- Office sales volumes post-COVID deviated from historic norms, with high transaction activity occurring despite elevated vacancy rates.

- Smaller office buildings (< 50,000 SF) drew significant private capital in 2021–2022, driven by low interest rates and stronger occupier fundamentals.

- Higher rates and tightening capital markets have since dampened investment activity, with office sales declining through Q1 2025.

Breaking The Trend

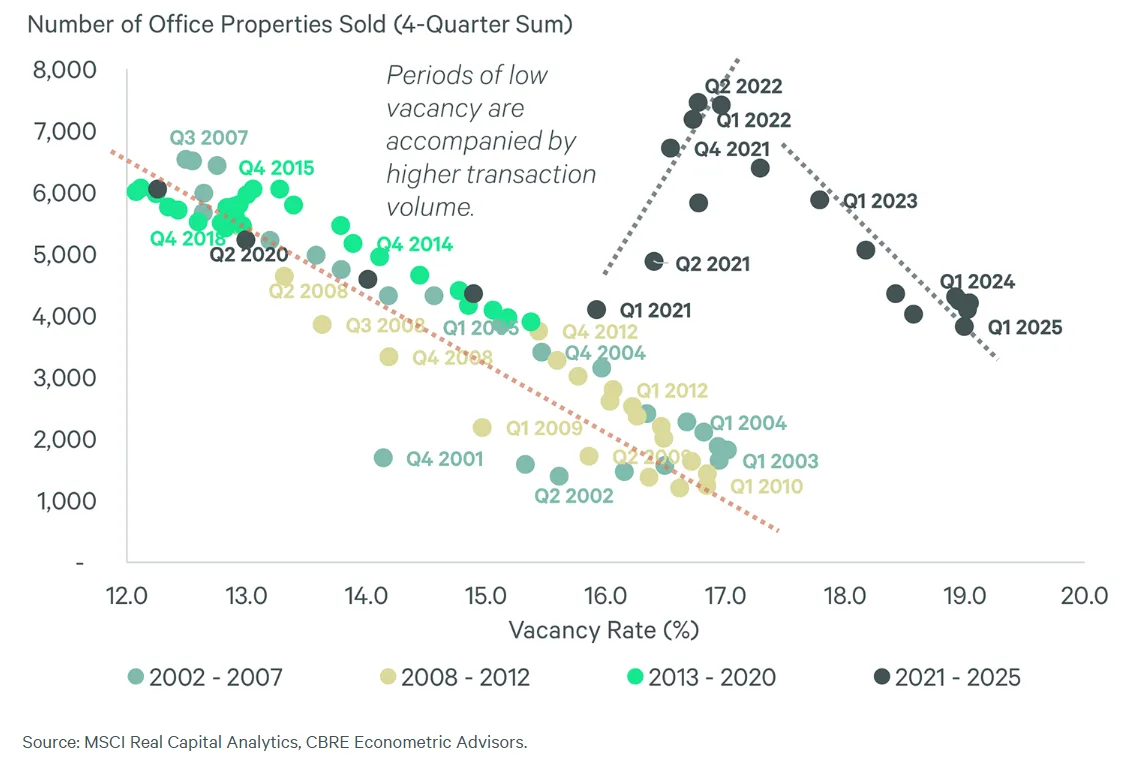

Historically, tight office availability and loose capital markets drove high transaction volumes.

That pattern held in 2007 and again from 2015 to 2018. In contrast, periods of high vacancy—such as the early 2000s and post-GFC years—correlated with weaker sales activity, according to CBRE.

Post-COVID Exception

The years following the pandemic broke with this pattern. Despite historically high vacancy rates, office investment surged in 2021 and 2022, fueled by ultra-low interest rates. Rather than institutional buyers, the spike was driven largely by private capital targeting smaller assets that were easier to finance and better occupied.

Small But Strong

Smaller office properties (under 50,000 SF ) proved more resilient, with 78% achieving 90%+ occupancy—well above the 45% rate seen in buildings larger than 800,000 SF.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cooling off

As interest rates climbed and capital markets tightened, the post-COVID sales momentum waned. Transaction volumes have fallen steadily from their 2022 peak through the first quarter of 2025.

The Takeaway

Office investment in the post-pandemic era is no longer moving in lockstep with vacancy trends, signaling a shift in market dynamics and investor strategy.