyers to obtain financing.

- A legislative response is underway, but for many owners, it may already be too late.

Condo Costs Spiral Out of Control

According to the WSJ, Florida condo ownership has taken a sharp turn from dream to burden for many residents. What was once seen as an affordable way to enjoy the Sunshine State is now a financial minefield. A combination of hurricane-fueled insurance spikes, building safety mandates following the Surfside tragedy, and a growing number of Fannie Mae–blacklisted properties have created a perfect storm for a condo crisis.

Rob and Karen Dickson, retirees from upstate New York, moved to Punta Gorda in 2021 and were initially thrilled with their $319,000 golf-course-view condo. But by 2023, soaring HOA fees, a $7,200 special assessment, and doubled insurance costs forced them to put the unit up for sale. They ultimately sold it below asking and moved back to New York.

“Florida is actually paradise,” Rob said. “It was superb, but things changed.”.

The Real Estate Fallout

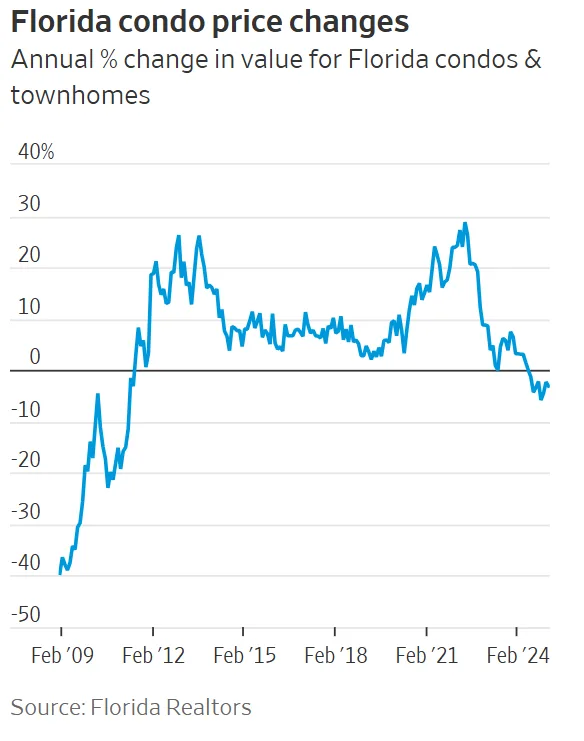

While Miami-Dade has seen some resilience in condo pricing, the broader Florida market is softening — particularly for older buildings. Condo prices statewide have been declining monthly since July 2024, with older properties hit hardest. According to ISG World, condos over 30 years old have lost 22% of their value over the past two years.

This trend aligns with the new state-mandated building inspections and reserve requirements passed after the 2021 Surfside condo collapse that killed 98 people. Many buildings are still scrambling to comply, but fewer than 25% have done so, according to state data— a key pressure point in the ongoing condo crisis.

Financing Headaches Compound the Problem

Beyond rising costs, owners are also grappling with financing challenges. Lenders are increasingly reluctant to underwrite mortgages for buildings undergoing structural repairs. Adding to the pressure: over 1,400 Florida condos are on Fannie Mae’s “blacklist” — flagged as too risky due to inadequate insurance or significant repair needs.

For some, a simple paperwork error is enough to stall deals. Jake Harrington, board president of a 17-year-old Boynton Beach condo, said sales fell through after a minor misclassification on a lender form placed his building on the blacklist — despite an ongoing $7M renovation.

“It’s just frustrating,” Harrington said. “This is going to be a beautiful property… except we’re on the blacklist for a typo.”

State Officials Seek Solutions

Governor Ron DeSantis acknowledged the unfolding crisis earlier this month, pointing to unintended consequences from recent legislation. A proposed Senate bill would delay some regulatory deadlines and help prevent unnecessary assessments.

Still, for many owners, legislative relief can’t come fast enough.

Bob and Barbara Maistros, who bought a Palm Beach County condo in 2015 for $75,000 and spent $90,000 on upgrades, tried to sell it to upgrade to a larger unit. But with the market saturated, they got only one offer — $30,000 below asking. They had to pull $210,000 from retirement savings to cover the new purchase.

“It’s turned out to be a financial disaster for us,” Bob said. “The market cratered on us.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Florida is home to 20% of the nation’s condos, and more than half are over 30 years old. The structural and financial risks facing these buildings now have broader implications — not just for individual owners, but for the state’s housing market and economy.

What’s Next

As lawmakers look to ease the burden, buyers and sellers alike remain in limbo. Until regulation, financing, and insurance challenges are addressed, Florida’s condo crisis is likely to stay volatile — especially for older buildings.

With more storms, aging infrastructure, and financial uncertainty ahead, many owners are asking: is it still worth it?